Voyager Wins Approval for Sale to Binance

Bankruptcy judge in the Voyager Digital case allows deal with Binance.us over SEC objections, issues at Silvergate Bank, and large new venture rounds for Believer, Kresus, and Toku

Issue Summary: Welcome to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders, where we review the top news, stats, and reports in the digital asset ecosystem. This week we cover Voyager’s asset sale to Binance.US, Silvergate Bank’s issues, and large new venture rounds from Believer ($55M), Kresus ($25M) and Toku ($20M). There was a total of $867M raised by crypto firms during February 2023, up 51% from $574M in January 2023.

Thanks to Our 2023 Coinstack Sponsors…

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Connect Financial empowers people and businesses to do more with their digital assets. Their flagship credit cards allow users to enjoy their crypto's spending power, without selling their digital assets and earn rewards on everyday purchases. Learn more at www.connect.financial.

Revix is a multi-asset WealthTech business targeting the African and Middle Eastern market. It allows for effortless purchase of crypto, stocks, thematic ETFs, real estate, currencies, commodities, and more. With Revix, everyday people can easily grow and manage their own wealth, using a personal wealth management platform that is effortless, automated, and engaging. Learn more at www.revix.com.

Block.Aero streamlines aerospace operations, reduces cost, and returns parts to service faster than ever before with the first commercially available aerospace enterprise blockchain platform. Gain efficiency by collaborating seamlessly in real-time across your aviation supply chain, replacing cumbersome excel sheets and email. Learn more at www.block.aero

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

Believer, an open gaming platform, has raised $55M from Lightspeed, A16Z, and Bitkraft

Toku has raised $20M for web3 payroll from Blockchain Capital

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Voyager wins court approval for sale to Binance US- The ruling allows the crypto lender a path out of its bankruptcy, but it still has to undertake some due diligence with Binance US before the $1.3B sale is final.

⚖️ SEC Lawyer Says Binance.US Runs Unregistered Exchange, Voyager Tokens Should Be Regulated - William Uptergrove, a U.S. Securities and Exchange Commission lawyer, said that SEC staff believe Binance.US operates an unregistered securities exchange.

🚩 Silvergate Suspends Silvergate Exchange Network (SEN) As Company Reels From Crises - Silvergate suspended its Silvergate Exchange Network on Friday, the result of what it called “a risk-based decision.”

⚔️ Coinbase Halts Payments With Silvergate Bank- Coinbase, the largest cryptocurrency exchange in the U.S. in terms of trading volume, today announced it is halting payments to and from Silvergate bank.

⚖️ Tether Has No Exposure to Sinking Crypto Bank Silvergate, Says CTO- The chief technology officer of Tether has said his company has no exposure to Silvergate, as companies across the crypto industry line up to distance themselves from the troubled bank.

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

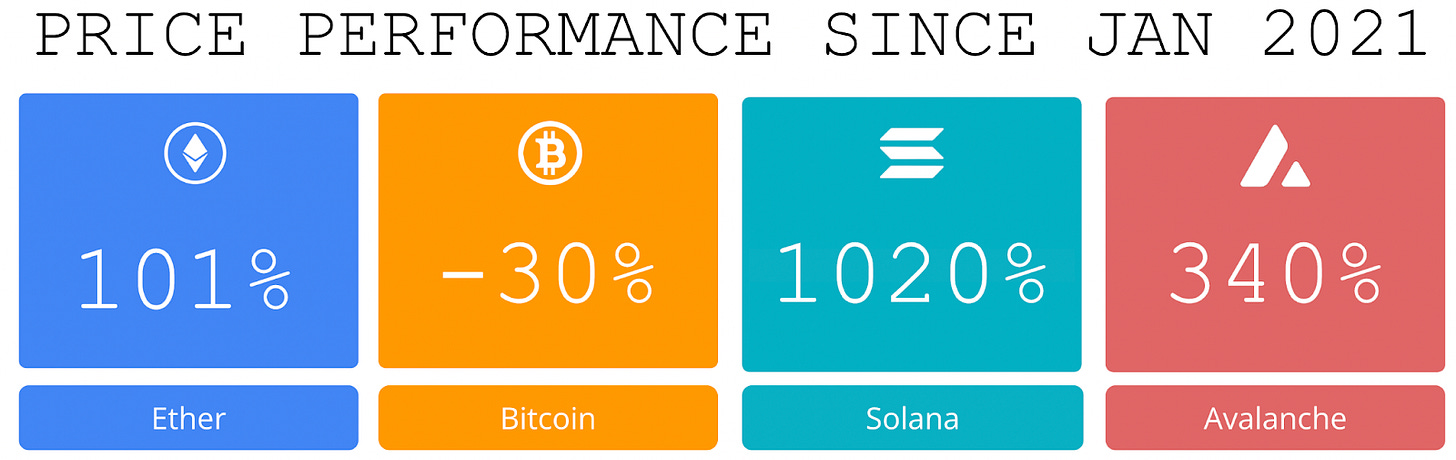

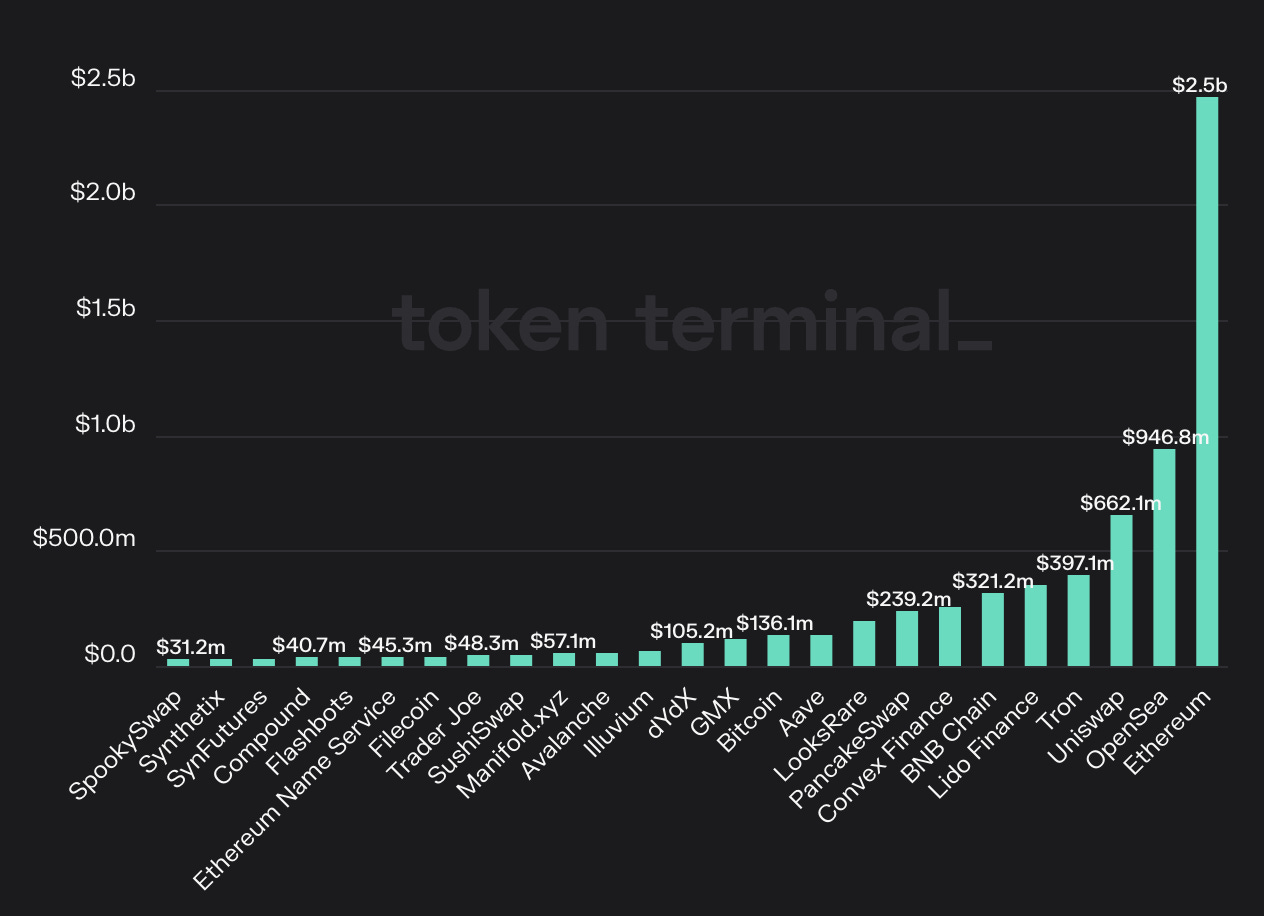

1. Top 5 Crypto Projects by Revenues Generated the Last 365 Days are Ethereum, Open Sea, Uniswap, Tron, and Lido

2. Apart From Doodles and CryptoPunks, Blue-Chip NFTs Witnessed a Substantial Contraction in the Number of Holders

3. Tether’s Market Share of Volume Hit an All-Time High Right After Silvergate Shut Down SEN, Its Fiat Transfer Network

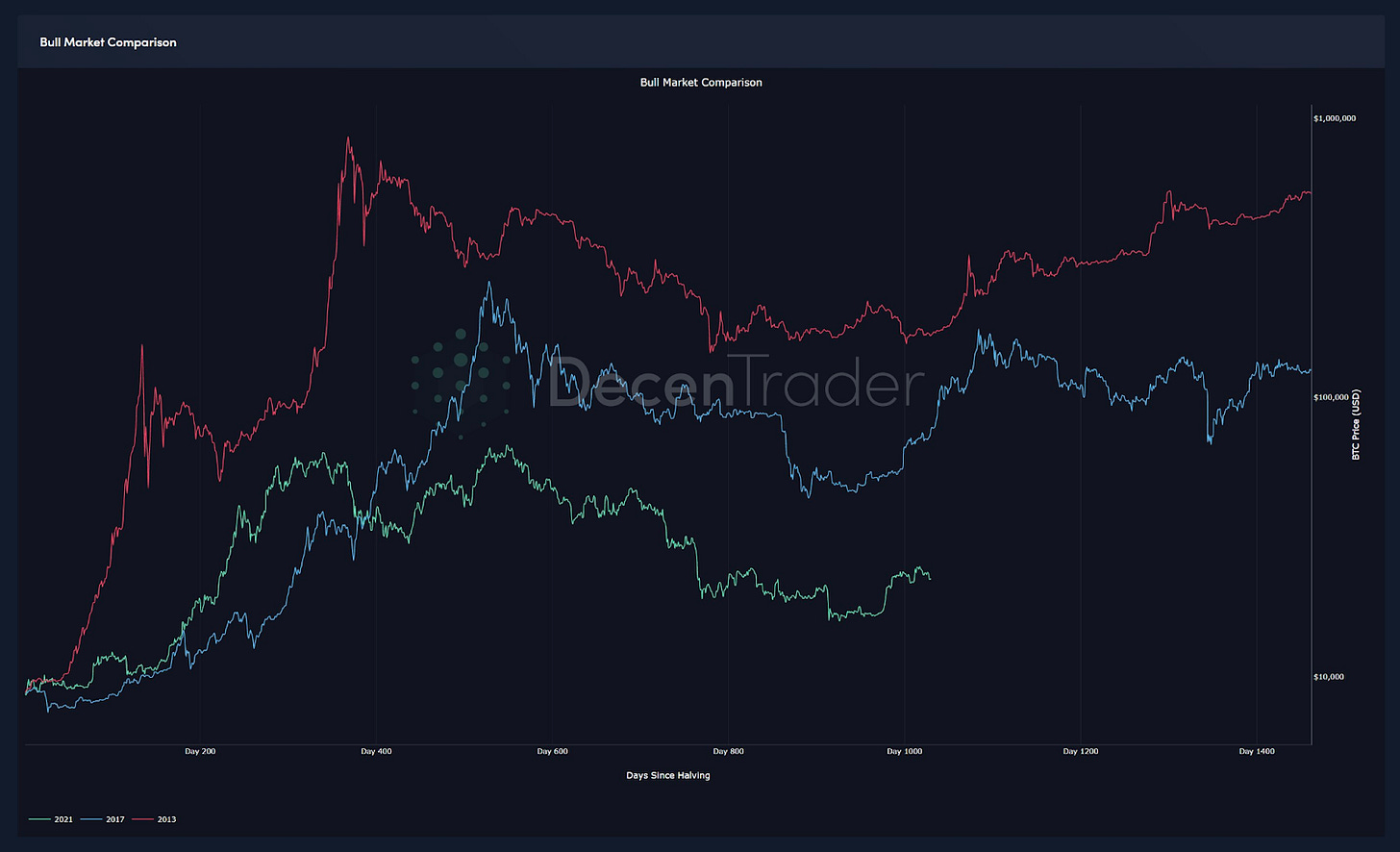

4. About 400 Days To Go Until the Next Halving. Whether There Is One More Major Shock or Not, We Are Likely Starting the Next Cycle Now.

5. LidoFinance Dominates With Almost 33% of All Staked ETH, While Coinbase Comes in Second With a Considerable Margin

6. We Had the Biggest Stablecoin Net Exchange Inflow of ~$1.4B Since Nov 18

7. Top 10 Crypto Projects By Fees Collected Show That Ethereum Network Generating 10x Revenues of Bitcoin

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

The Decentralized Science Ecosystem: Building a Better Research Economy

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Why DeSci? The Scientific Lifecycle is Broken

The current scientific research economy incentivizes prestige capture at the expense of transparency and innovation. Researchers must game a system with rent-seeking overlords (research institutions), misaligned reviewers, and double-dipping gatekeepers (publishers).

The system is plagued by problems that can be broadly categorized into three main pillars:

1. Centralized Decision-Making and Funding

Research is most often funded by government grants or corporate-driven inquiry with small groups of decision-makers. Both show inherent bias toward what and who receives funding. This serves as a negative feedback loop where researchers tailor laborious funding applications towards hypotheses they deem most likely to be selected, at the expense of those they may be most passionate about. Research variance is greatly narrowed as a result. For instance, billions of dollars have gone towards funding a single theory for Alzheimer’s research, while promising new ideas continue to be denied funding.

2. Poor Methodology and Data Transparency

Bad science may be perpetuated as researchers must “publish or perish” to guarantee employment and funding. Further, a lack of transparency surrounding datasets and methodologies makes it difficult, if not impossible, for others to verify or build on existing results. This has led to the “replication crisis,” where it is estimated that upwards of 50% of research papers are irreproducible and 85% of biomedical research spend is wasted on poorly designed and redundant studies.

3. Unincentivized Review and Gate-Kept Publishing

Manuscripts must pass the review of small groups of unpaid peers to be considered for publication. This leads to major publication delays, bias toward competing ideas, and poor attention to detail. Countless scandals involving fake reports, doctored and reused images, and manipulations of impact factor scores have resulted in the number of retracted articles increasing tenfold in the past decade.

Traditional scientific publishers then go on to slam scientists with thousands of dollars in article processing charges and high subscription fees for readers. What’s most jarring about this system is that the public must pay twice for scientific research: first through the tax money that finances studies and then through subscriptions to publishers to access the results. When all is said and done, a publisher’s profit margin ranges from 20% to 50%.

The Call for Open Science

In response to these issues, the Open Science movement emerged with the rise of the internet. It is a commitment to open and FAIR data, manuscripts, and collaboration. Pioneers like the Open Science Foundation issue badges to researchers that publish manuscripts with open data and methodologies. The movement uses Web2 coordination tools and largely relies on volunteers and donations. While a number of Open Science organizations are alive today, many have struggled to sustain operations or keep costs low for end users (researchers or readers):

Sci-Hub: An open-access site whose founder publishes studies from various journals. The platform is considered illegal and constantly faces the threat of being taken down.

Experiment: A project crowdfunding site for independent researchers. The platform relies on one staff member per project to review submissions and charges an 8% platform fee and ~3% for payment processing.

PLOS: An open-access publisher that must inevitably push the costs of staffing and website maintenance on applicants. Fees for publishing in PLOS can set authors back a similar amount to traditional journals.

Additionally, the field struggles with verifiability as open-access journals have been known to accept bogus papers at an alarming rate. Open Science is certainly a step in the right direction, but after twenty-odd years, it's become apparent to many builders that additional coordination, incentivization, and verification tools are needed to bring in the next wave of open research.

The Rise of DeSci

DeSci is disrupting the traditional scientific research lifecycle by combining the foundational principles of open science with novel coordination mechanisms and incentivization schemes. The DeSci ecosystem has a wide variety of projects that address some or all parts of the research economy.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Real Vision - Raoul Pal & Mike Novogratz: Lessons & Future Plans for Crypto

The Breakdown With NLW - What the Silvergate Death Spiral Means for the Crypto Industry

Coin Bureau - Did You See THIS? Crypto Hedge Fund Research!!

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.