Unlocking Institutional Alpha for All

Fyde Treasury has pioneered secure, non-custodial, "Liquid Vaults" enabling a painless solution to enhancing crypto returns.

Fyde Brings AI Driven Liquid Vaults to Ethereum

Fyde is an on-chain portfolio and liquidity optimizer that helps users consistently capture gains, earn yield, and stay liquid. At the core of Fyde is a new innovation called the Liquid Vault, which is risk and liquidity managed by AI. The goal of the protocol is to support the growth of crypto holdings with reduced volatility.

In crypto, vaults collect funds from multiple users and invest them together following a specific strategy. This process is designed to enhance returns for users while also saving them time and transaction costs.

Fyde’s Liquid Vault offers a sophisticated approach to managing crypto assets. The vault is directly accessible via 40+ different types of tokens and uses advanced agents, simulation modeling, and diversified allocations to lower risk. Depositors receive $TRSY, a tokenized representation of the vault that is optimized for heightened liquidity.

Utilizing machine learning, the protocol dynamically fine-tunes the liquidity of $TRSY in real time, providing increased trading depth and liquidity pathways for depositors.

Unlocking Institutional Alpha for All

Crypto adopters often struggle to keep track of token allocations across multiple wallets. This can lead to missed trading opportunities, unclaimed airdrops, and even potentially unnoticed hacks and rugpulls. Trying to determine which emerging token narrative to invest in—be it DeFi, RWA, or any other—adds to these challenges.

Fyde's Liquid Vaults solves these issues for depositors by accepting a broad range of tokens and redistributing them across a diverse range of tokens and narratives. Gains from winners are locked in, and AI and machine learning risk detection protects users against isolated events like rugpulls and liquidity attacks. This can help lower downside volatility for users.

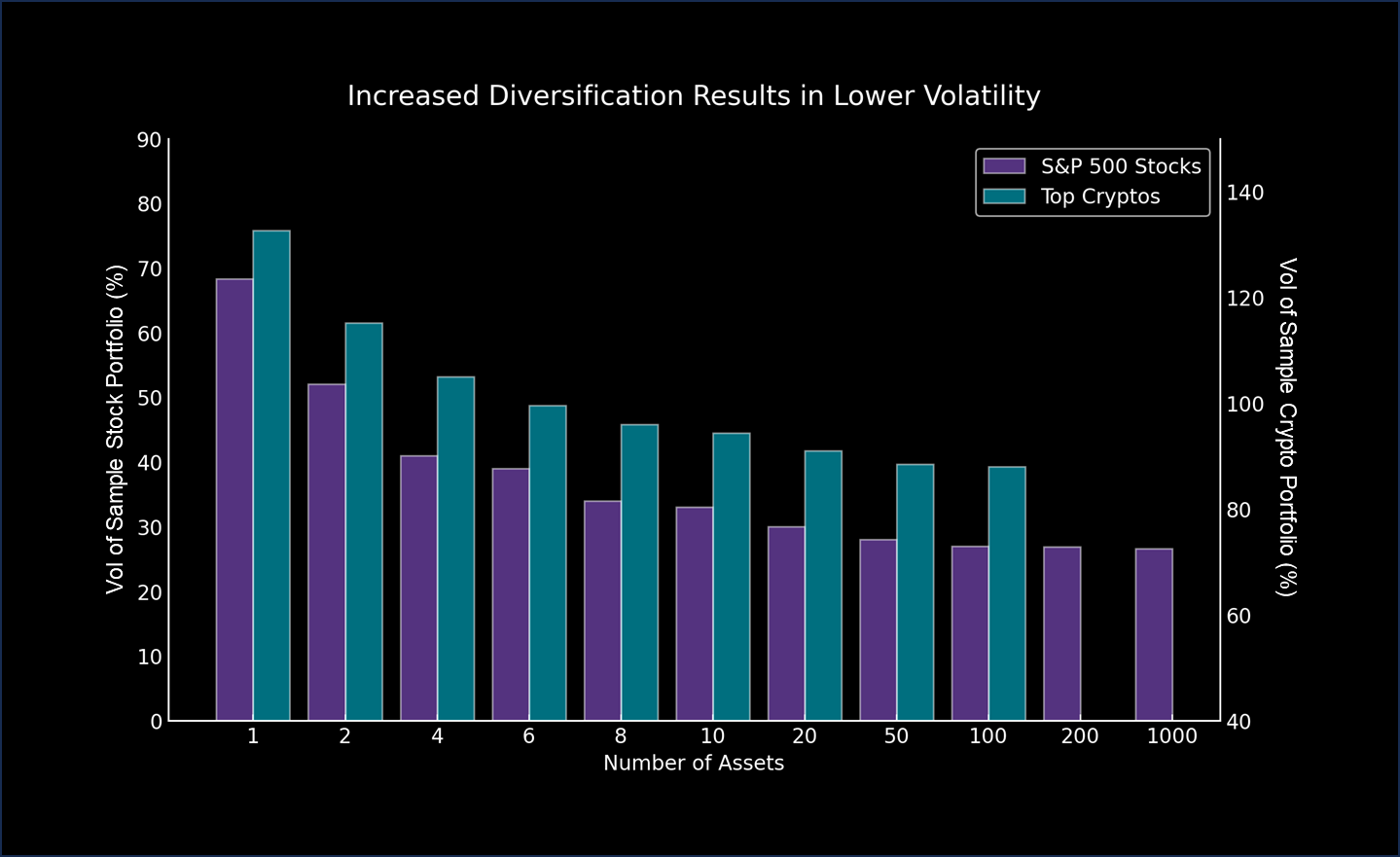

Through these different methods, the goal of the protocol is to become a tool that can help users generate more predictable and less volatile returns over time. This, in turn, allows for faster compounding. An illustrative example can be seen below, where both portfolios have an average return of 5% per year, but the higher volatility portfolio is down -10% while the lower volatility portfolio is up 22%.

The Fyde Liquid Vault

The Liquid Vault is non-custodial and gives depositors a receipt token ($TRSY) in a manner similar to liquid staking services such as Lido. Depositors are able to retain voting rights on their deposited tokens and participate in their communities' governance voting. This ensures that large users don’t inadvertently open themselves up to governance attacks, which is often the case when deploying capital across DeFi and infrastructure tools.

$TRSY is pegged 1-to-1 with the initial deposit value, and changes over time to reflect the performance of the vault’s assets and the vault’s rebalancing activities. Machine learning tools track and modify the liquidity position of $TRSY in real time, unlocking new liquidity pathways for depositors.

The vault uses algorithmic incentives to balance its holdings, with penalties to deter excess deposits of any single token or withdrawals that could destabilize the vault. After TGE of Fyde’s governance token ($FYDE), rewards will encourage users to contribute optimal tokens or assist in rebalancing. Arbitrage loops are in place to align the price of $TRSY with the vault’s actual value.

$TRSY acts as both a liquid receipt token to be utilized across DeFi and as a well-diversified AI risk managed portfolio, and is always backed dollar for dollar by the tokens within the non-custodial vault.

The Role of AI

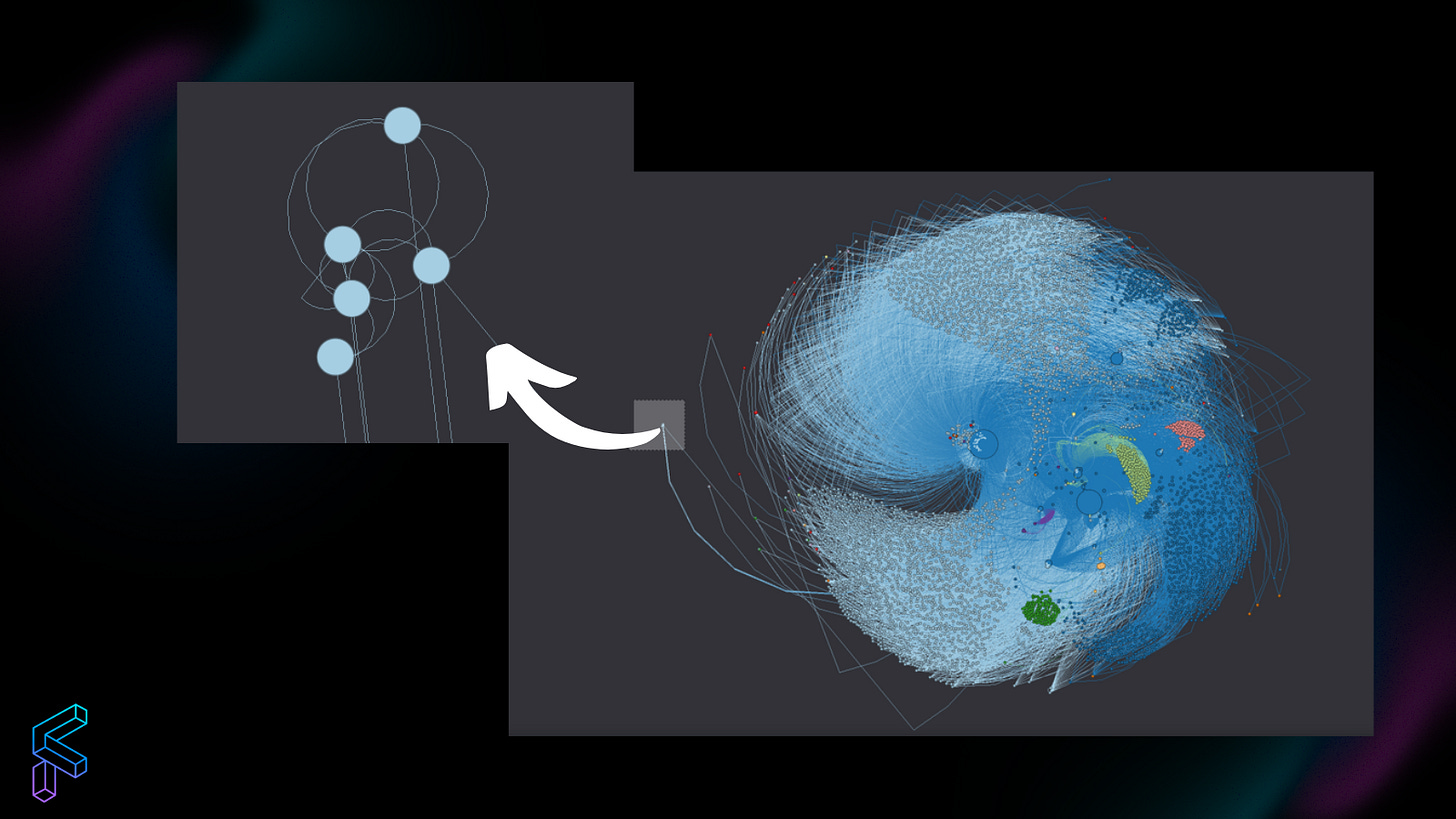

Fyde uses AI to enhance risk management and to optimize liquidity. The protocol uses machine learning (specifically graph machine learning) to analyze blockchain transaction networks, which evaluates relationships between network transactions, wallet flows, and token prices. This allows the protocol to assess the risk of tokens in real-time and decide whether to retain, quarantine, or remove them from the vault.

These tools also aid in preemptive threat detection, monitoring on-chain activities to identify potential risks such as liquidity pool vulnerabilities, governance attacks, and hacks. A visual example of this network analysis can be seen below:

To optimize liquidity for TRSY, Fyde creates simulations that test and refine liquidity strategies under various market conditions. The system dynamically adjusts these strategies based on real-time machine learning insights, increasing the liquidity generated for each dollar invested in a Uniswap V3 pool.

These tools are incorporated into the vault as safeguards and to enhance liquidity, providing a layer of protection for users’ assets that users might not be able to access by themselves.

To learn more about Fyde and how to leverage its capabilities, visit Fyde’s homepage or follow them on Twitter.