Uniswap Releases Unichain

Unichain will feature many technological innovations like a new block builder and validator network to improve network security and minimize MEV.

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 300k weekly subscribers. This week, Uniswap Labs released Unichain on mainnet, crypto investment products saw $1.3B in weekly inflows, Tornado Cash developer Alexey Pertsev was set a release date and big venture news for Reservoir ($14M) and Superlogic ($13M).

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Amphibian Capital, managing $140MM+ AUM, is a fund of the world's leading hedge funds. *+20.50% net YTD approx with their USD fund, *+14.38% net BTC on BTC YTD (*+152.85 in USD terms), and *+17.80% net ETH on ETH YTD (*+71.97% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com. *Approximate estimates through 2/4/25

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

SDM Financial is a US derivative dealer, building custom options strategies for funds, family offices, miners & HNW investors. Specializing in derivatives on altcoins, exotics, and illiquid assets, we craft strategies to hedge portfolios, boost returns, and capture market opportunities. Elevate your investment strategy today with unparalleled market expertise. Learn more

Become a Coinstack Sponsor

To reach our weekly audience of 300,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

Join SDM Financial and Blockworks for a free webinar with Mysten Labs, The HBAR Foundation, and Lekker Capital.

Join SDM Financial and Blockworks for an exclusive webinar featuring insights from two of 2024’s fastest growing Layer-1 protocols. Hear from the Hedera Foundation (HBAR) and Mysten Labs—the visionary team behind SUI—whose combined market capitalization now exceeds $18 billion and ranks them among the top 15 protocols. Also joining the conversation is Lekker Capital, a forward-thinking discretionary macro hedge fund.

Topics We’ll Cover

New trade ideas and how to capitalize on the wave of fresh liquidity and new institutions joining crypto.

How investors can identify new opportunities across altcoins.

Market-neutral strategies that generate yield using derivatives.

Using options to enhance your returns while actualizing a view.

How disciplined allocation and timing can enhance your portfolio returns during volatile market cycles.

About SDMF

SDM Financial (SDMF) is a US-based derivatives dealer that offers custom crypto trading strategies for asset managers, funds, miners, and high-net-worth investors. Specializing in top-25 tokens and altcoins, we craft strategies to hedge portfolios, boost returns, and capture market direction.

Why SDMF:

Specialized Derivatives Solutions: SDMF develops derivatives and options strategies that generate yield, capture market-neutral direction, and provide effective hedging.

US-Based: Operating from the United States, SDMF offers institutional counterparties the advantage of onshore trading, ensuring compliance and security.

Top-25 Tokens: The firm excels in identifying liquidity in large-cap (Top-25) tokens, as well as altcoins and emerging protocols.

Deep liquidity: Our notional trading volume increased 8x YoY. SDMF works with 12+ liquidity providers to secure optimal liquidity from small to large coins.

Discreet Counterparty: SDMF serves as a trusted, discreet counterparty for protocol treasuries, token holders, miners and funds, enabling effective balance sheet management.

Trading Strategies at SDMF

SDMF builds derivatives and options products that are not commonly found on the CME or on other derivatives exchanges.

Accumulator: Bitcoin (BTC)

Accumulate your next position at a discount to the current spot price with SDMF's Accumulator. This structured product is tailored for clients seeking to systematically build Bitcoin exposure at prices below market levels. By providing a disciplined approach to asset accumulation, the Accumulator enables investors to take advantage of favorable pricing while mitigating the impact of market volatility.

Covered Calls: Sui (SUI)

SDMF's Covered Call strategy is designed to enhance your portfolio's income while maintaining your exposure to market opportunities. By leveraging your existing long positions, this approach systematically captures option premiums to generate a consistent yield, helping to smooth out market volatility.

Secure your free spot for this exclusive webinar, where you'll gain unparalleled insights from the industry's top-15 protocols and industry experts.

For a personalized quote or to learn how SDM can enhance your digital asset strategy, please contact us here.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Uniswap Labs releases Unichain on mainnet: 'We're entering a cross-chain world' says Hayden Adams: Unichain will feature many technological innovations like a new block builder and validator network to improve network security and minimize MEV.

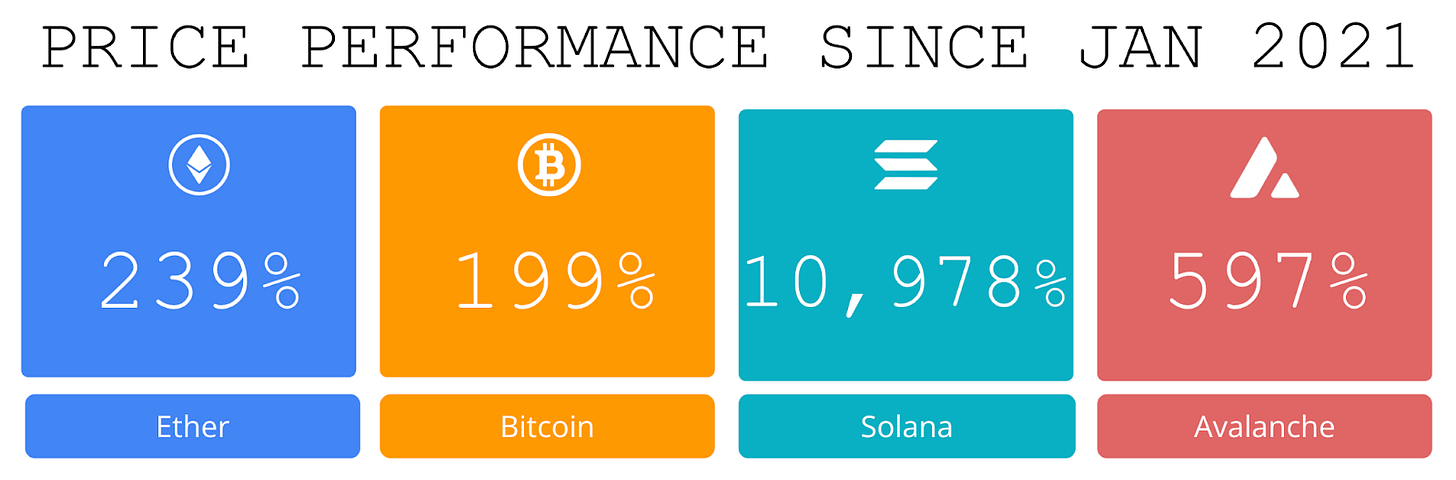

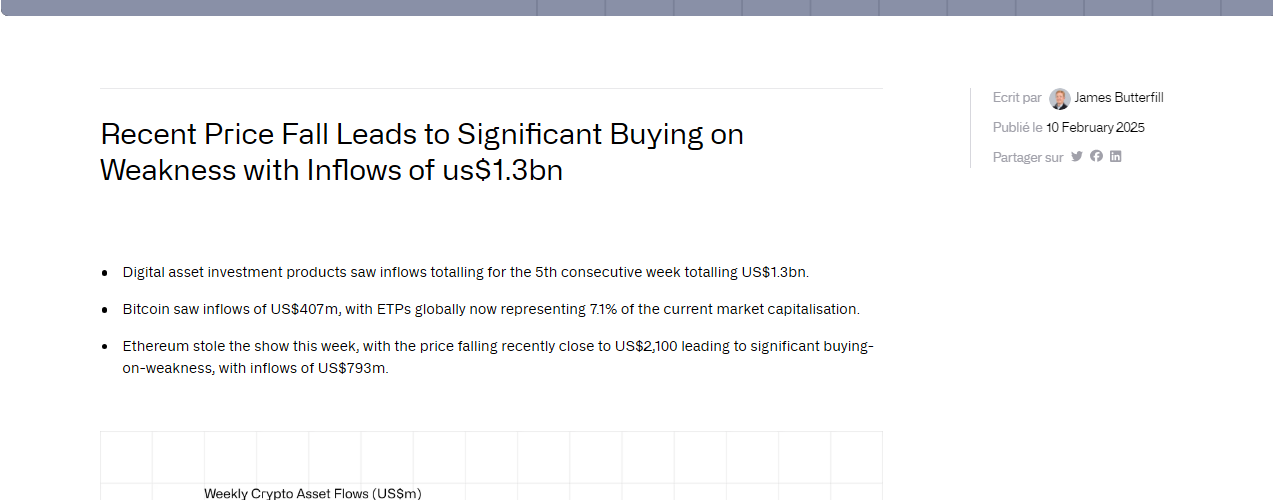

📈 Crypto investment products see $1.3 billion in weekly inflows: Global crypto investment products run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered net inflows of $1.3 billion last week, nearly doubling from $747.4 million the week before despite President Trump’s tariff-fueled price plunge, according to CoinShares.

⚖️ Tornado Cash developer Alexey Pertsev gets nod for conditional release from prison to work on appeal: Alexey Pertsev, a developer of Tornado Cash, said he would be released from pretrial detention on Friday to work on his appeal. Pertsev, who has been accused of money laundering charges in the Netherlands, wrote on X today that a Dutch court suspended his pretrial detention under the condition of electronic monitoring.

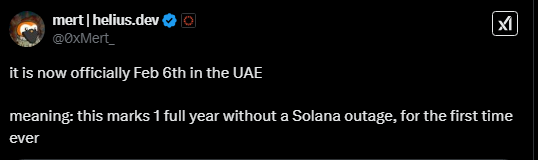

🚀 Solana celebrates a year without network failures as ecosystem thrives:Solana has completed an entire calendar year without a block production failure.This marks a notable improvement in network stability, especially given its past performance issues.On Feb. 6, Helius Labs CEO Mert Mumtaz acknowledged this achievement, emphasizing that the network had maintained uninterrupted operation for an entire year. He also noted that Solana had avoided performance-related failures for nearly two years

🚀 Arweave's computing platform AO goes live on mainnet:Decentralized storage project Arweave has officially launched the mainnet release of its computing platform, AO, following a year-long testnet phase.

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Uniswap interface fees have now surpassed $100M. This represents the fees Uniswap collects from their web interface and wallet. Perhaps just as interestingly, total interface fees collected grew by more than 740% since the protocol increased them from 0.15% to 0.25% in April, while cumulative trading volume grew by 80%.

Indeed, the interface level is where real value accrues.

2. Interestingly, ETH ETFs had their second best day ever with $308M of inflows.

"The trenches" got sent to 0, meanwhile institutions are quietly accumulating some fresh ETH.

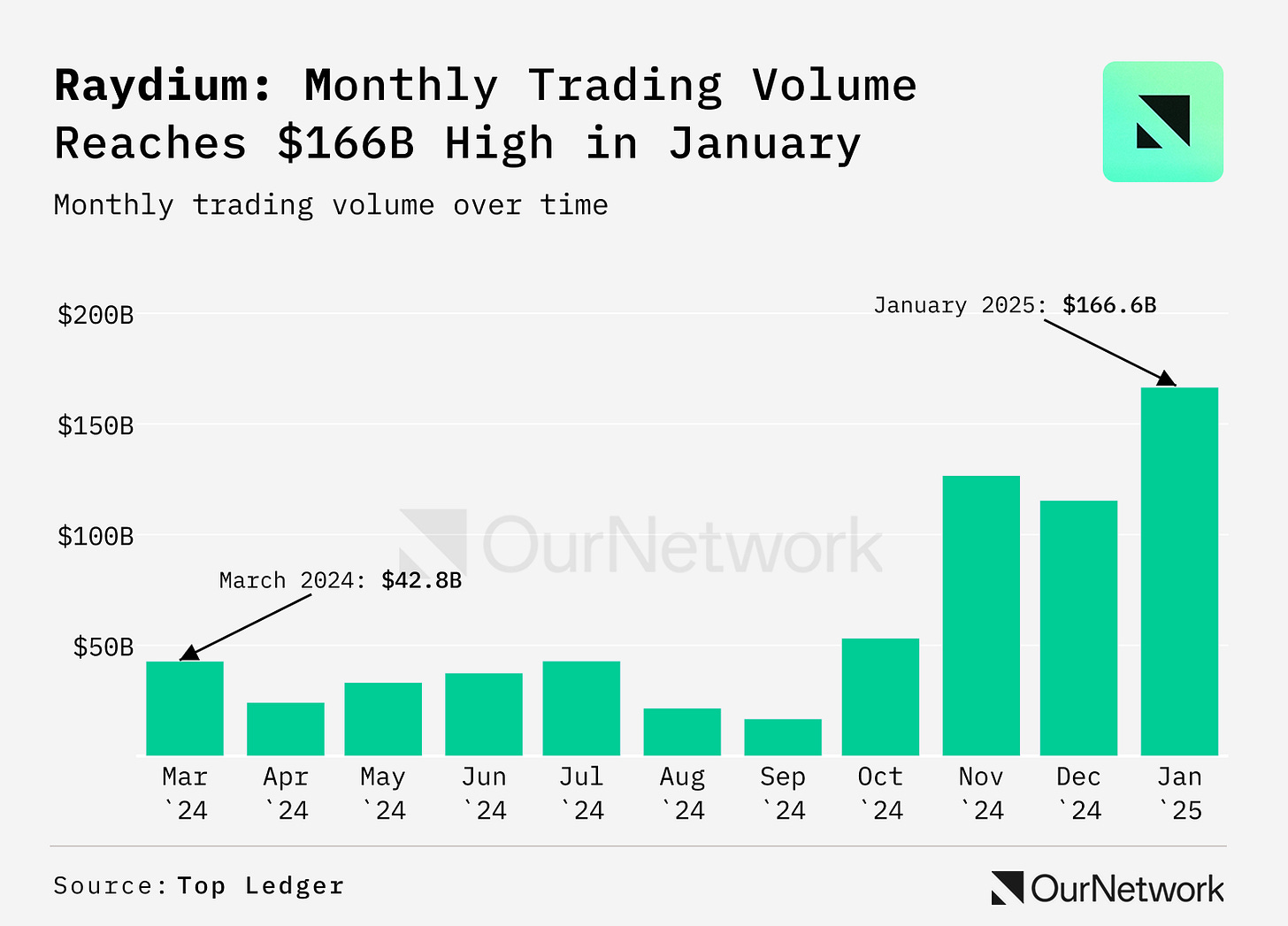

3. Raydium Hits $166.6B in Volume, Becomes Largest DEX in January

4. PancakeSwap's Monthly Volume is over $50B as CAKE Supply Continues to Decrease

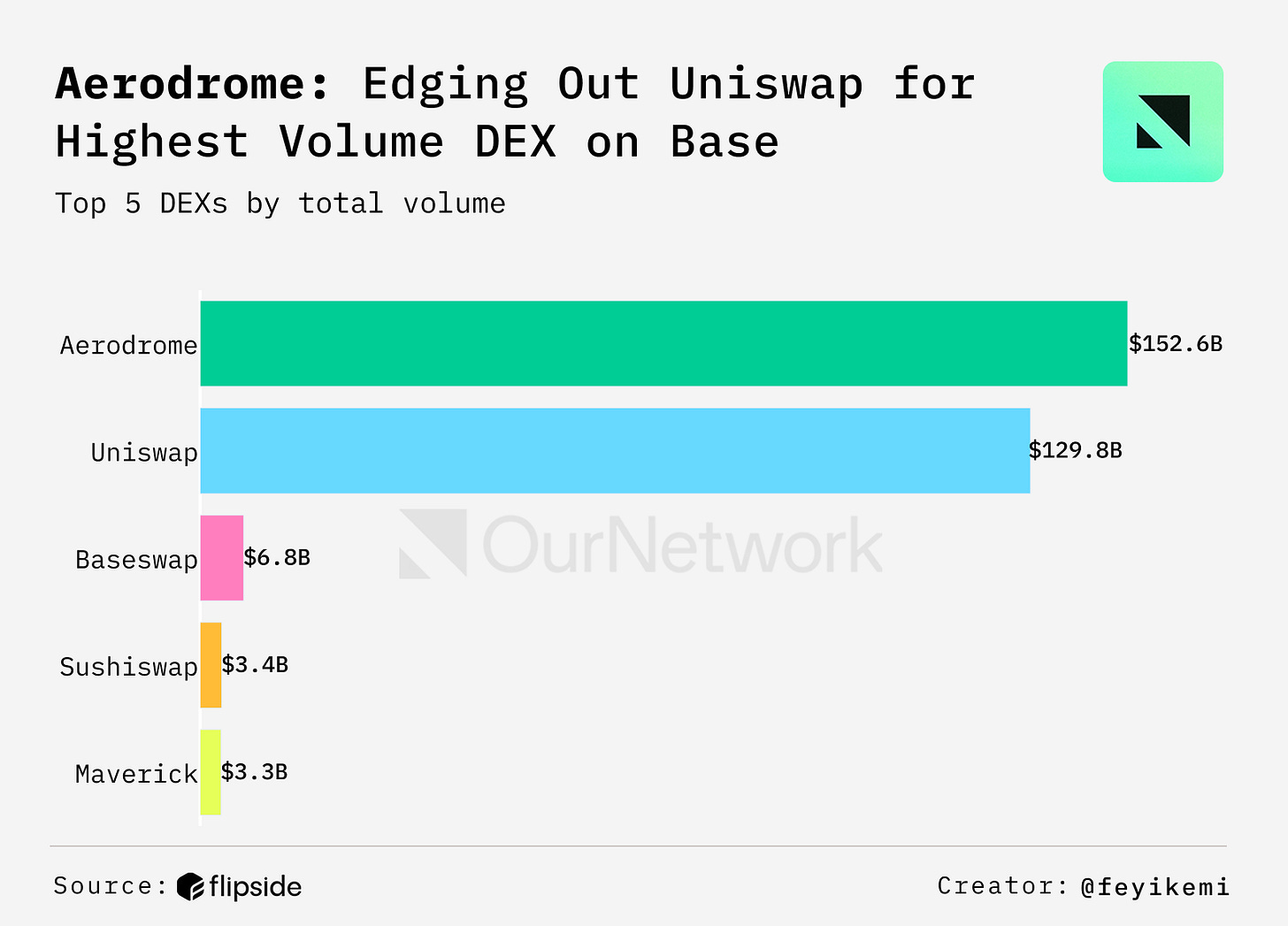

5. Aerodrome Dominates Base DEXs with Over $152B in Volume, Covering ~1.6M Unique Addresses

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

ON–311: DEXs 🔀

About the Author: OurNetwork aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is made possible by a community of contributors who actively participate at the forefront of this emerging data landscape. This is an excerpt from the full article, which you can find here.

Uniswap 🦄

👥 Tubaecci | Website | Dashboard

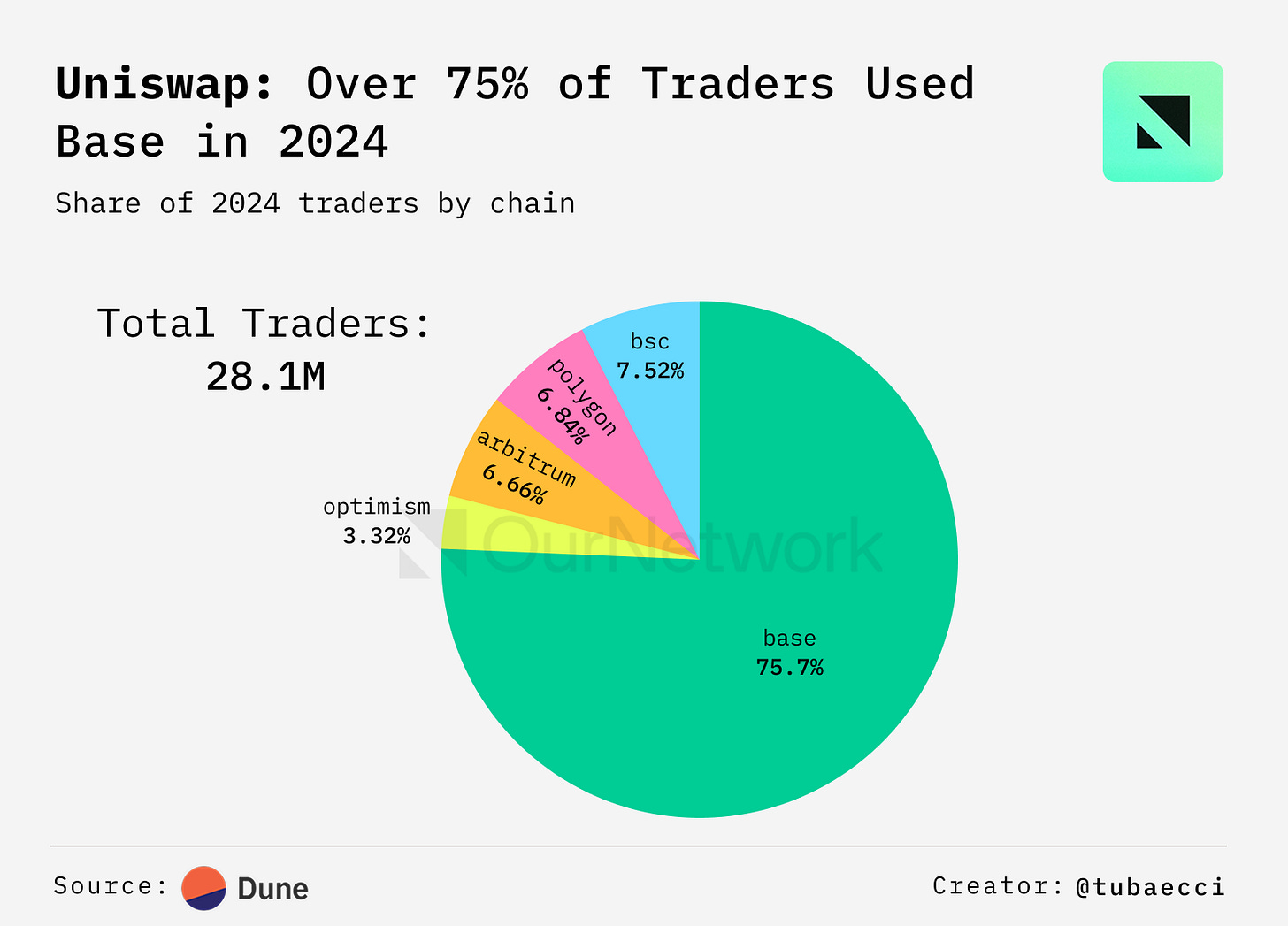

📈 Uniswap V3 Onboarded over 21M New Traders on Base in 2024.

Uniswap V3 is the third iteration of the Uniswap DEX, supported by most Layer 2 chains. Insights were primarily derived from the activity of new users (traders and liquidity providers) on five major L2 chains—Base, Arbitrum, Polygon, Optimism, and BSC in 2024. Trader onboarding steadily increased from January to December across these chains, peaking at over 400K around November 23. Base stood out, accounting for over 75% of the total onboarded traders, signaling healthy on-chain adoption in 2024.

Dune - @tubaecci

Dune - @tubaecci

With over $28M and a 68.4% share, Base dominated all other L2 chains in fees collected from trade activity of onboarded traders in 2024. Arbitrum, Polygon, Optimism, and BSC follow with shares of 24.8%, 4.3%, 1.4%, and 1%, respectively.

Dune - @tubaecci

On Arbitrum, active liquidity providers (LPs) stood at 88,050 on the last day of 2024, the highest among the other L2 chains. Which pools are these LPs most active in? WETH/USDC consistently leads weekly liquidity flows, making it a key liquidity driver for new LPs on Uniswap V3 on Arbitrum.

Dune - @tubaecci

Dune - @tubaecci

Read the Rest of the Article Here

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Bankless - Trump, Tariffs, Bitcoin, & The Dollar’s Fate: Lyn Alden’s Macro Predictions for 2025

The Defiant - The Ethereum Controversy: What's Next for the Foundation?

Coin Bureau - Trump’s Victory RUINS WEF – Globalists in PANIC MODE!

Nathaniel Whittemore: Why the Trump Tariffs Aren't Actually Economic Policy

Blockworks Macro: The U.S. Job Market Is On The Brink | Danielle DiMartino Booth

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.