The Crypto VC List

The Top 300 Global Crypto VC firms by fund size and investment activity

The Crypto VC List

By Ryan Allis, Managing Partner of Coinstack Partners

About this article: This special edition of Coinstack presents our latest research on the Top Global Crypto VC firms. In total, we identified 300 crypto VCs in our research. You can see the full top 300 global crypto VC list here. Coinstack Partners helps post-launch, post-revenue crypto/web3 companies raise venture capital in equity and token rounds. If we can be of help with an upcoming venture raise for your crypto/web3 firm, review our deck and then schedule a call to discuss. Learn more at www.coinstackpartners.com.

Following up on our popular 2022 Crypto VC List post, over the last week, we’ve created the below report to rank the Top 300 Global Crypto VC funds. Below is our list – shown in three formats:

Top Crypto VC Firms By Fund Size

Top Crypto VC Firms By All-Time Investment Count

Top Crypto VC Firms by Last 12-Month Investment Count

Let’s start with some summary data:

The total amount of capital under management by the top 300 global crypto VCs is $83.9 billion.

San Francisco is the #1 city in the world for crypto VC firm capital, representing 45.16% of the total capital among top 50 global crypto VC firms – followed by NYC, Hong Kong, Singapore, Austin, London, and Shanghai.

Even with a downturn in the 2nd half of the year, 2022 was the biggest year in history for crypto VC, with over $26.2 billion of new capital invested into companies compared to $25.1B in 2021.

New crypto VC investment in Q4 2022 ($2.5B) was 77% lower than Q1 2022 ($11.2B) – but we’ve turned the corner and we’re now heading back up.

In February 2023 there was $872 million in venture capital invested in crypto/blockchain firms, up 52% from $574 million in January 2023.

This means that even in our lowest bear market moments, we’re still seeing over $25M per weekday invested into crypto/blockchain company equity by venture capital firms (and around $45M per weekday currently). This doesn’t even count the amount being invested into tokens by venture firms.

When you zoom out and look at the bigger picture, there is currently 3.1x more venture capital currently (Jan/Feb 2023) being invested into companies compared to this same time four years ago (Jan/Feb 2019) during the last bear market.

So even though the bear is here at the moment, there’s still 3x as much capital going around as last time. The digital assets industry is maturing – and we’re seeing much more institutional capital stick around this time. This is a big deal.

The crypto VC capital market isn’t just surviving, it is thriving compared to past downturns and is poised for a big comeback in 2024/2025.

We’re starting to turn the corner in crypto VC investing as we gear up for the April 2024 Bitcoin halving and the likely resulting 2025 crypto bull market. Good times in our industry tend to return every four years – for about 18 months.

Now’s the time to get ready for the next bull run now.

At some point (I expect around Dec 2024/Jan 2025 if history is a guide) BTC will surpass $69k again and ETH will surpass $4800 – and the current capital allocators in the sector will look very smart. They ran in while everyone else ran away, realizing that smart contracts, distributed ledgers, always-on markets, and tokenized financial assets were the underlying technologies for the future of global finance.

The smartest venture firms are placing their bets now while valuations are discounted — and for the most part are following through on their investment theses around web3, gamefi, DeFi, infrastructure, and DLT in the midst of the market noise.

The Crypto VC List for 2023

It’s time for the list.

So which crypto-focused venture firms are the largest and which ones are most actively investing in a Post-Terra/Three Arrows/Celsius/FTX world?

The biggest crypto-focused VC firms by fund size are A16Z Crypto, Binance Labs, Multicoin, Pantera, and Paradigm.

The top crypto-focused VC firms by all-time crypto investment count are Coinbase Ventures, DCG, NGC, AU21, and Animoca.

But which firms are leading the charts with new crypto VC investments over the last 12 months? Those are the firms that are most active right now.

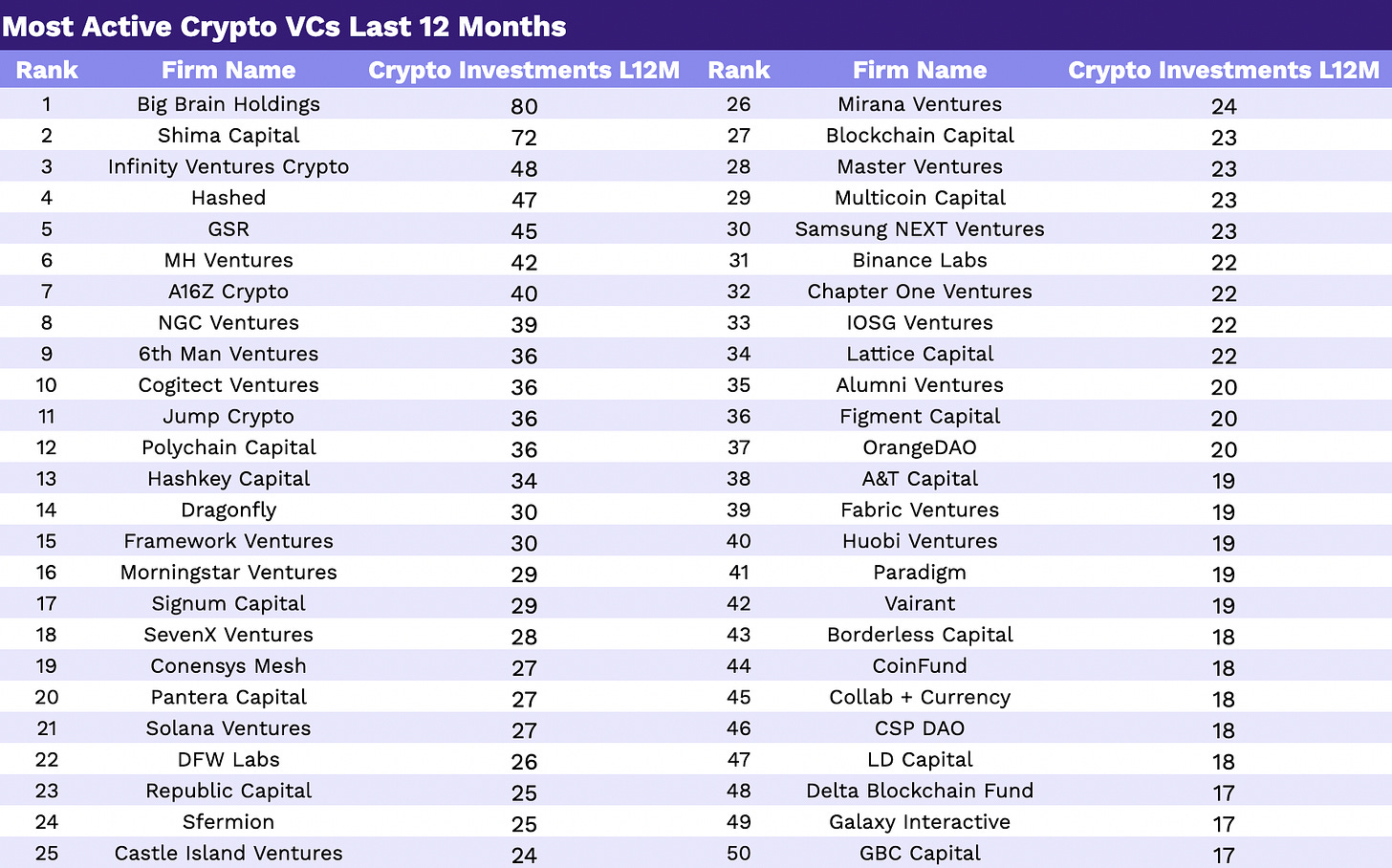

Well, that’s an entirely different list of firms. The most active current crypto VCs are: Big Brain Holdings, Shima Capital, IVC (Infinity Ventures Crypto), GSR, and MH Ventures.

Let’s jump into our analysis and full rankings.

The Biggest Global Crypto VCs By Fund Size

Let’s start by figuring out which are the biggest crypto VCs.

We’ve ranked the top global crypto VC firms below by their crypto fund size.

This list was compiled using our own research and combining data sources from Pitchbook, Crunchbase, AUM13F, and firm websites. When firms invested in sectors beyond blockchain/crypto, we only included the investments and funds dedicated to the crypto sector where possible. You can view and download the full 300 firm list here. (Research note: If we left your firm off or would like to update the data we have on file, just send us a reply.)

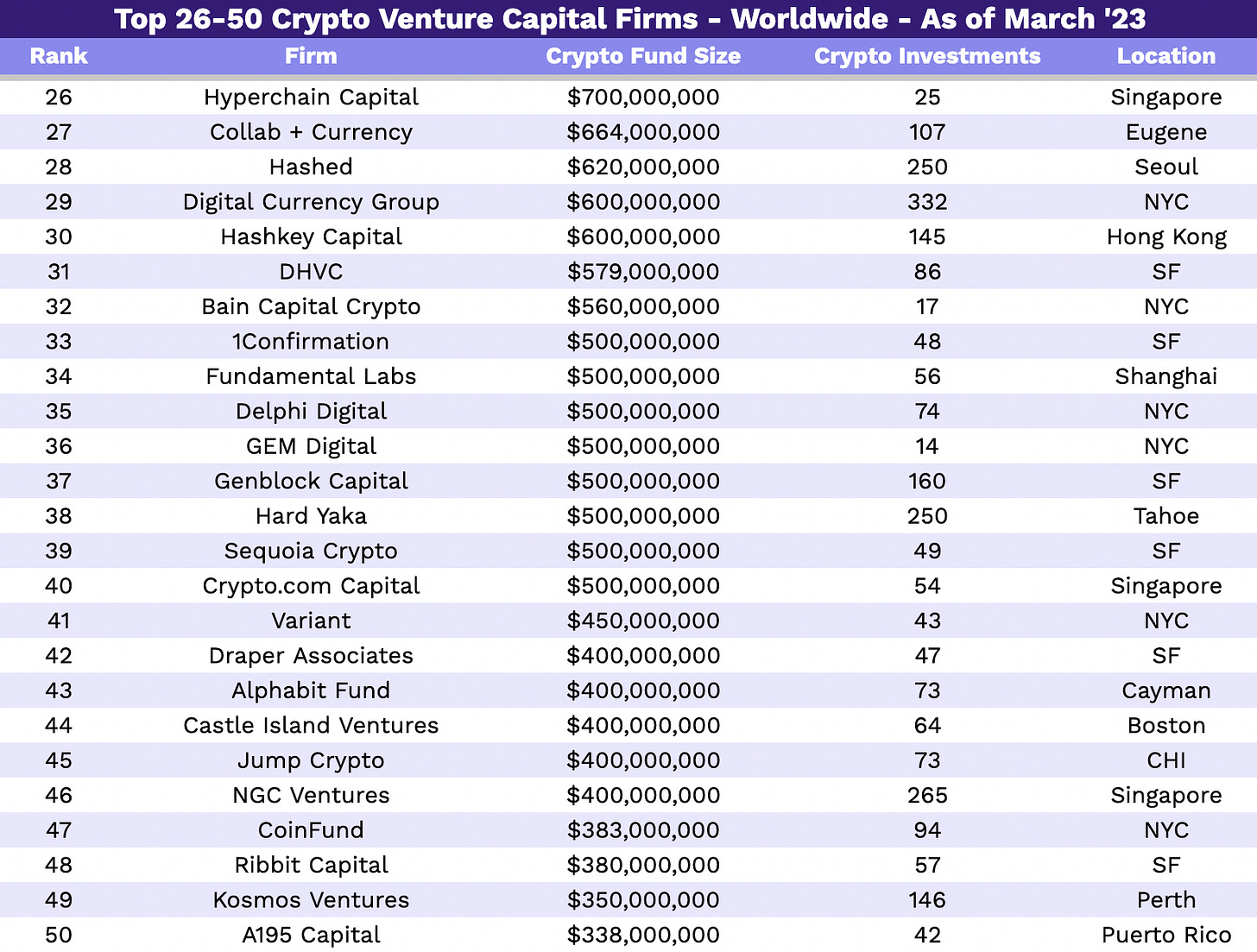

Below are the top 50 firms by fund size. There are, by our research, 19 crypto venture capital firms with $1 billion or more dedicated to crypto investing.

We have also built a separate list that we use for our Coinstack Partners venture capital advisory clients that has information on each partner, associate, and investment professional at these firms and details on the partners we’ve built direct relationships with.

Crypto Venture Capital by City

The total amount of capital under management from the top 50 crypto-focused venture capital funds is $59.6 billion. Where is this money geographically located? Let’s take a look at the capital by firm HQ:

The SF Bay Area dominates with 45.2% market share by capital under management among Top 50 Global Crypto VCs with more than $26B under management, nearly equal to all other global cities combined.

The United States is dominant in the crypto VC game, at least among the top 50 firms by fund size.

The 50 Top Crypto VCs - Ranked By Investment Count

Now let’s rank the top crypto VCs by the number of all-time investments they’ve made into the crypto/blockchain sector. This paints a very different picture of the top 50.

The 50 Most Active Crypto VCs The Last 12 Months

Finally, let’s look at overall crypto investments by the number of crypto investments the last 12 months. This tells us who’s active right now versus in 2018-2021 — and who may be particularly open to seed/early stage deals.

Here’s what we found when we ran the numbers.

These are the firms you’ll likely have the most success with if you’re raising now. If you want help deciding on which firms to reach out to and how to prepare your firm for an upcoming raise, please set up a call with us to discuss. We work with post-launch, revenue-producing web3/crypto firms who will be raising $1M-$50M.

Overall Crypto VC Sector Health

According to Pitchbook, 2022 was the biggest year in history for crypto/blockchain VC investing – with over $26.2 billion in new capital invested in companies – narrowly edging out $25.1B in 2021. Let’s look at some of the graphs.

Looking at the numbers from Pitchbook by quarter, however, tells a different story. Activity peaked in Q1 2022 with a little over $11B in new capital invested, reaching $2.5B in Q4.

Q1 2023 is on track to come in around $1.8B in new capital invested into the sector, the lowest amount since Q4 2020. However, based on February 2023’s large increase over January 2023, it appears that we’ve now turned the corner and are trending back upwards as we head into Q2 2023. Smart firms are making their bets now for the next cycle.

Looking at exits, there were around 70 major VC equity exits in both 2021 and 2022 (not to mention all the liquidity from token investments). While exits are down for 2023, the long term trend is clear. This industry is here to stay.

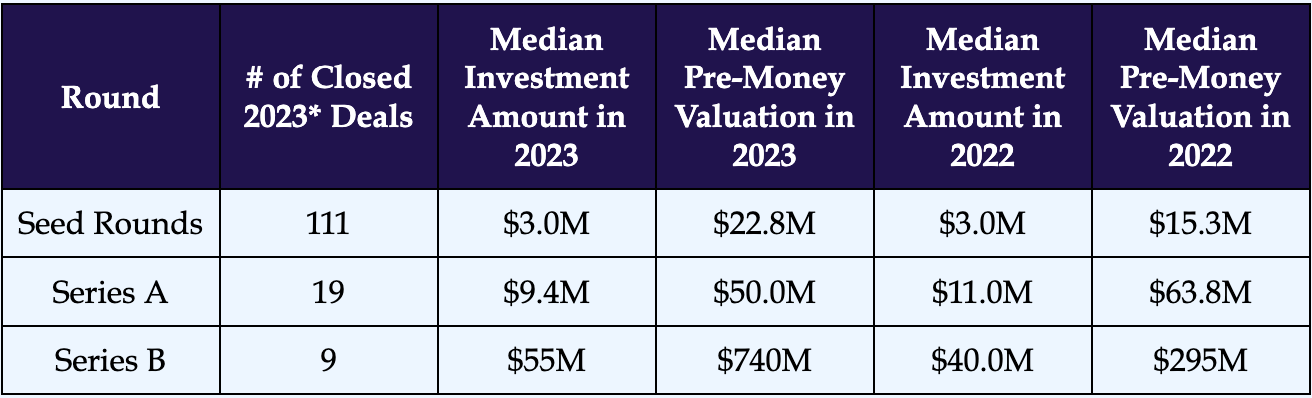

What Round Valuations Are We Seeing Currently?

Lastly, we’ll cover what’s going on with median pre-money valuations by year in the crypto VC sector for Seed Rounds versus Series A. Here’s where median valuations are right now (deals from Jan 1, 2023-Mar 16, 2023) for Seed, Series A, and Series B deals.

Seed Deal Valuations

How have valuations and amounts raised evolved over time in the crypto industry for seed deals? Let’s take a look. As you can see below the median seed round in 2023 has raised $3M on a $22.8M pre-money valuation, with the 25-75% percentile of valuation ranging from $11M to $43M. Interestingly, average seed valuations are actually higher right now than in 2022 according to Pitchbook, but about 50% fewer deals are getting done than the 2022 average. In our own anecdotal experience, most pre-revenue seed deals in crypto are coming in with pre-money valuations in the $10M to $20M range — so perhaps Pitchbook has a limited data set for ‘23 YTD crypto firm seed valuations.

Series A Deal Valuations

How have valuations and amounts raised been evolving over time in the crypto industry for Series A deals? The median Series A round in 2023 has raised $9.7M on a $90M pre-money valuation, with the 25-75% percentile of valuation ranging from $55M to $115M. These Series A rounds tend to go to firms with between $1M and $10M in annual revenues that have achieved product-market fit and are growing month-over-month even in the current downturn.

Series B Deal Valuations

How have valuations and amounts raised been evolving over time in the crypto industry for Series B deals? The median Series B round in 2023 has raised $55M on a $740M pre-money valuation, up from $295M in 2022. There have only been a few (9) Series B rounds done in 2023, so this number may come down as more deals get done. The 25-75% percentile for 2022 was $150M to 1.25B.

Are You About to Do a VC Raise? We’re Here to Help.

If your firm is planning an upcoming venture raise and would like to hire us to advise you on the round and introduce you to our relationships at these firms, please review our deck and then schedule a call to discuss. We help post-launch, revenue-producing crypto/web3 firms get connected to venture capital for Seed/Series A/B/C for equity and token raises between $1M and $50M.

About Our Research Process: The Coinstack Research team ranked the top crypto VCs by investment count, fund size, and last 12-month investments. Our research tools included Pitchbook, Crunchbase, AUM13F, and Signal NFX. Where fund size was not disclosed, we estimated it by multiplying the number of crypto venture deals completed times half of the median investment deal size (since there are often other investors too). If you’d like to submit a correction or your firm for the next edition of this list, please reply to send us a message with your firm name, number of crypto investments, and crypto fund size. If we can be of help with an upcoming venture raise for your crypto/web3 firm, review our deck and then schedule a call to discuss.