Sui Goes Mainnet 💧

Mysten Labs’ Sui Activates Mainnet. Sui trading at 1,200% higher than its public sale price. Coinbase and Gemini Launch Offshore Exchanges. Plus the top deals, news, stats, and reports of the week.

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders, where we review the top news, stats, and reports in the digital asset ecosystem. This week we cover Sui going Mainnet, Coinbase and Gemini going offshore, Bitcoin setting new records for daily transaction volume, and big new rounds from Zodia Custody ($36M), iZUMi Finance ($22M), and ThetaNuts ($17M).

Coinstack Sponsors

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

To reach our weekly audience of 90,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

iZUMi Finance, a DeFi protocol, has raised $22M, led by strategic partner Solv Protocol

ThetaNuts, a DeFi structured products firm, raises $17M in a round led by Polychain Capital

Giddy, a crypto wallet, raised $6.9M, led by Pelion Venture Partners, Peak Capital Partners

FARE Protocol, an ecosystem for probability contracts, raised $6.2M, led by C Squared Ventures

Amboss Technologies, a Lightning Network optimizer, raised $4M, led by Valor Equity Partners

Oort, a web3 data cloud provider, raised investment and partnered with EMURGO Ventures

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

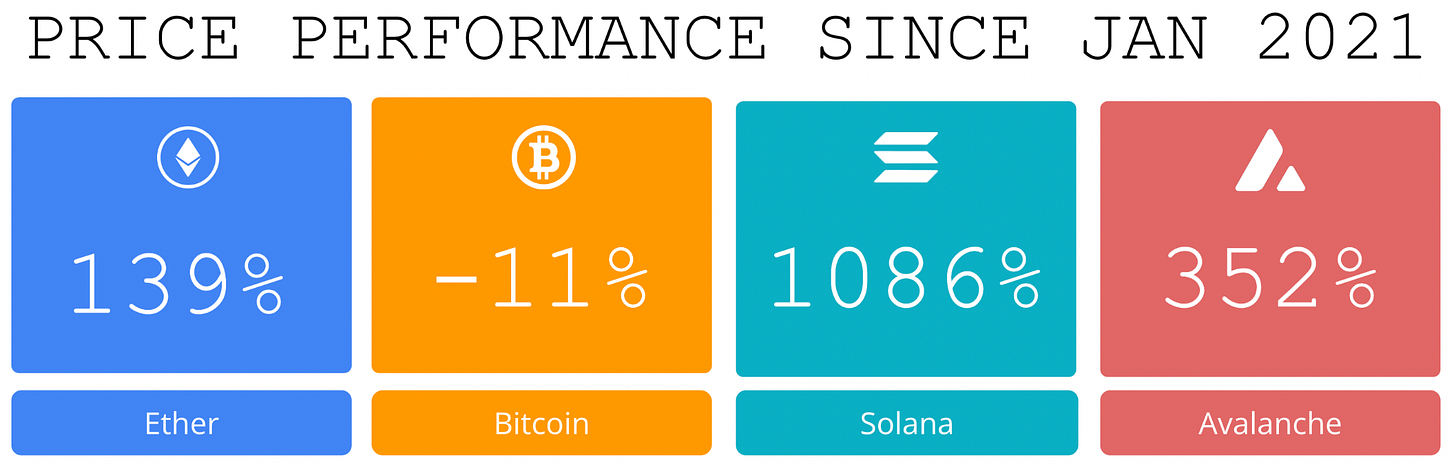

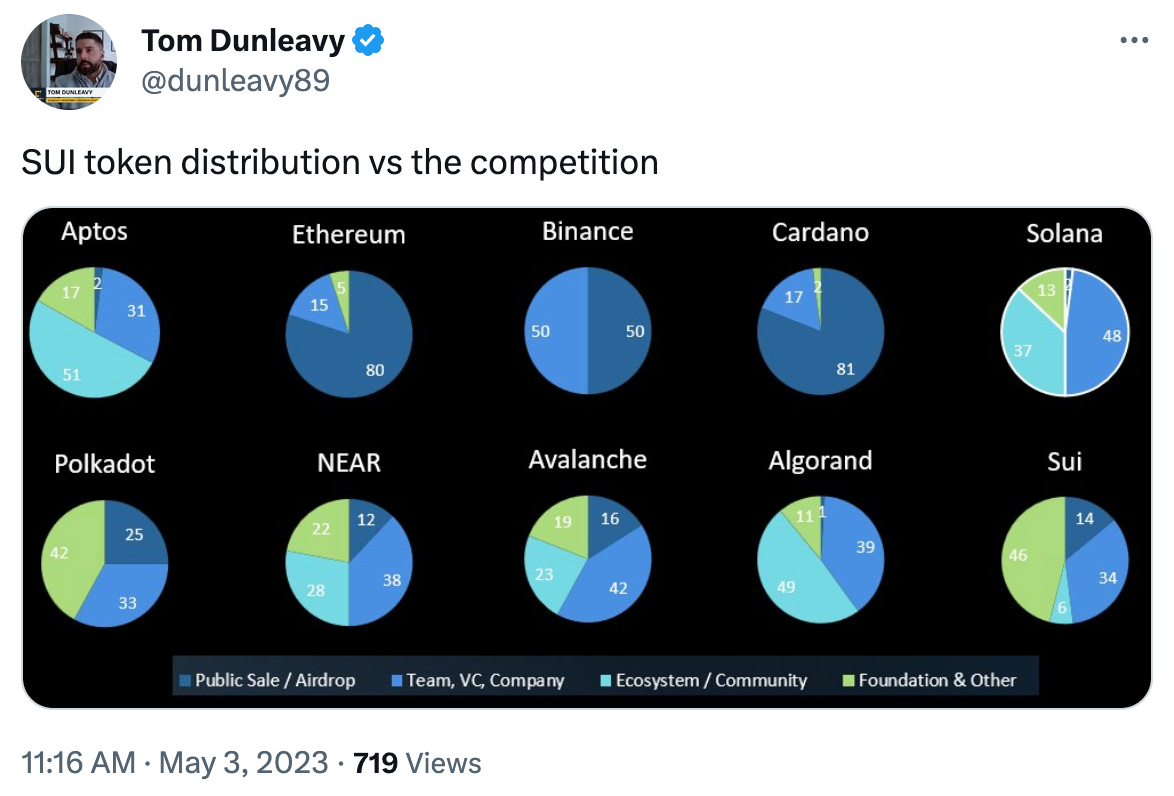

🪂 Mysten Labs’ Sui Activates Mainnet, Entering Competitive Layer 1 Space - Sui, a Layer 1 blockchain developed by Mysten Labs, has launched on mainnet. Sui’s native asset will be traded on major exchanges including Binance, OKX, Bybit, and Kucoin.

💸 Sui Token Yielding a 12-Fold Windfall for Public Sale Investors- Sui token was trading at $1.25 shortly after 10:30 a.m. ET. The token is trading at about 1,200% higher than its public sale price of $0.10.

💸 U.S. Crypto Exchanges Coinbase and Gemini Launch Offshore Derivatives Exchanges- Two high-profile cryptocurrency exchanges, Coinbase and Gemini, have both gone live with offshore cryptocurrency derivatives platforms. The platforms are not available to U.S.-based clients, and both have been accused by the U.S. regulator, the SEC, of trading unregistered securities.

⚖️ Ethereum’s High Gas Fees See Users Flock to EVM-Compatible Chains- Usage of Ethereum Virtual Machine (EVM)-compatible blockchains hit a new all-time high last week, thanks to consistently high gas fees on Ethereum.

⚖️ Celsius’s Alex Mashinsky Responds to New York State Lawsuit Blaming Him for the Crypto Lender’s Collapse- Celsius Network co-founder and former CEO Alex Mashinsky has moved to dismiss the New York State complaint against him that seeks to compensate everyone who lost money in the collapse of his crypto lender, which once held $30 billion in assets.

Bitcoin Set New Record of Daily Transactions the Same Day the U.S. Government Quietly Engineered a Bank Buyout - On Sunday, as the U.S. government worked behind the scenes with two major banks to engineer the latest financial rescue plan, the Bitcoin network hit a new all-time high for the number of daily transactions processed. There were more confirmed transactions than it ever had in its 14-year history, beating the previous record set during the 2017 bull run. The same day, JPMorgan Chase has acquired First Republic after the distressed bank’s assets were seized by regulators, becoming the second-largest bank failure in U.S. history. An interesting harbinger of times to come?

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

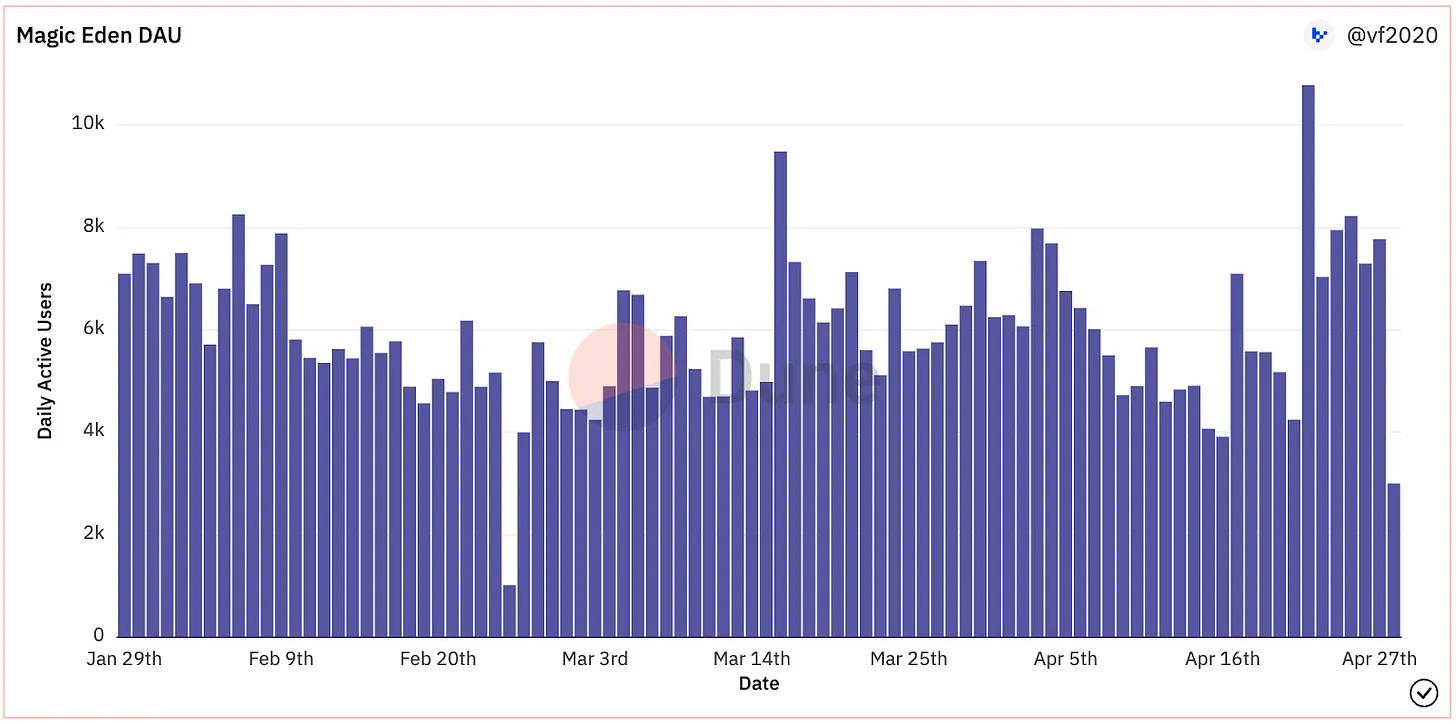

1. Solana sees uptick in daily active users in April

2. MadLads generates $2.5m+ in NFT revenue last week

3. Over half of Solana NFT sales volume is from Mad Lads since its launch ($18M; ~830K SOL)

4. Magic Eden Polygon daily users increase 5-10x

5. Jupiter adds 95k wallets in last 3 months of bear

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Staking Since Shapella

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

Ethereum’s Shanghai/Capella (Shapella) upgrade went live on April 12, 2023. The most significant protocol update was that it enabled ETH withdrawals from the staking contract. With the upgrade, Ethereum finally completes its transition to a full-featured Proof-of-Stake (PoS) network.

Owing to its history of originally being a Proof-of-Work network, Ethereum withdrawals work slightly differently from other PoS networks. It has two layers that work in tandem, with consensus and staking on the Consensus Layer, and everything else, like smart contracts, stablecoins, etc., on the Execution Layer. To unstake ETH, it must move from the Consensus Layer to the Execution Layer. There are two types of ETH unstaking events –

Full or Principal Withdrawals – When a validator wants to stop validating on the network, they can withdraw the full staked amount from the Consensus Layer, i.e., 32 ETH and any staking rewards they have accrued. Full withdrawals require validators to enter a withdrawal queue and take a minimum of ~27 hours.

Partial or rewards withdrawals – The network automatically distributes staking rewards to validators that have updated their withdrawal credentials. This distribution is required because Ethereum considers only a fixed amount (32 ETH) as the effective stake per validator, regardless of the amount staked.

The Numbers Game

Since the Shapella upgrade, there has been a net outflow of 320,000 ETH from the staking contract. A gross total of ~2 million ETH has been withdrawn, of which 1.03 million ETH were full withdrawals and 980,000 ETH were partial withdrawals.

However, withdrawals being enabled has significantly derisked ETH staking. Validators can now withdraw as they please, with limited liquidity risk and virtually no execution risk. As such, deposits have been much higher after Shapella, with a total inflow of 1.7 million ETH. As withdrawal activity settles, we expect ETH staking to grow steadily.

Centralized exchanges have been the primary contributors to full withdrawals, collectively accounting for 82% of the ETH withdrawn. Kraken was responsible for 48% of the ETH withdrawn as it had to cease its staking program in the United States per a settlement with the Securities and Exchange Commission (SEC). Binance and Coinbase follow Kraken, accounting for 18% and 11% of the full withdrawals, respectively.

It should be noted here that Lido, the largest staking provider, currently does not support full withdrawals. However, a healthy peg for its derivative, Lido-staked ETH (stETH), indicates no significant withdrawal pressure.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.