SEC Declares Liquid Staking Outside of Securities Laws

Because the liquid staking activities do not constitute securities offerings, participants in such practices do not need to register with the SEC.

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 330k weekly subscribers. This week, SEC declared liquid staking is outside of securities laws, Galaxy Digital will be tokenizing GLXY Stock via Superstate, SEC updates staff guidance on accounting rules for USD stablecoins, and big new rounds from RD Technologies ($40M) and Stable ($28M).

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

Tap into the $8.5T Generative AI Economy with CEEK, the AI-powered platform securing content as digital assets on the Blockchain. Trusted by Meta, Universal Music, and Microsoft, CEEK enables users with Agentic AI tools to create, monetize and scale content and expertise. CEEK is the Web3 Monetization OS for the new economy. 👉Learn more at www.ceek.com

Become a Coinstack Sponsor

To reach our weekly audience of 330,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ SEC declares liquid staking is outside of securities laws in latest guidance following 'Project Crypto' initiative: In guidance released on Tuesday, the SEC said that people engaged in liquid staking activities do not have to register with the agency under the securities laws. Liquid stakers that could be exempted from securities laws include Lido, Marinade Finance, JitoSOL and Stakewise.

🙌 Galaxy Digital to Tokenize GLXY Stock via Superstate: Crypto financial services firm Galaxy Digital unveiled plans to tokenize its stock, GLXY, via Robert Leshner’s Superstate, according to a filing published today, Aug. 5. Galaxy published the prospectus supplement alongside several U.S. Securities and Exchange Commission (SEC) filings, including the firm’s Q2 financial report, on its website today.

💲SEC updates staff guidance on accounting rules for USD stablecoins: Essentially, the fresh guidance suggests that stablecoins pegged to the U.S. dollar could receive cash equivalent classification, contingent on having guaranteed redemption mechanisms and value stability tied to another asset class, according to the Bloomberg report.

⚖️ FCA opens door for UK retail investors in crypto exchange-traded notes:In an Aug. 1 announcement, the regulator confirmed that these products will now be available on UK-regulated markets, marking a significant policy shift to broaden access to digital asset investments.

🚀 Phantom acquiring Solana memecoin trading platform Solsniper: "We've acquired Solsniper, one of the fastest, most advanced trading platforms on Solana," Phantom posted to X. "Built for precision and speed, Solsniper helps traders monitor tokens, track wallets, and react instantly."

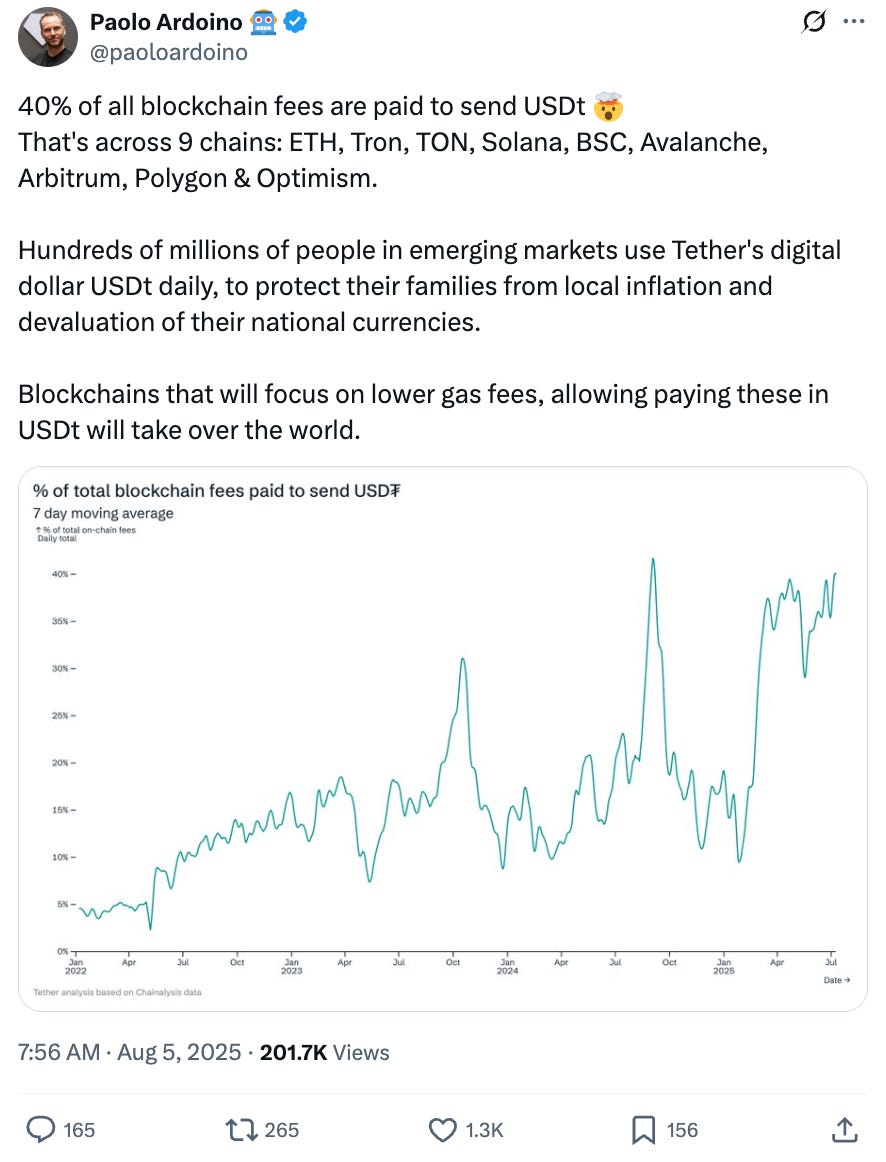

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

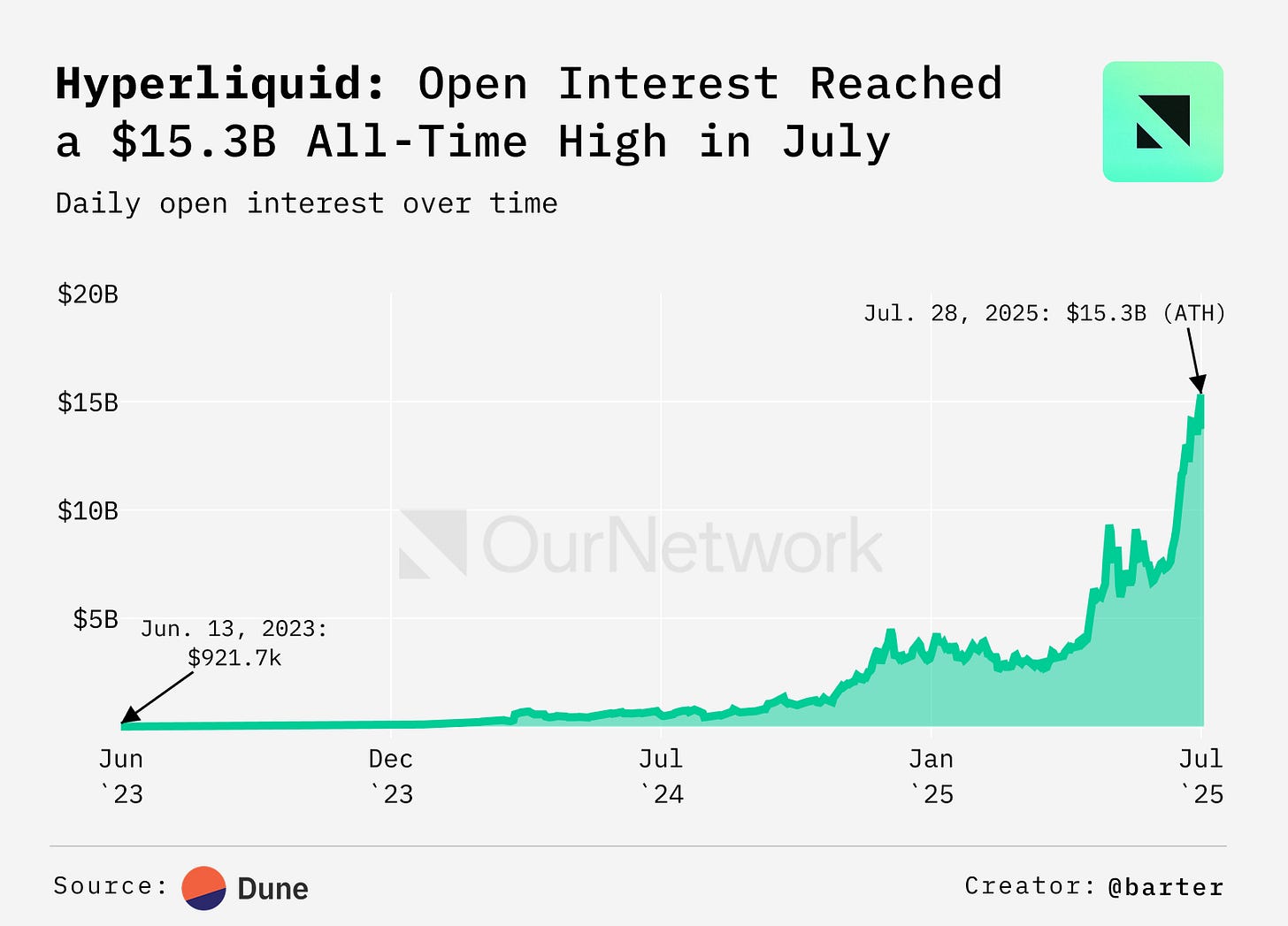

1. 📈 Hyperliquid is Scaling Fast with $15.3B Open Interest, $5.1B USDC Inflows, and a Phantom Wallet Integration Driving Retail Growth

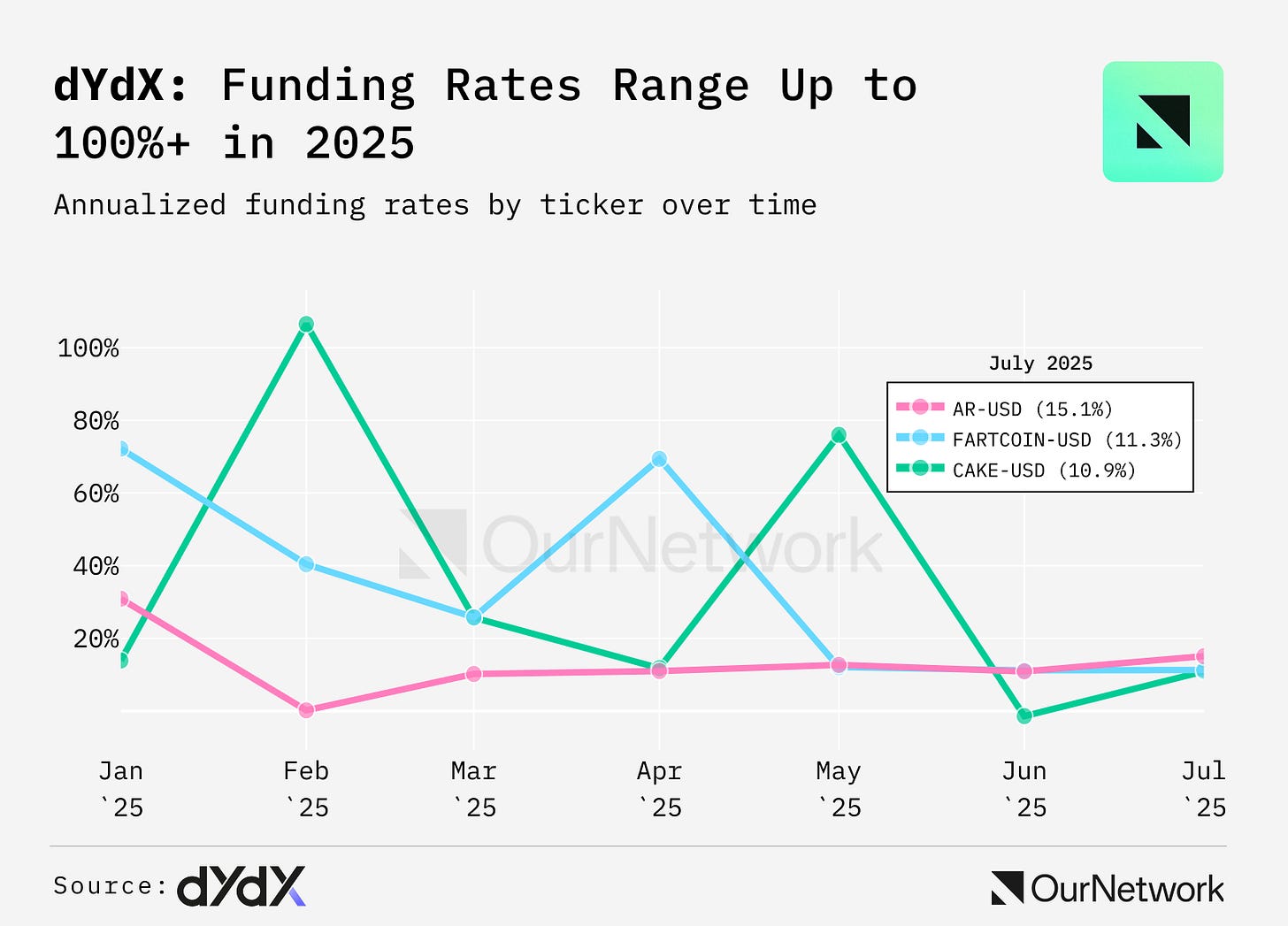

2. 📈 dYdX Saw Strong Trading with Elevated Funding Rates in 2025, While XRP Tripled Its Market Share to 10% Amid Volatility.

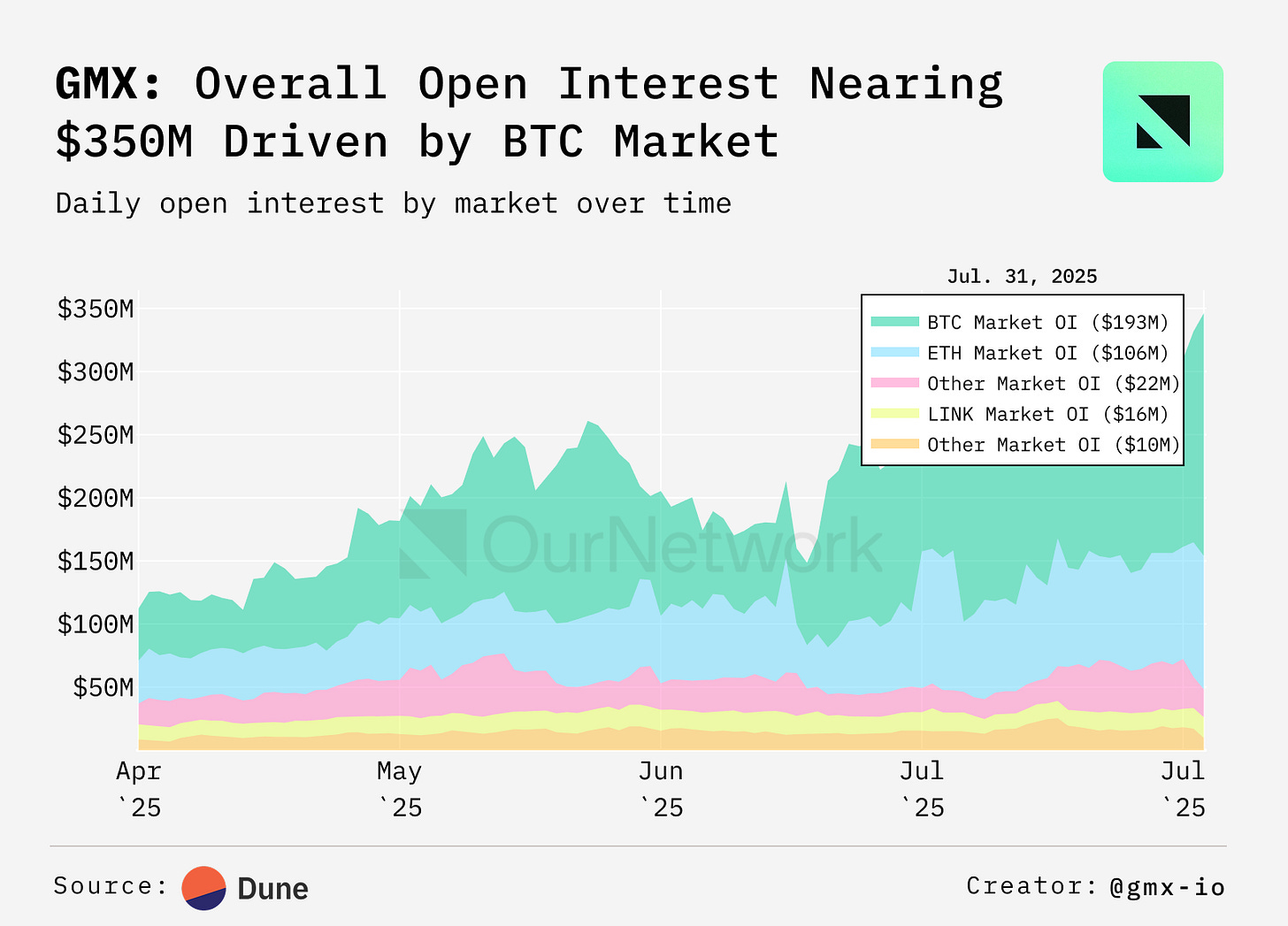

3. 📈 GMX is on the Road to Recovery as Open Interest Climbs to New Heights, Protocol Launches on Botanix, and Yields Grow

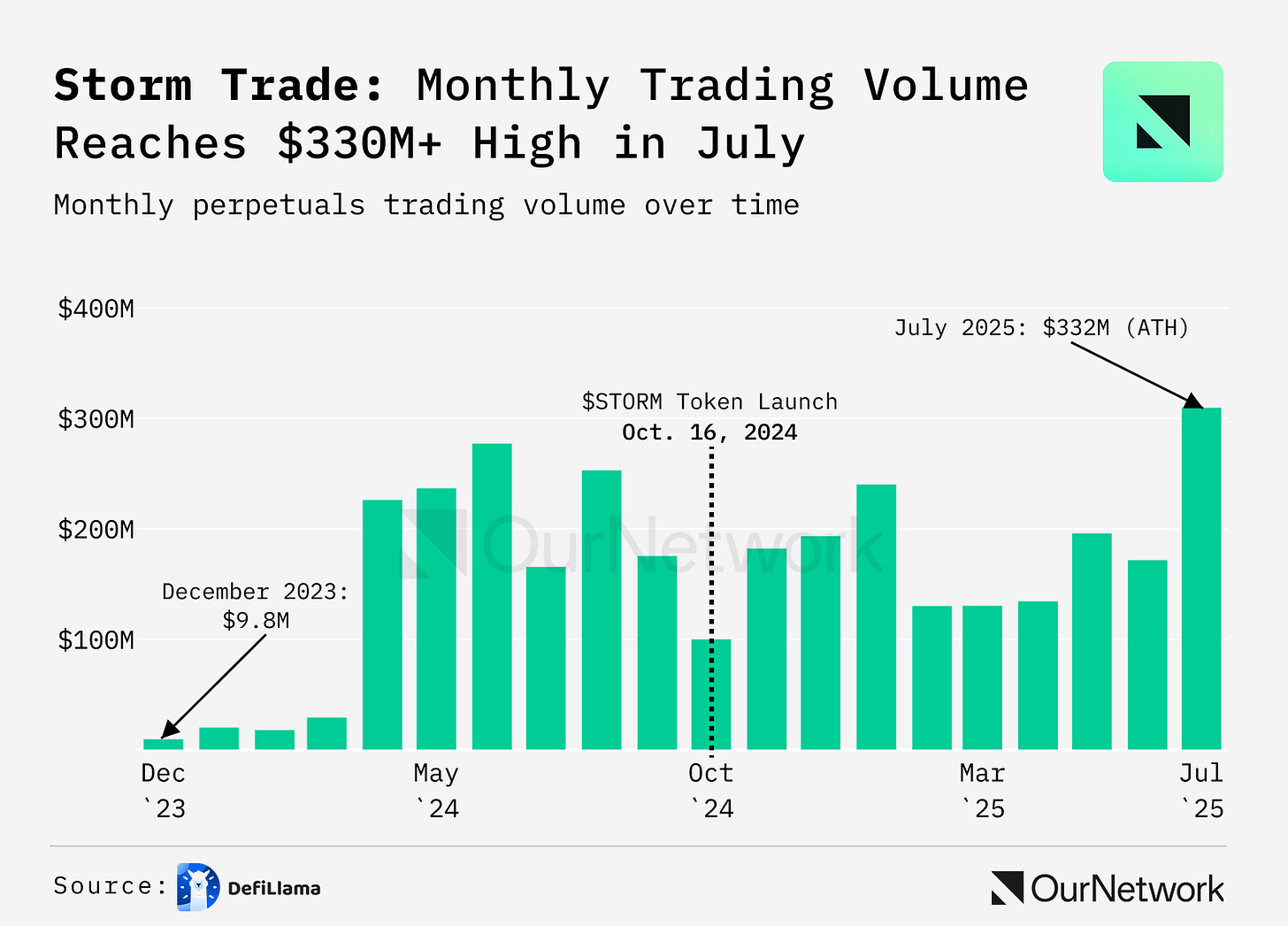

4. 📈 Storm Trade Ranks Second by Revenue on TON as Volume Surged after Degen Mode's Launch, and TVL Stays High Thanks to the Fee Share for Liquidity Providers

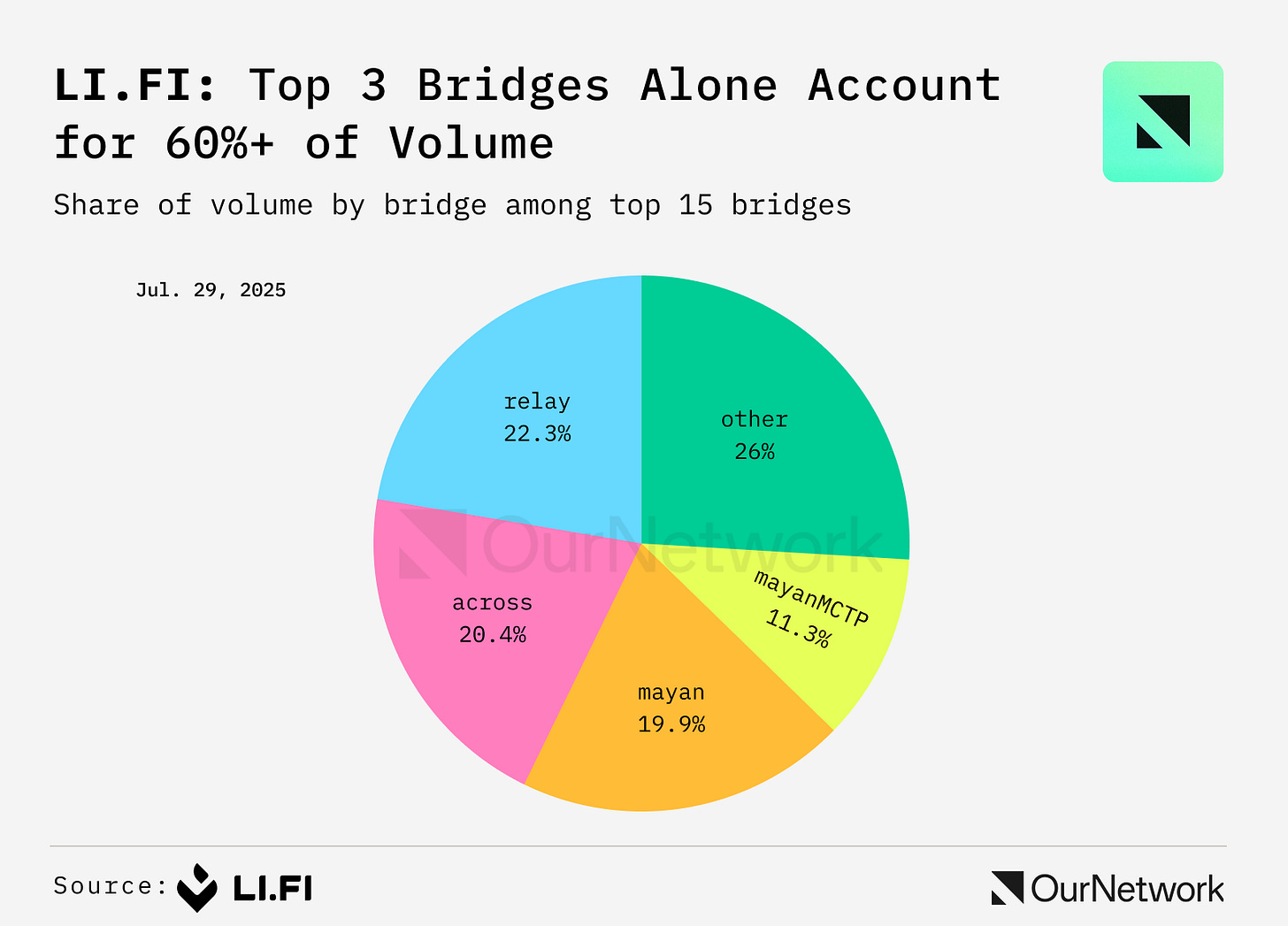

5. With LI.FI's Aggregation Across Top Liquidity Sources, Bridges Compete and Users Win

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

ON–358: Bridges 🌉

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork's latest covering bridges, a sector which has come a long way since its hack-laden origins. In fact, bridges were the key piece of infrastructure in three of the top five hacks, according to Rekt's famous leaderboard.

However, bridges have become much more secure as all the aforementioned hacks happened in 2022 and 2021. In 2025, no bridge-exploits have even entered the top 100 hacks by monetary value.

Below, OurNetwork contributors dig to some of the biggest players in the more-secure space of bridges — IrishLatte covered Across, Noam Cohen covered IBC, Eloviano covered Staragte, and Damian covered LI.FI, which provides cross-chain infrastructure to bridges.

– ON Editorial Team

📈 Across's Total Volume Surpasses $25B as Total Bridging Transactions Near 20M

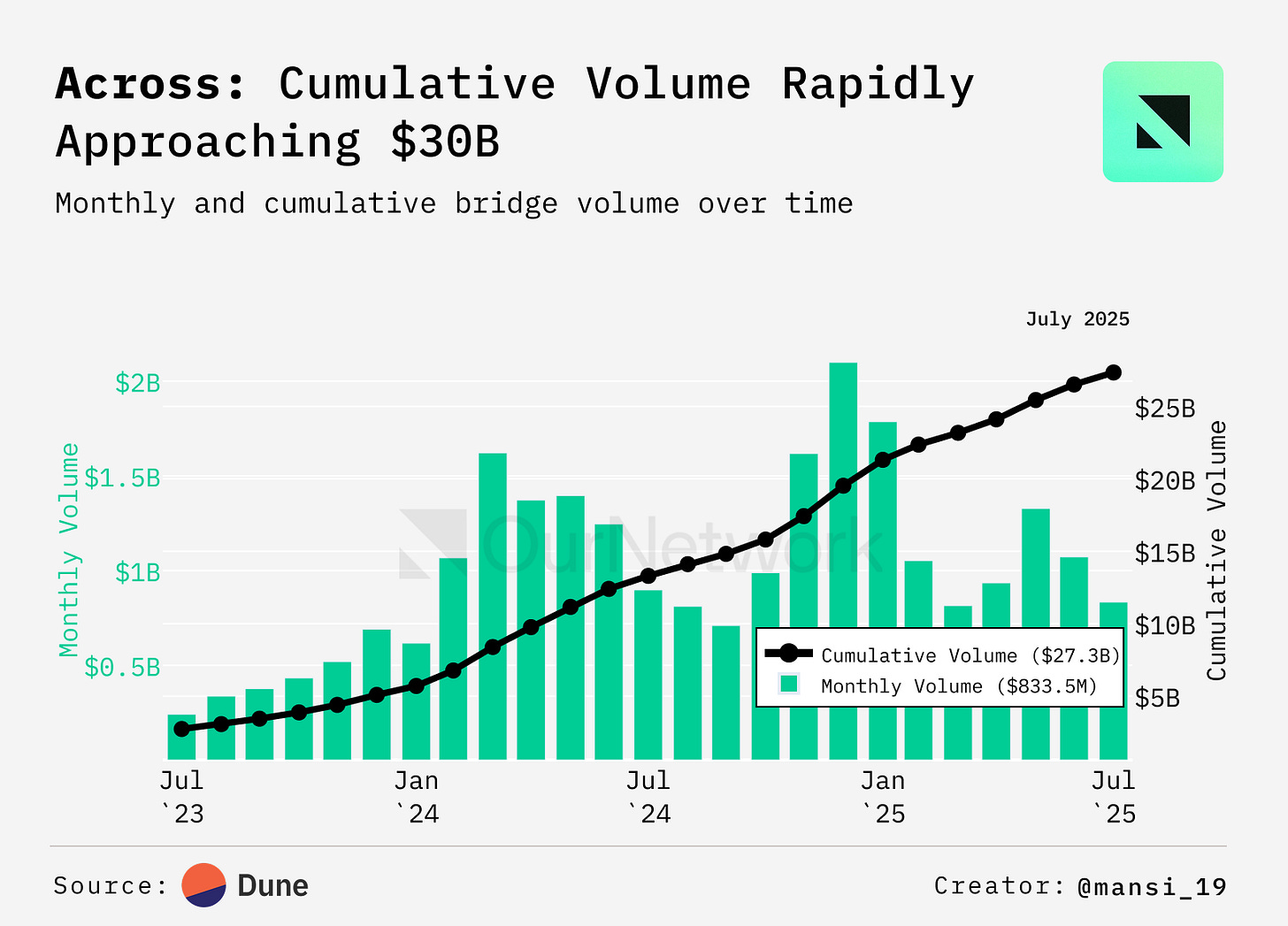

Across, a leading cross-chain bridging protocol leveraging intents, has surpassed $25B in cumulative bridging volume and is rapidly approaching the $30B milestone, with total bridging transactions nearing 20M. Particularly striking is the sudden surge in daily volumes that began in mid-July, where daily bridged volume nearly doubled. This dramatic increase appears to be primarily driven by an integration with Unichain, Uniswap's Layer 2.

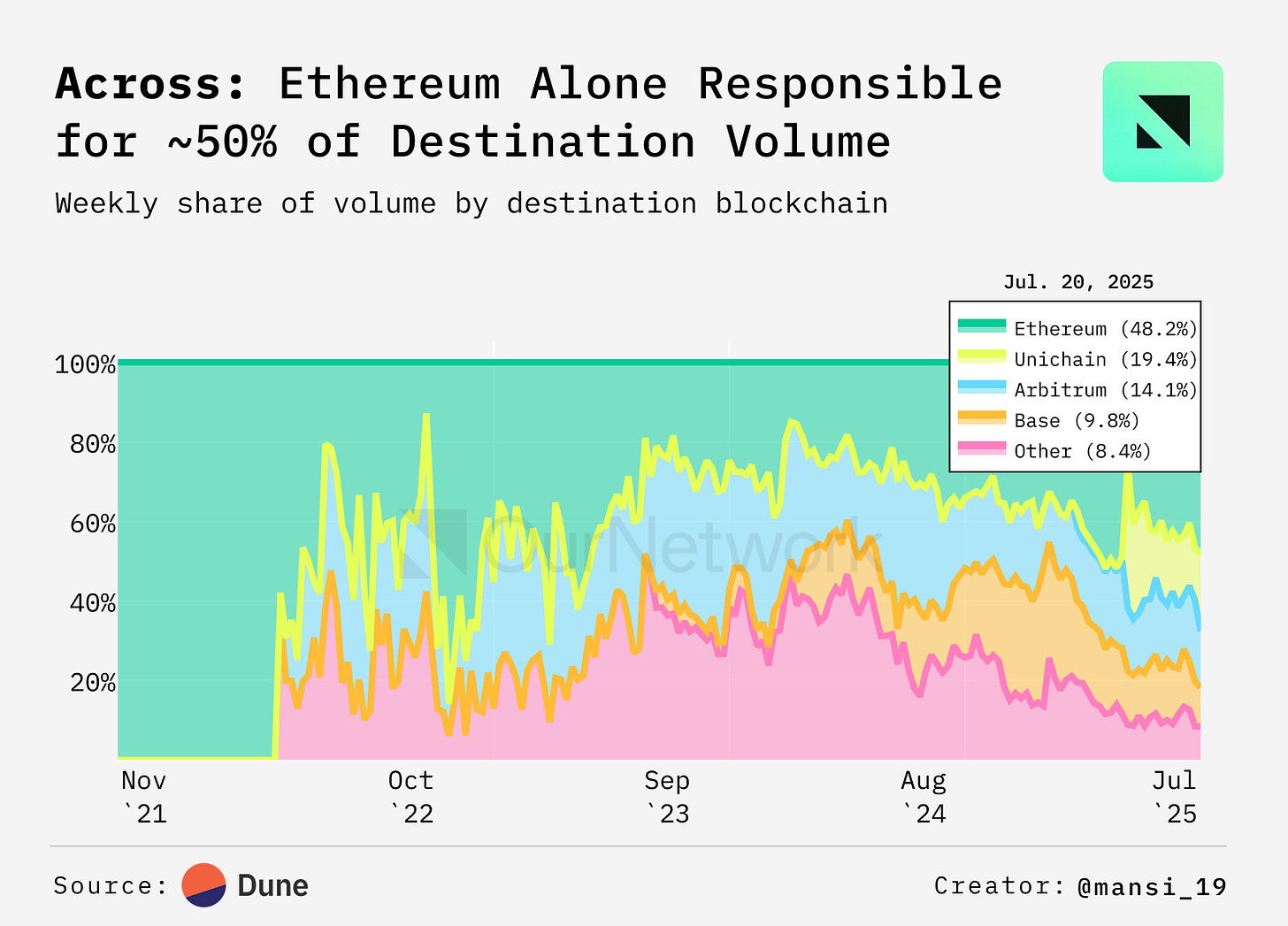

New rollups and even Layer 1 integrations, such as BNB Chain, have shown minimal uptake in bridging volume percentage. This contrasts sharply with Unichain's success, which has recently claimed over 15% of Across's total volume as both source and destination chain.

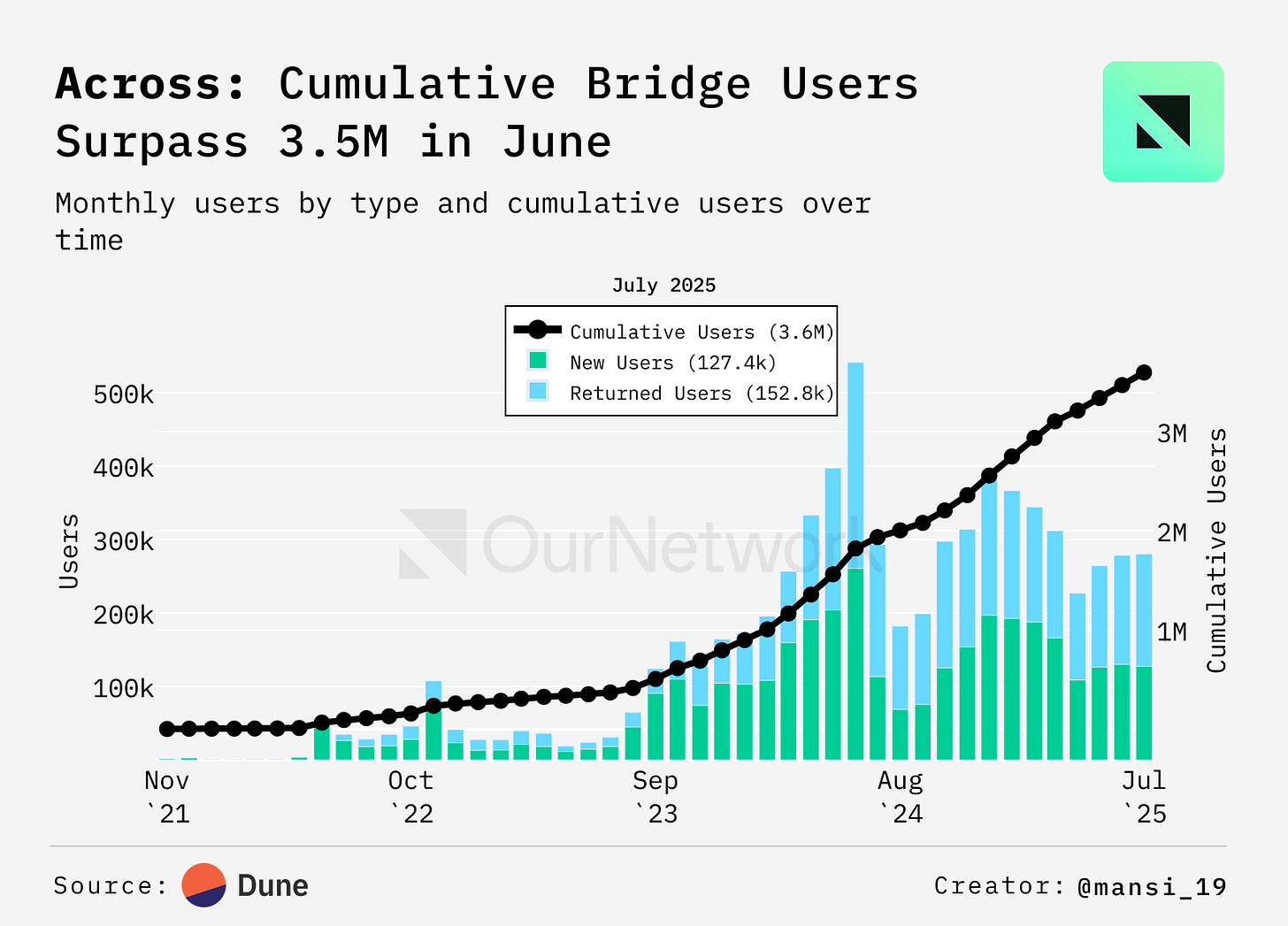

Across's user growth rate has been on a decline, though there's a silver lining in the user composition data — approximately two thirds of active users are returning users rather than new acquisitions, indicating strong retention among existing users despite subpar performance in new user acquisition.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Bankless - Ben Cowen: Ethereum Season Is Here | How Far Can ETH Go?

The Defiant - Ethereum Turns 10: Joe Lubin on Revolutionizing the Global Economy

Coin Bureau - New Token Launch? Use These Pro Tips to Win Early

The Breakdown: $9 Billion Bitcoin Sale Stress Tests the Market—and Passes

Forward Guidance: Will Market Euphoria Cool Off In August? | Weekly Roundup

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.