Money, it’s all about money

Hello, Coinstack members.

We thought you might find this article from our sister publication, The Alpha Edge Digest, to be quite interesting.

So, we’re sharing it with you today. Enjoy!

Money, It’s All About Money

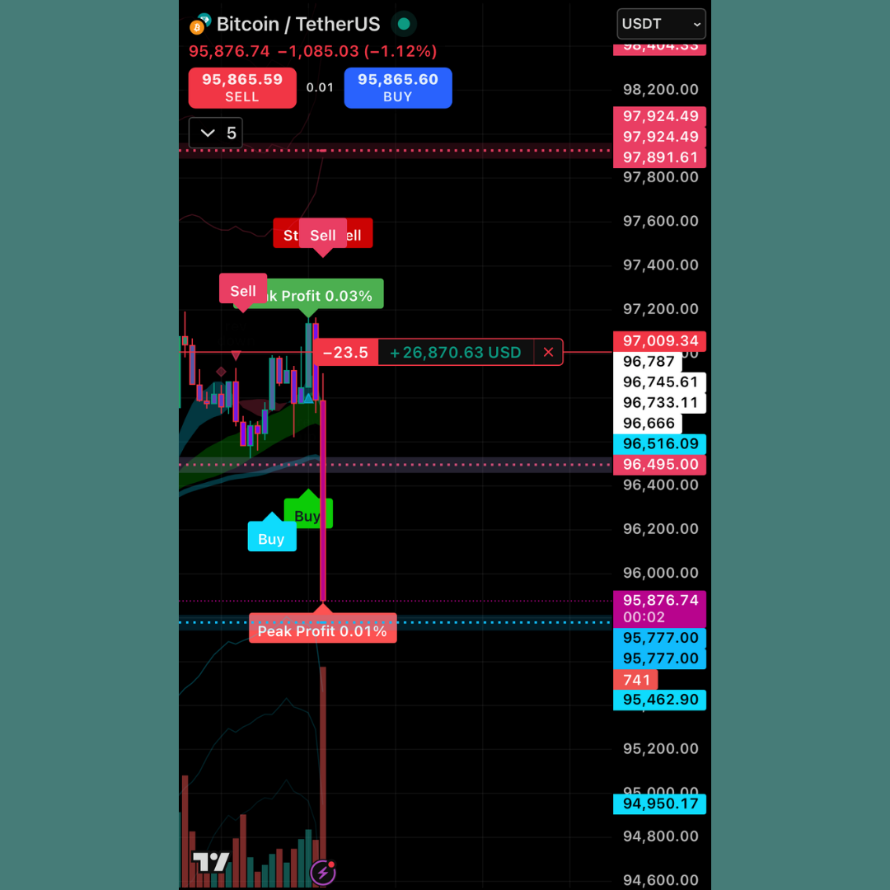

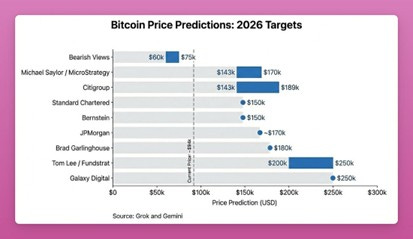

Have a look at this chart…

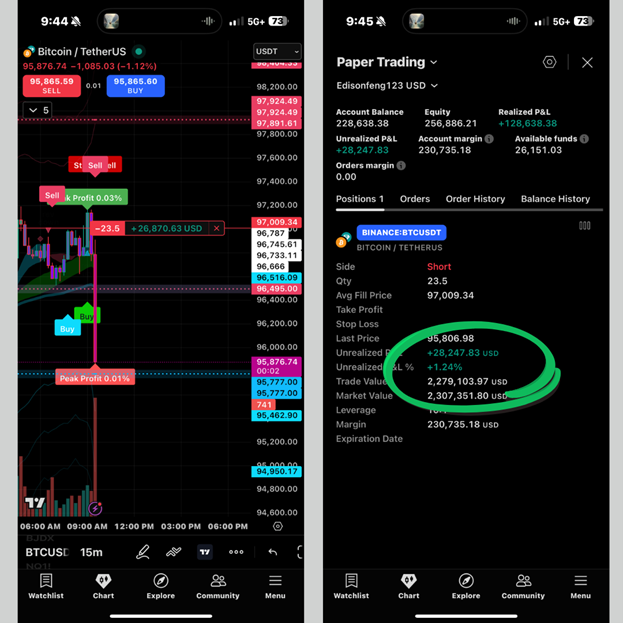

This is the 15 minute BTC/Tether US chart from Thursday January 15, at 9:44 am Eastern.

Now, keep this chart in mind, because in just a moment we’ll show you exactly why it’s so important.

But first…

Obviously, the only reason anyone invests, or trades, is to make money. It’s as simple as that.

Take the stocks we showed you last week, for example. Money.

In those stock charts (you can see them HERE), we showed how our proprietary trading technology spotted what looked like, a whole lot like, institutions buying into Chevron (NYSE: CVX) and Halliburton (NYSE: HAL) stock…

Days before the Trump administration captured Nicolas Maduro.

If you’re a new subscriber, you’ll want to review that article and those charts HERE, because what’s coming next is far more important…

But you need the backstory to really know why.

Of course, after the Maduro news became public, and the market opened on Monday morning, those stocks popped.

Money, possibly huge money, was made.

Had you been aware of the buy signals, signals flashed by our algos, in these two stocks before the raid, and taken advantage of them, you might have made a lot of money too.

But that’s hindsight, right?

See, even we didn’t realize the algos flashed buy signals in CVX and HAL until we looked back at them…

Because we weren’t watching those charts live, when it happened.

Unfortunately, hindsight doesn’t make money. Foresight does.

So, with foresight in mind, what you’re about to see next is different. Much, much different.

First, let me explain…

For a few months now, the Fintech division of our company has been working on trading technology designed specifically to help investors find solid buy/sell points, and to help traders make more money.

Because, like we said earlier, it’s all about money.

Now, the technology’s been tested with paper trades for a while now. Adjustments here, adjustments there. You get the point.

Paper-trade testing is important as you wouldn’t want to trade with real money if the tech is wonky, or it simply doesn’t work.

So, paper trading was a must.

By now, you may be thinking, “who’s been doing all this paper trading?”

Well, his name is Edison. You’ll learn a whole lot more about him soon.

He’s been doing paper trades using the tech for a while now, figuring out the best ways to use it.

And yes, he’s done so with great success.

I’ve seen the paper trades myself, and, obviously, there would be no reason to bring this to your attention if he didn’t show such success.

But paper trades aren’t real.

So…

To prove the tech, Edison started trading with real money.

And the results of the real money trades he shared with me, Luke Hodgens, are nothing short of astounding.

Have a look…

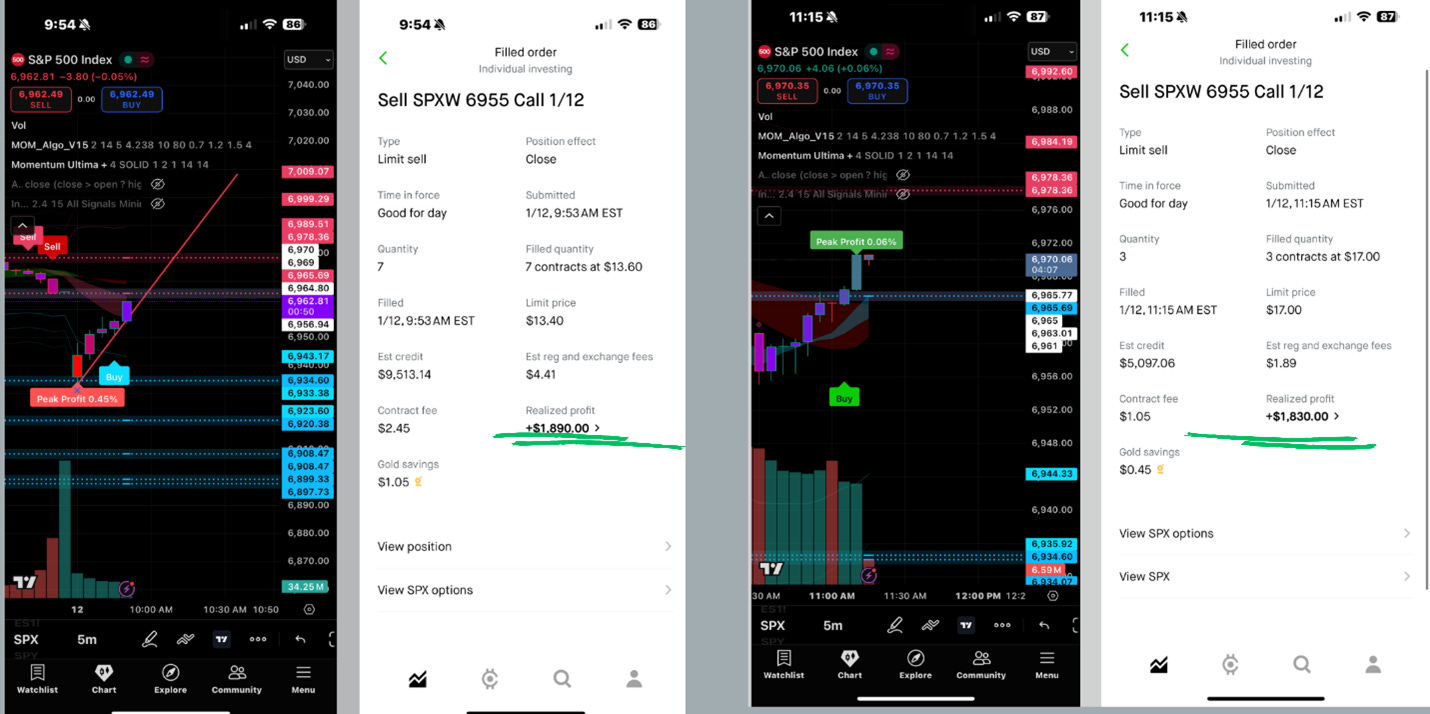

These are two real-money trades Edison made this Monday. Notice the green underlined areas. Look closely.

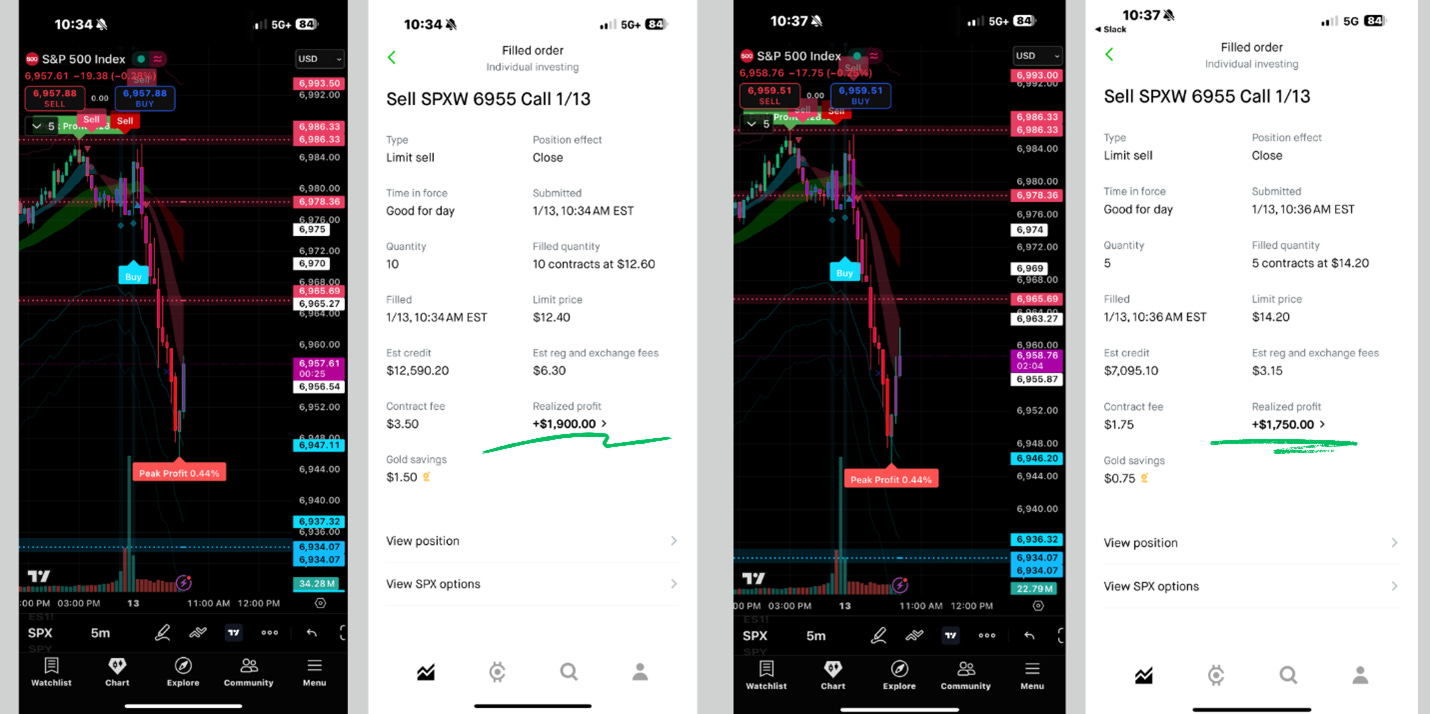

And below, you’ll find real money trades he made on Tuesday…

Again, notice the green underlined areas.

Impressive, right?

Now, the algorithms Edison is using to make his trades are not the same algos/indicators I wrote to you about last week, the ones indicating buys in CVX and HAL, before the Maduro news broke.

Those were the “All in One” indicator and the “Institutional Algo.”

No. Edison is using what’s called the MOM_Algo_V15 & the Momentum Ultima + for his trades.

Oh, from what I know, he’s NOT trading on margin, and he’s not trading often enough to trigger pattern day trading rules.

So…

Now it’s time to have a look at this:

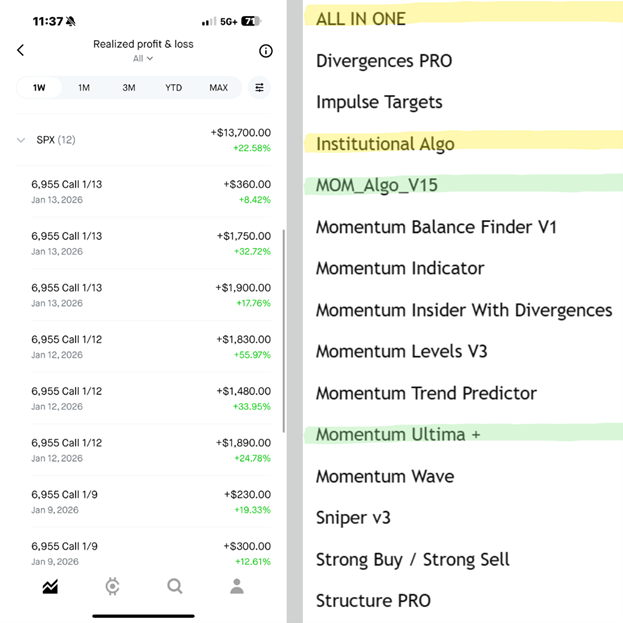

This is Edison’s P/L from Friday through Tuesday, next to the full list of indicators our Fintech team will soon release to the masses.

The indicators with the green highlight, those are the ones Edison is using. The ones with yellow highlights, those are the ones that gave buy signals in CVX and HAL, pre- Maduro.

The important thing here is this: Edison has been sending me screenshots of his real-money trades. He’s using the tech, and he’s killing it…

And once the technology is released to the public (Digest subscribers get first dibs), you could kill it too.

So, stay tuned. There’s plenty more to come.

BTC at $174k, This Year? …

And About That Chart We Showed You Above

After last year’s missed calls, and there were plenty, outside of Michael Saylor nobody wants to get on financial news TV and make bold predictions about Bitcoin for 2026.

But if we look closer, we don’t need a talking head espousing the wonders of Bitcoin to CNBC hosts...

Because a quiet consensus has emerged.

Have a look…

Most institutions cluster BTC forecasts around $150k–$180k for 2026.

Have a very close look… JPMorgan has BTC at $170k.

So, the $174k case is surprisingly simple:

Bitcoin continues to behave like digital gold

Rate cuts push gold toward $5k

BTC only needs to reach 10% of gold’s market cap to hit $174k

No supercycle. No hype. Just relative value catching up.

Even more important:

OG whales and 4-year cycle traders already sold. The seller overhang is fading.

If supply dries up, BTC doesn’t grind higher… it reprices fast.

See, the real risk isn’t being wrong about the 2026 target price. It’s being underexposed if the catch-up trade happens.

Continue reading, HERE

Oh, by the way…

That Bitcoin/Tether chart

Have a look at it again…

I was sent this Thursday morning.

Edison strikes again!

He just started paper trading Bitcoin using the tech. So yes, the algos/indicators look like they can be very effective with cryptocurrencies too.

Rare Earth Research Report Now Available (Complimentary) to Alpha Edge Digest Subscribers

As promised, we’ve completed our research on domestic/US friendly rare earth companies and we’re ready to deliver.

The report is about 16 pages long and is available to all Alpha Edge Digest subscribers, for free.

You can find it HERE.

Have a lovely weekend,

Luke Hodgens

Director of Publications

Alpha Edge Media

Disclaimer:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss. AI usage disclosure: Some portions of this document may have been created with the assistance of AI tools. The content has been reviewed and edited by a human. As a result, our research/editorial may contain errors. For more information on the extent and nature of AI usage, please contact the publisher. For personalized investment advice consult with a registered investment advisor.