Galaxy and Superstate Launch GLXY Tokenized Public Shares on Solana

The top news, stats, and reports from the crypto bull market.

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 330k weekly subscribers. This week, Ethereum ETFs reported $4B in August inflows, CFTC provided clarity on US access to foreign crypto exchanges, NFT brand Pudgy Penguins waddled into mobile gaming with launch of Pudgy Party, and big new rounds from Rain ($58M) and M0 ($40M).

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Tap into the $8.5T Generative AI Economy with CEEK, the AI-powered platform securing content as digital assets on the Blockchain. Trusted by Meta, Universal Music, and Microsoft, CEEK enables users with Agentic AI tools to create, monetize and scale content and expertise. CEEK is the Web3 Monetization OS for the new economy. 👉 Learn more at www.ceek.com

First Block’s vision is clear: a world where every stock, bond, fund, and real asset can be tokenized, traded, and settled in real time. By merging the discipline of Wall Street with the innovation of blockchain, First Block is creating the infrastructure for liquid, compliant, and borderless capital markets. Learn more at www.firstblock.ai

Become a Coinstack Sponsor

To reach our weekly audience of 330,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

OrangeX, a global cryptocurrency exchange, has raised $20M in a Series B funding round, led by KryStaStablecoin Platform M0 Raises $40 Million in Series B Round - Decryptblecoin Platform M0 Raises $40 Million in Series B Round - Decryptptos

First Block: Timing the Market and Merging TradFi with Crypto Wrapped with AI

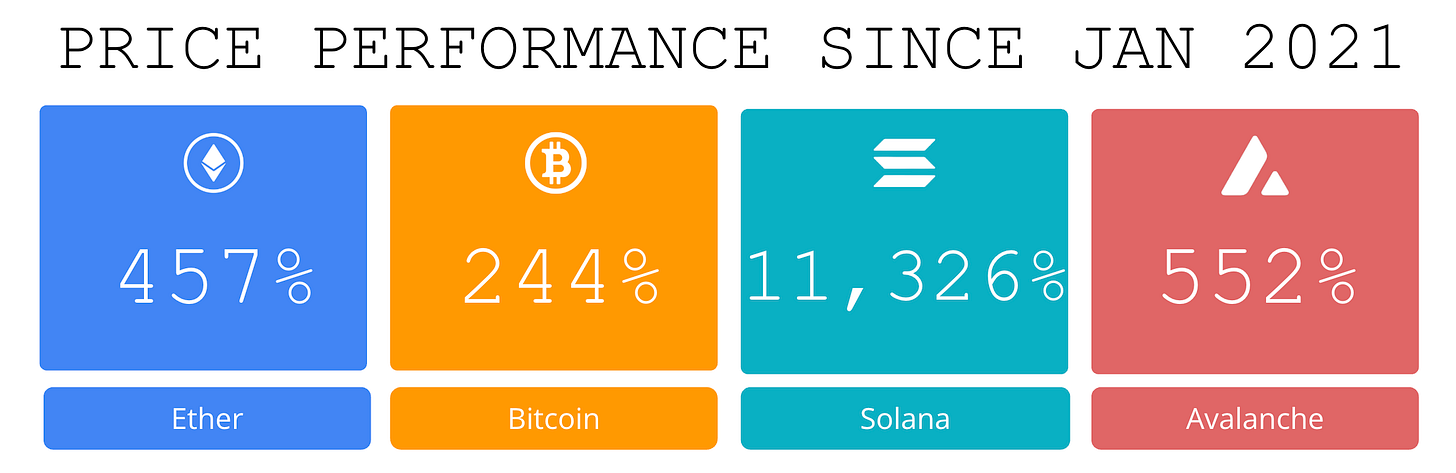

In finance, timing isn’t just important—it’s everything. Few firms embody this truth as clearly as First Block, Inc., a company at the nexus of traditional finance (TradFi) and next-generation blockchain infrastructure.

With over four decades of Wall Street experience combined with more than a decade of blockchain and crypto innovation, First Block has positioned itself at the right place and the right time: a market moment when real-world asset (RWA) tokenization is moving from concept to inevitability.

Market Timing: The $16 Trillion Shift

Global private markets—worth more than $274 trillion—remain plagued by illiquidity, long settlement cycles, and costly intermediaries. Tokenization solves this by turning real estate, private equity, funds, and structured products into digital, tradable instruments that can be fractionalized and exchanged globally.

Analysts project that over $16 trillion in assets will be tokenized by 2030, with private equity, funds, bonds, and real estate leading the way. Already, leading players like J.P. Morgan (JPM), Robinhood (HOOD), and Mercado Bitcoin have initiated tokenization programs, while regulators from the SEC to global standard-setters have begun openly embracing digital securities.

What makes this shift inevitable is not only the efficiency tokenization brings but also the rise of Hybrid IPOs. In a landmark example, Figma tokenized 20% of its recent IPO, signaling that the future of public offerings will increasingly merge traditional listings with blockchain-enabled fractional ownership. This dual-track model provides issuers with new distribution channels while giving investors faster, more global access to liquidity.

First Block’s timing is impeccable. The company is executing a phased launch of a fully compliant U.S. platform, anchored in broker-dealer and ATS acquisition, with a regulatory-first architecture designed to institutionalize tokenized trading.

Breadth of Services: From Tokenization to Stablecoin Rails

First Block offers more than just tokenization. Its universal framework for real-world assets is backed by smart contracts, liquidity pool design, and institutional custody. This positions the firm as a full-stack infrastructure provider—covering issuance, custody, compliance, and secondary trading.

By embracing Security Token Offerings (STOs), Initial Coin Offerings (ICOs), and Hybrid IPO/STO structures, First Block is preparing clients for a world where tokenization becomes the default path to liquidity. Whether a private fund looking for secondary markets, a high-growth tech company exploring a partially tokenized IPO, or a global investor seeking fractionalized access, the platform is designed to serve every layer of the emerging capital stack.

Beyond securities, First Block is pioneering stablecoin integration in the wake of the GENIUS Act, the most sweeping U.S. financial reform since Dodd-Frank. With stablecoins now federally regulated and elevated as a new payment rail, First Block advises financial institutions on how to adapt, integrate, and thrive in the post-GENIUS Act era.

Competing Where Giants Can’t

The largest players in tech and finance—Alphabet (GOOGL), Meta Platforms (META), Microsoft (MSFT), Bank of America (BAC), and J.P. Morgan (JPM)—are spending billions to build their blockchain and AI strategies. But here’s the truth:

• Too Slow: Legacy banks like BAC and JPM remain buried under regulatory red tape and outdated infrastructure. They can experiment at the edges, but they cannot transform their core businesses without cannibalizing themselves. First Block, unencumbered by legacy systems, is building next-generation rails from the ground up.

• Too Broad: Tech giants like GOOGL, META, and MSFT chase every vertical—advertising, cloud, social, gaming, enterprise. Their blockchain and tokenization initiatives are side projects, not mission-critical priorities. First Block lives and breathes one mission: transforming capital markets with tokenization, stablecoin rails, and AI-driven infrastructure.

• Too Bureaucratic: For every initiative that moves forward at a mega-cap, dozens die in committee. First Block moves with the speed of a startup and the expertise of a Wall Street veteran team, seizing opportunities the giants are structurally unable to pursue.

First Block does not just cooperate with these giants—it competes aggressively where they cannot move fast enough or deep enough. And in capital markets, speed and focus matter more than scale.

Leadership: Experience Meets Innovation

At the helm is Daniel P. Cannon, Founder and CEO of First Block. Cannon is a veteran investment banker with four decades of Wall Street experience, including advising international banks, consulting with the SEC on digital asset regulation, and building trusted relationships at the highest levels of government and industry—including contacts within the Trump Administration.

Beyond the boardroom, Cannon is a respected educator. He currently teaches Investment Banking, Blockchain & Crypto, and Artificial Intelligence courses at Auburn University, bringing real-world expertise into the classroom and cultivating the next generation of financial innovators.

Leading the technology vision is Ramon Stoffel, Chief Technology Officer, whose background spans artificial intelligence, machine learning, and blockchain innovation. After earning his degree in AI & Machine Learning, Stoffel founded and successfully exited an AI startup, gaining hands-on experience in building innovative products. Today, he advises payment providers on integrating crypto solutions and supports insurance companies in leveraging AI to drive efficiency and innovation. With a mix of deep technical expertise, entrepreneurial experience, and strategic insight, Stoffel brings a forward-thinking approach to the intersection of finance, crypto, and emerging technologies.

Together, Cannon’s capital markets experience and Stoffel’s AI-driven technical leadership ensure First Block operates at the cutting edge of financial transformation.

The Future of Finance

First Block’s vision is clear: a world where every stock, bond, fund, and real asset can be tokenized, traded, and settled in real time. By merging the discipline of Wall Street with the innovation of blockchain, First Block is creating the infrastructure for liquid, compliant, and borderless capital markets.

The inevitability of tokenization—across RWAs, STOs, ICOs, and Hybrid IPOs—marks the beginning of a new era. Just as the Stone Age didn’t end because we ran out of stones, the banking age won’t survive simply because it’s “too big to fail.”

Alphabet, Meta, Microsoft, BAC, and JPM will talk about the future. First Block is building it.

For more information go to www.firstblock.ai or daniel@firstblock.ai

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Galaxy and Superstate Launch GLXY Tokenized Public Shares on Solana: Galaxy has partnered with Superstate to allow stockholders to tokenize and hold GLXY shares onchain. This milestone marks the first time a public company has tokenized its SEC-registered equity directly on a major blockchain.

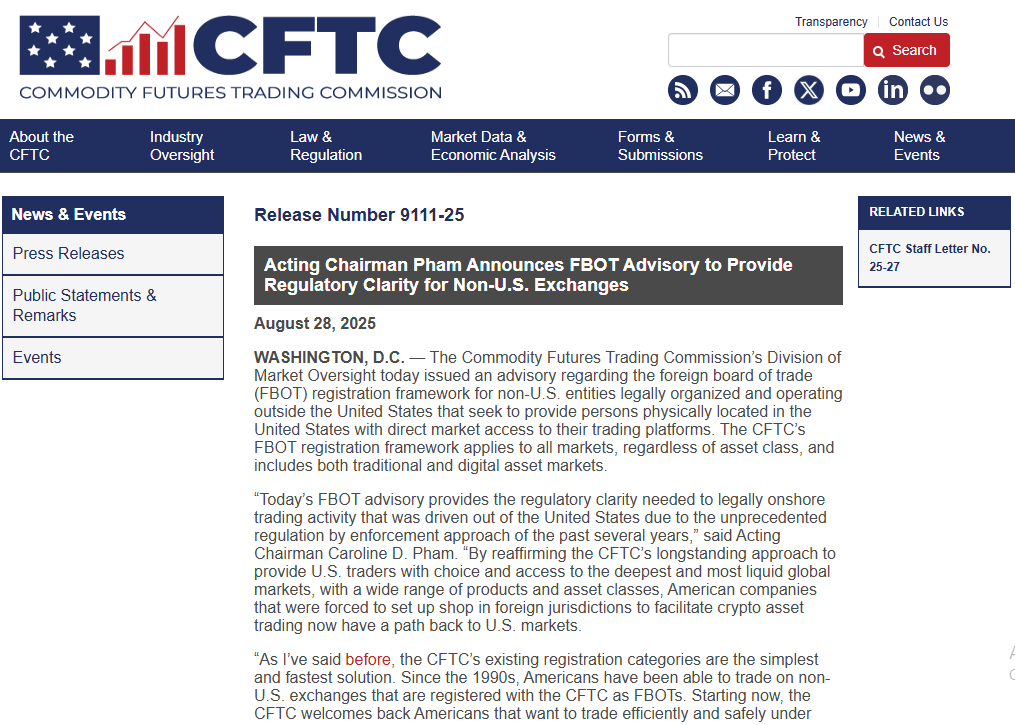

⚖️ CFTC provides clarity on US access to foreign crypto exchanges after being 'driven out': The Commodity Futures Trading Commission clarified on Thursday that non-U.S. exchanges have a path that allows Americans to trade on their platforms, advancing its push toward being friendlier to the crypto industry under the Trump administration.

🧑⚖️ NFT brand Pudgy Penguins waddles into mobile gaming with launch of Pudgy Party:The popular NFT brand Pudgy Penguins and FIFA Rivals creator Mythical Games announced the global launch of the web3 mobile game Pudgy Party on Friday.

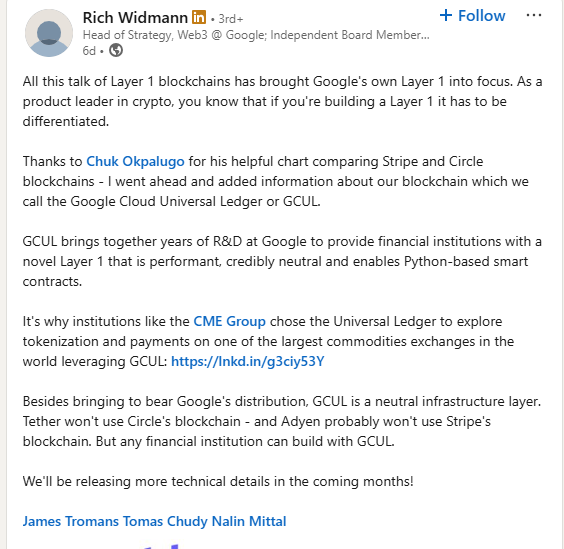

🎉Google Cloud is developing its own blockchain for payments, currently in private testnet:Google Cloud is building its own blockchain network, named Google Cloud Universal Ledger (GCUL), for the financial sector, according to Rich Widmann, Google Cloud's Web3 Head of Strategy, who announced this on Tuesday.

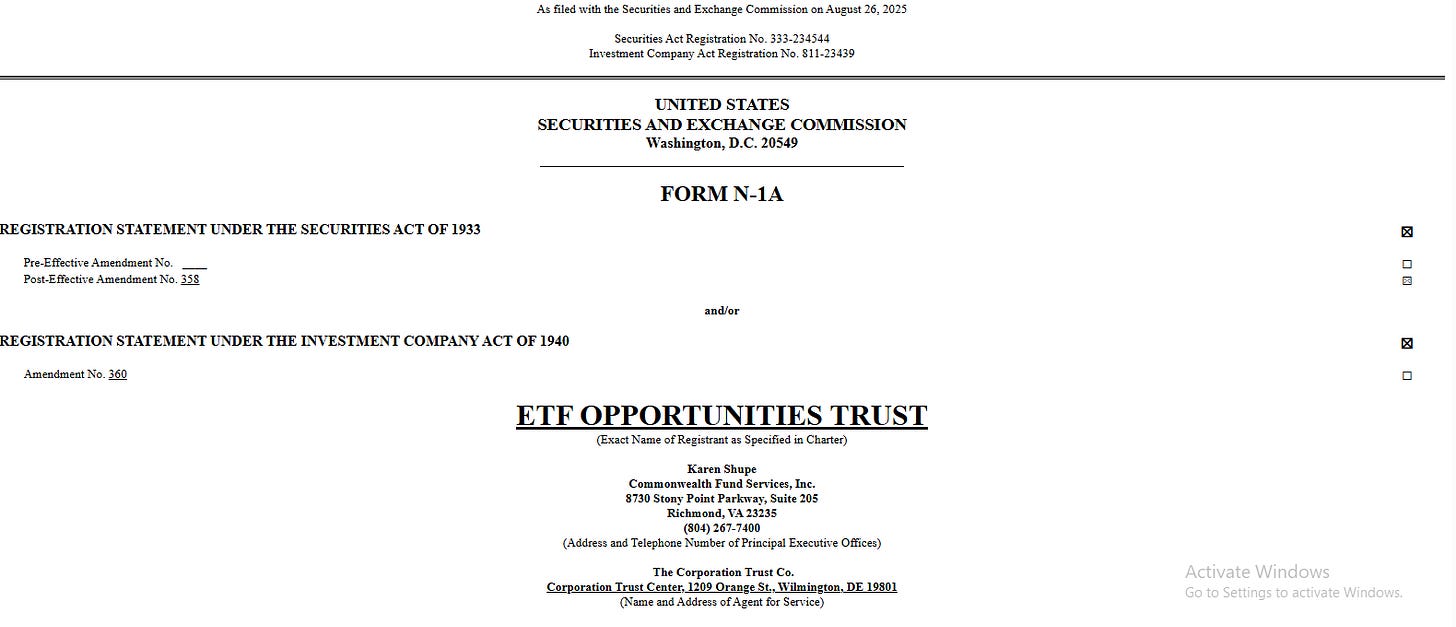

🧑⚖️ REX-Osprey seeks SEC approval for BNB staking ETF, following Solana fund route:REX Shares, in partnership with Osprey Funds, filed an N-1A registration statement with the Securities and Exchange Commission late Tuesday in a bid to manage what could be the first spot exchange-traded fund in the United States, including a staking component.

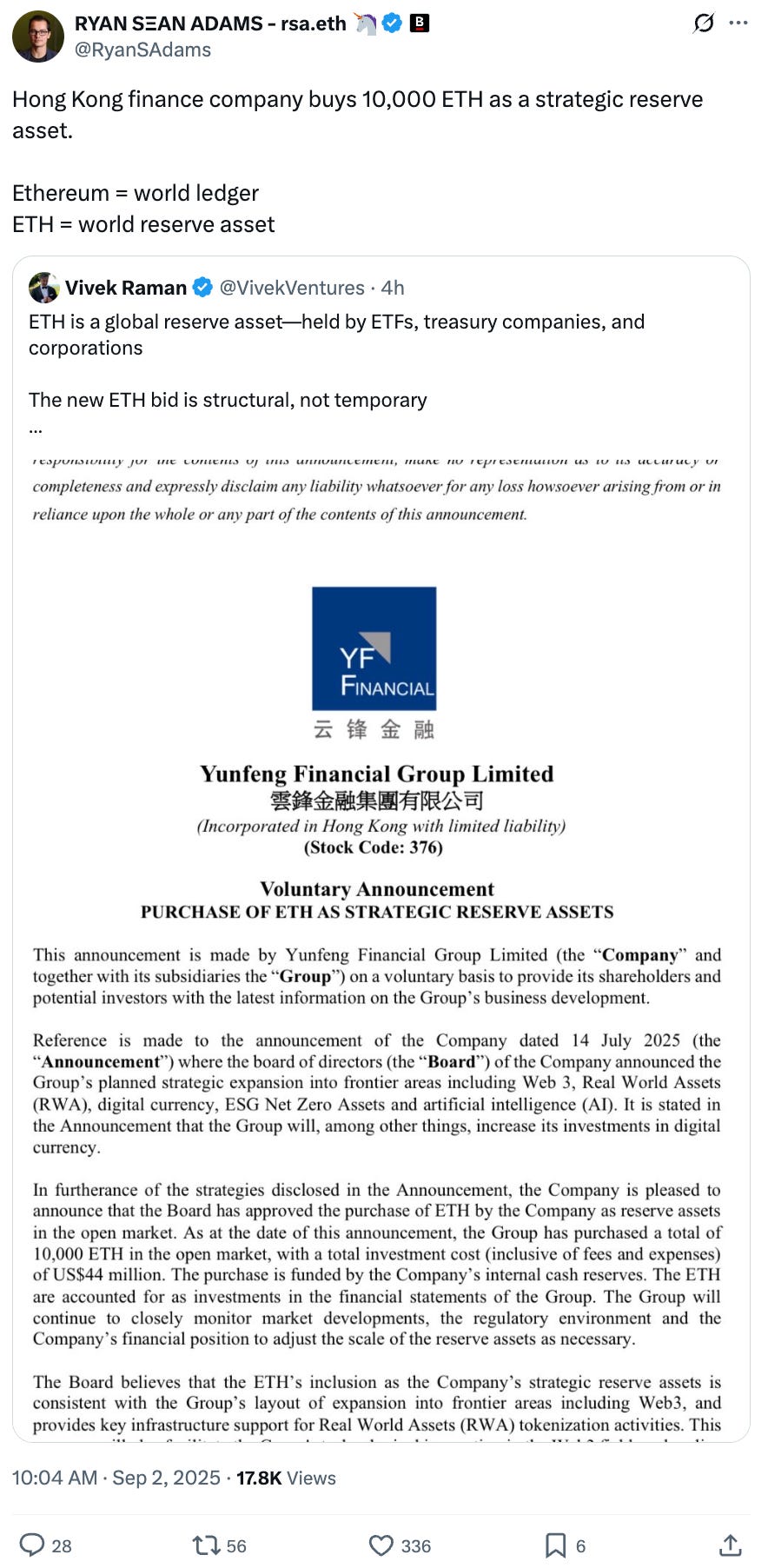

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

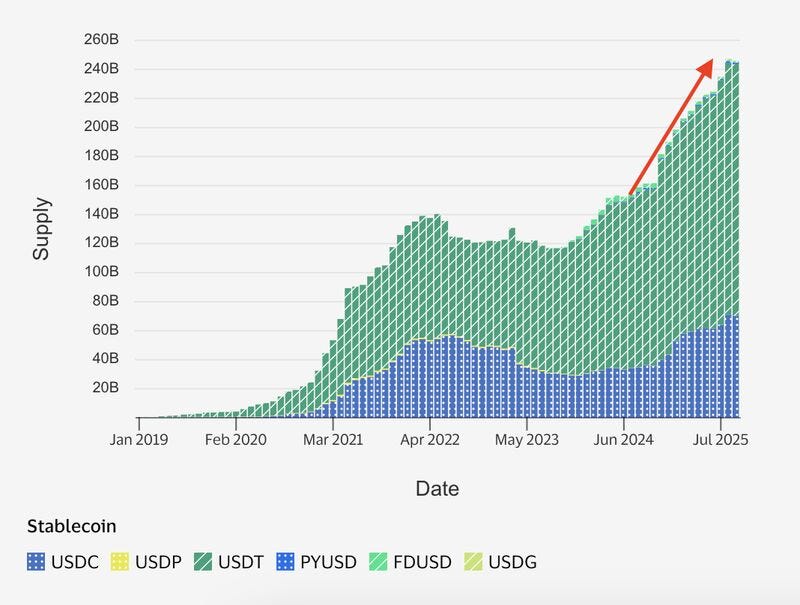

1. Fiat-backed stablecoins reached yet another all-time high in August, climbing to $247B in circulation (+5% month-over-month).

That's a staggering 54% surge since August 2024.

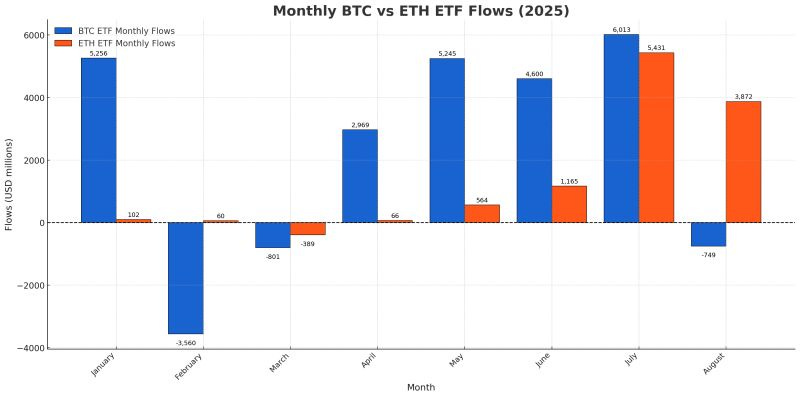

2. It was an incredible summer for ETH. We close it out with August ETF inflows outpacing BTC by the largest margin ever:

+$3.87B for ETH vs. –$749M for BTC

In just 3 months, ETFs bought more than 2.96M ETH ($13.3B).

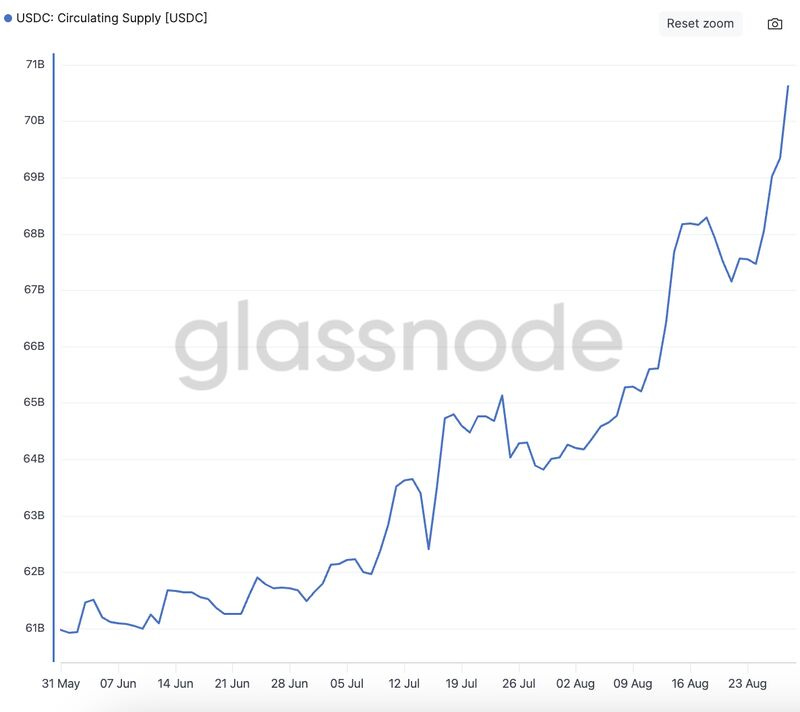

3. Interesting shift in stablecoin liquidity.

USDC circulating supply just surged $4.1B (+6.5%) this week, hitting a new record high of $71.2B.

In August, USDC’s growth has outpaced Tether more than 2:1 — $7.5B vs $3.6B.

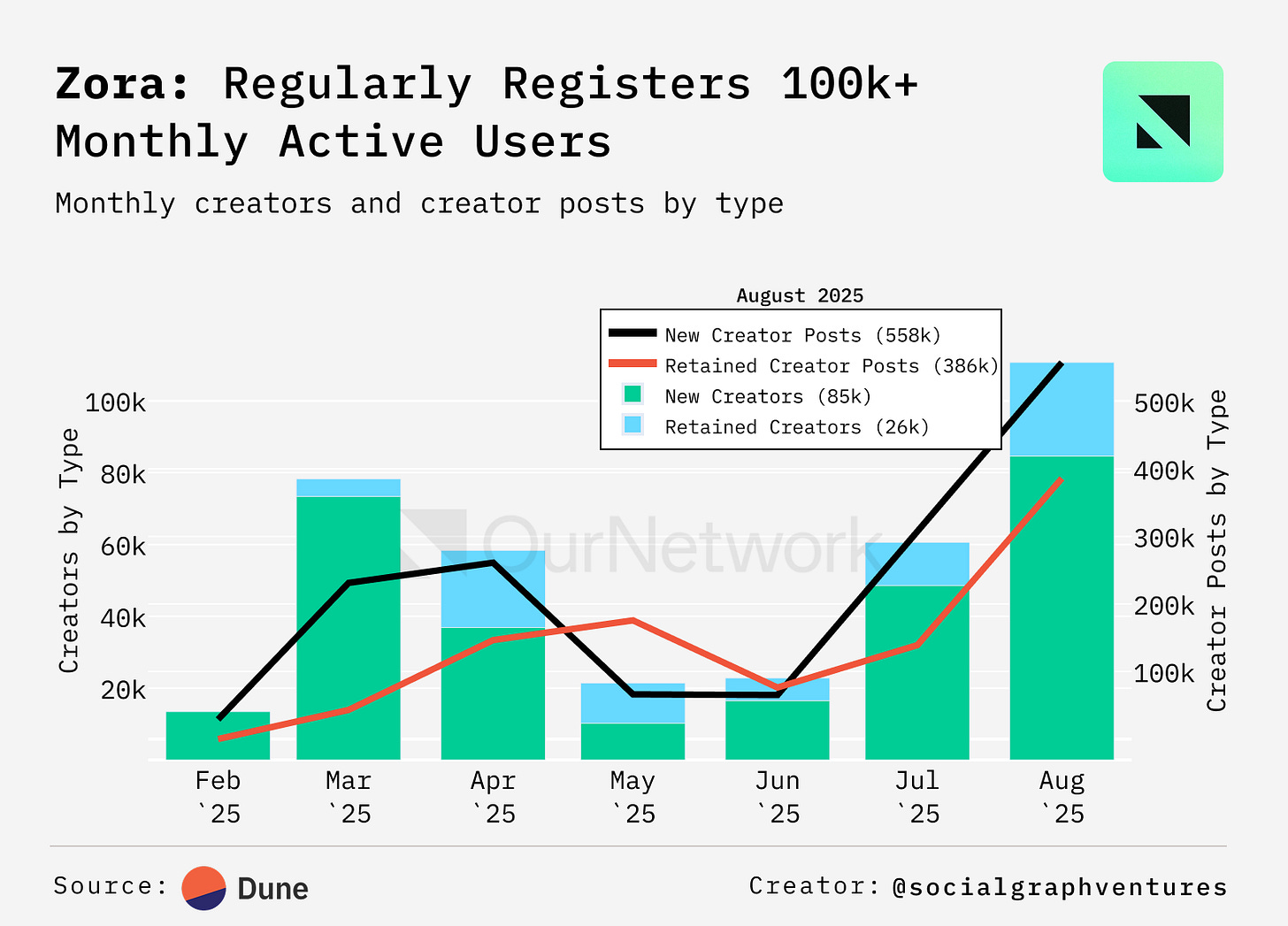

4. Zora’s Gains Traction as Aggregate Coin FDV Surged Above $150M, Monthly Creators Topped 100k, and Revenue Hit $500k Per Week

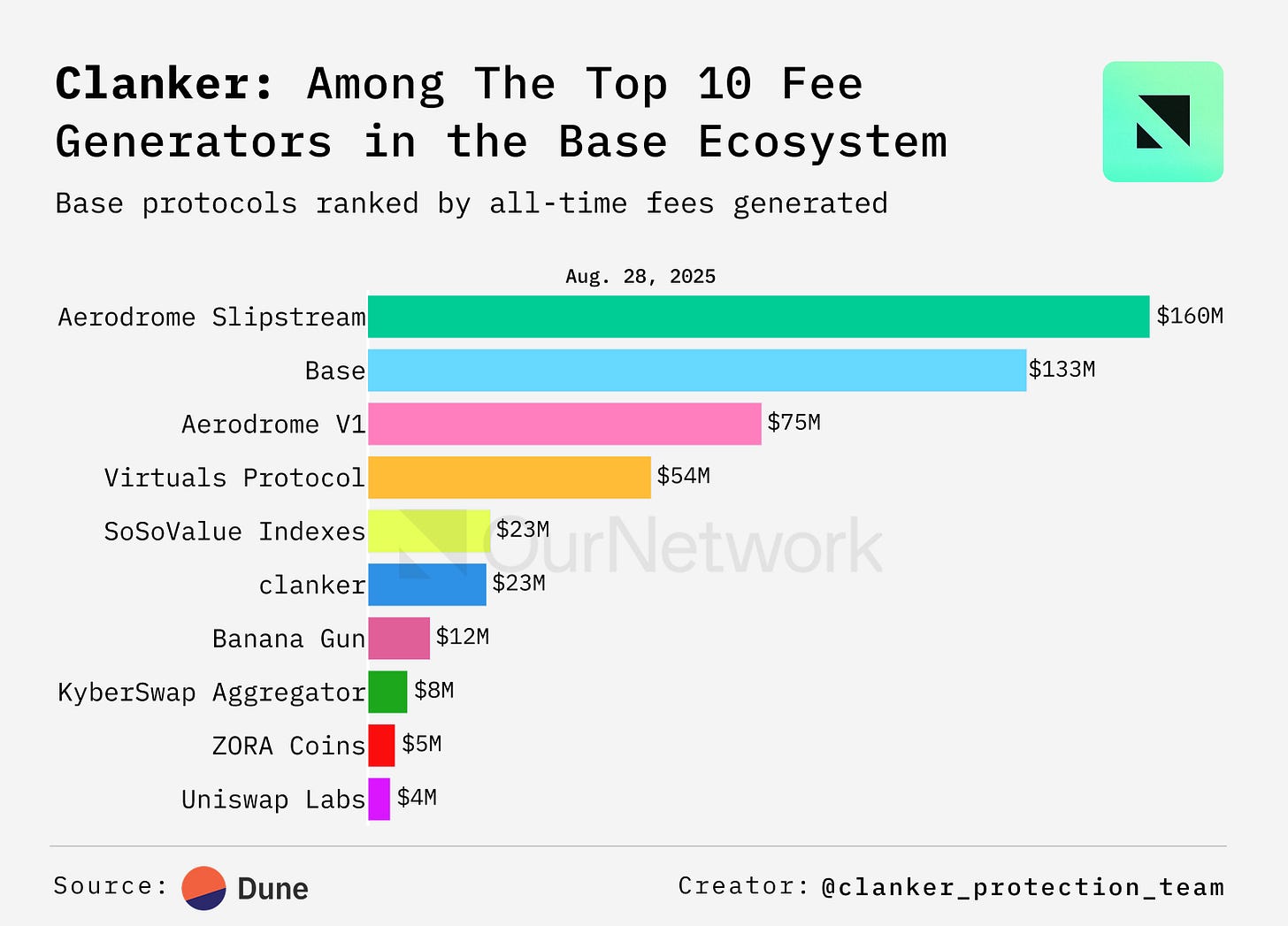

5. Clanker generated the sixth highest fees among apps in the Base ecosystem, trailing Aerodrome, Virtuals, and Base itself

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

ON-365: Onchain Culture Part 1 🌐

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork’s latest, a dive into some of the leading projects pushing onchain culture forward.

Leading off this issue, we have Rafi covering Story the IP-focused Layer 1. Next, Seoul Data Labs, chipping in to cover the seemingly indefatigable demand for CryptoPunks. Alex follows with the latest on POAPs, crypto’s signature event badge project. Finally, Tim covers Telegram Stickers, which have garnered attention from Pudgy Penguins and major NFT communities.

Be on the lookout for part two, which comes out on Friday!

Let's get into it.

– ON Editorial Team

📈 The Negative Sentiment Surrounding the Departure of Jason Zhao, Story Founder, Differs from the Continued Adoption of the Project

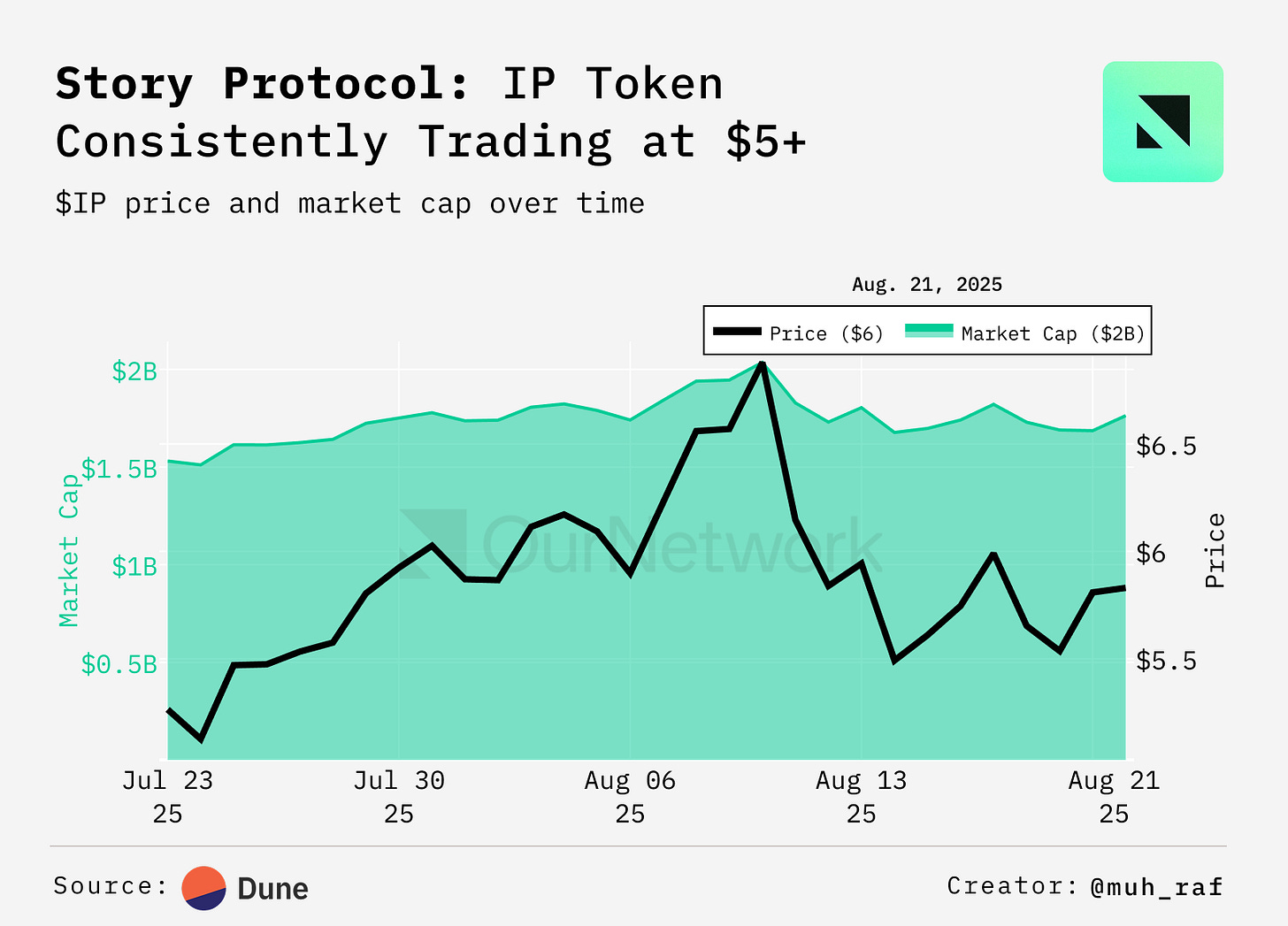

Story is an EVM-compatible Layer 1 blockchain that provides infrastructure for IP management. It empowers artists, musicians, and creators to monetize and protect their work, tackling the opacity and exploitation in traditional royalty systems. Boasting a robust $1.7B market cap with its IP token trading above $5 for 30 days, Story signals strong investor and societal confidence, highlighting the urgent need for transparent IP solutions.

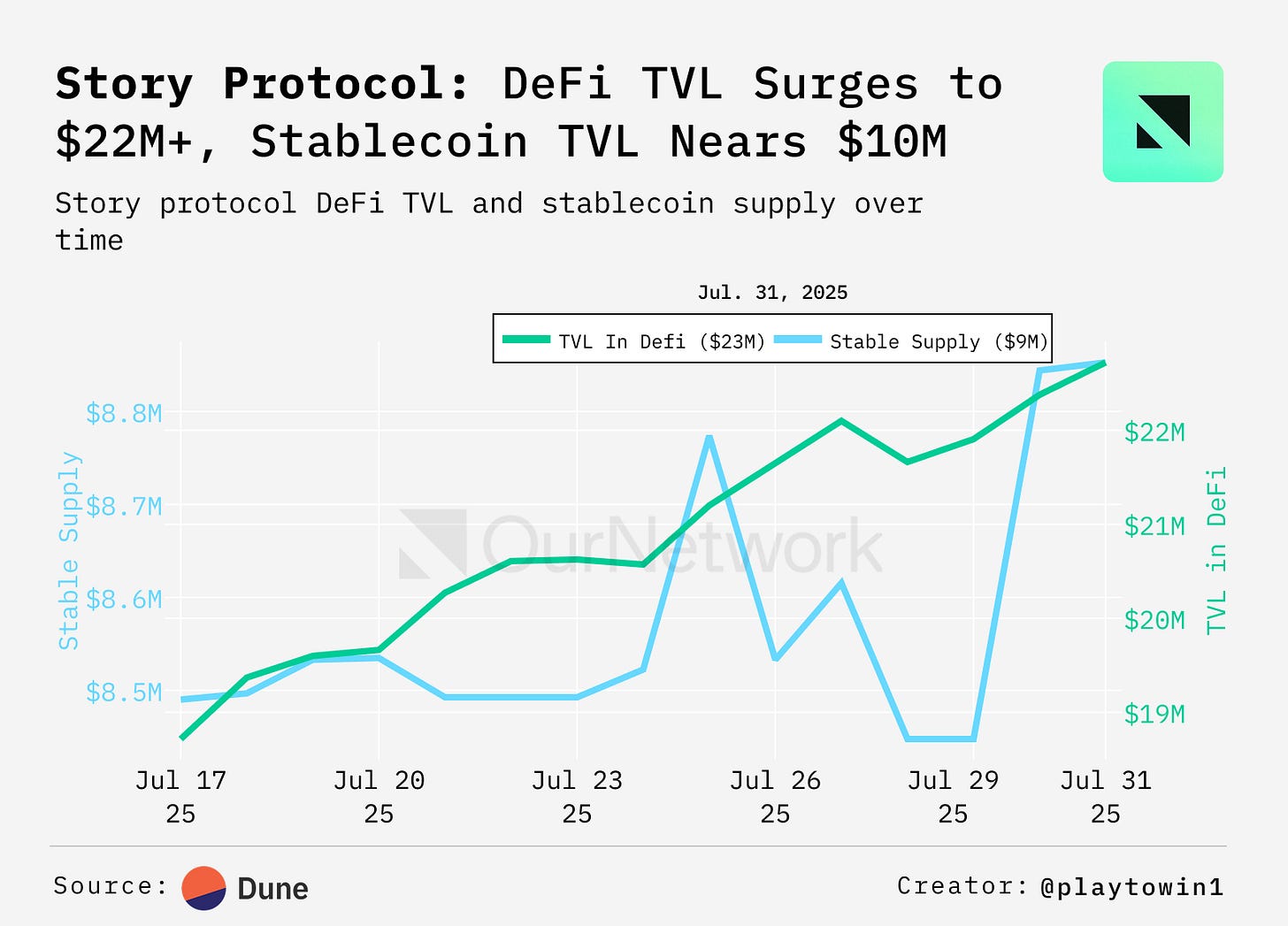

As of July 31, 2025, the Story network's stablecoin supply reached $8M, with DeFi TVL surging to $22M. The stablecoin supply primarily consists of USDC.e, bridged via Stargate, demonstrating growing adoption and liquidity in the ecosystem.

Story's mainnet launched on Feb. 13, 2025, with 600k active addresses in its first month. New account creation dropped from 500k in February to 24k by August. Since its launch, active accounts have stabilized above 100k, demonstrating steady adoption.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Bankless - Will Crypto Peak in 2025… or Run Into 2026? Onchain Data Signals

The Defiant - The $10 Trillion Question: Crypto's Biggest Cycle Yet with Ellio Trades

Coin Bureau - The Crypto Bull Market is ENDING! Get Out Now?!

Forward Guidance: The Post-Summer Market Rotation is Here | Weekly Roundup

Unchained: Tom Lee the New Saylor? DAT Consolidation, Token Wrappers Under Fire – The Chopping Block

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.