Ethereum Staking Just Got Juicier 🥩

How to increase staking yield with OETH from Origin Protocol. Plus news about Worldcoin, Magic Labs, Optimism, Sui, Bitcoin, Genesis, Gemini, and Circle.

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 102k weekly subscribers. This week we cover the updates on the Bitcoin mining tax, Optimism and Sui token unlocks, China releasing a white paper for web3, and big new venture rounds for Worldcoin ($115M) and Magic Labs ($52M). We also hear from our new sponsor, Origin about their ETH staking options.

Thanks to Our Coinstack Sponsors…

At a trailing 7-day APY of 12%, Origin Ether offers the best liquid staking yield on the market. Users can deposit ETH or liquid staking tokens for OETH to earn over twice the yield from liquid staking tokens. The protocol has already accrued over 7,200 ETH ($13.5M+) in deposits from holders of stETH, rETH, frxETH, and ether. Origin Ether is audited by leading auditor OpenZeppelin, the team responsible for security audits of Coinbase, Aave, and The Ethereum Foundation. To learn more and to start stacking ETH faster, head over to www.oeth.com

TokenX streamlines Web3 tokenization for Web2 companies, simplifying integration of blockchain technology into existing applications. Powerful APIs tokenize assets with on/off blockchain metadata, policies, and authentication. Leveraging TokenX, Web2 companies can access the benefits of decentralization, ownership, authentication, and transparency provided by Web3, unlocking new opportunities for growth, customer engagement, and innovation. Learn more at www.tokenx.is

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

To reach our weekly audience of 102,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

Ethereum Staking Just Got Juicier – How To Increase Staking Yield With OETH

ETH staking is in full force following Ethereum’s Shanghai upgrade.

Ethereum staking inflows have surged, and earnings on staked ETH have skyrocketed as network usage continues to increase. Many regard Ethereum staking as one of the safest ways to grow one’s ETH balance.

The most popular way to earn staking rewards is through liquid staking tokens (LSTs), such as Lido’s stETH and Rocket Pool’s rETH. These tokens represent staked ether plus accrued rewards, offering an accessible route to ETH staking yield.

Traditionally, users would need to stake 32 ether and maintain a validator node to earn higher staking rewards on ETH. However, users now have the option to boost yield using Origin Ether, a liquid staking yield aggregator for Ethereum. Audited by top firms and offering twice the APY earned on LSTs, Origin Ether has attracted over $10 million in TVL since its launch in May.

What is OETH?

Origin Ether (OETH) optimizes ETH staking yield between leading liquid staking protocols and DeFi strategies. Users can deposit ETH, stETH, rETH, or frxETH as collateral and receive OETH tokens in return. The Origin Ether protocol deploys funds into DeFi applications to harvest token rewards and trading fees, sending this revenue to OETH holders as additional yield.

OETH is a rebasing token, meaning that the token grows directly in your wallet as rewards are earned. If you hold 10 OETH today and earn 10% APY over the next year, you’ll have 11 OETH at the end of the year. There are no gas fees required to stake, and OETH is fully liquid at all times, so there is no staking and unstaking required.

Origin DeFi has been audited by top security firms, including OpenZeppelin. OpenZeppelin is responsible for auditing The Ethereum Foundation, Coinbase, Aave, and other leading players in the industry.

How to Get Started

Ethereum holders can swap ETH for OETH on Curve or Uniswap. There is currently over $4 million in liquidity in the ETH-OETH Curve pool, offering the most liquidity on Origin Ether out of any DEX. Alternatively, users can mint Origin Ether directly from the dapp by depositing ETH, stETH, rETH, or fraxETH to the Origin Ether Vault.

The Origin Ether dapp can be found at dapp.oeth.com. To mint OETH, first connect your wallet in the upper-right hand corner of the interface.

Next, select the amount of ETH or liquid staking tokens you’d like to swap for OETH. The dapp will show you the best swap route, displaying the effective price after accounting for gas fees.

After selecting the type and amount of tokens you’d like to swap for OETH, click the swap button. Your crypto wallet will show a notification to confirm the transaction; after confirmation, OETH will appear in your wallet within a few minutes. Importantly, this will be the only gas fee you’ll need to pay to start earning ETH staking rewards.

You may need to add OETH to your wallet manually, using the contract address found on etherscan. Once the tokens are in your wallet, sit back and enjoy elevated staking rewards! Each day, OETH grows in your wallet automatically, compounding returns from staking and DeFi.

We hope you found our deep dive on Origin Ether insightful, and we invite you to start stacking ETH faster with OETH. To read more about Origin Ether, visit the protocol’s documentation for a full debrief.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

📢 US Debt Ceiling Deal Blocks 30% Bitcoin Mining Tax- As the details of the agreement reached between President Joe Biden and House Speaker Kevin McCarthy on the U.S. debt ceiling were made public Sunday, one notable part of the deal appears to have blocked some taxes proposed by the Biden administration, including the Digital Asset Mining Energy (DAME) excise tax.

.🚀 Optimism, Sui Set for Large Token Unlocks, Worth a Combined $650 Million-Crypto networks Optimism and Sui are set for token unlocks this week that will see each of their circulating supply of tokens increase significantly.

🇨🇳 Beijing Municipal Science and Technology Commission Releases White Paper for web3 Innovation and Development - Beijing reportedly released a white paper this morning aimed at promoting innovation and development of the web3 industry.

⚖️ Genesis, Gemini Seek Dismissal of SEC Lawsuit Over Lending Product-Crypto exchange Gemini and financial services firm Genesis have filed motions to dismiss a lawsuit filed earlier this year by the Securities and Exchange Commission.

🚀 Circle Launches Euro-Backed Stablecoin on Avalanche-Stablecoin issuer Circle has rolled out its Euro Coin stablecoin on the Avalanche network, making it the second blockchain to support the asset following the initial launch on Ethereum last year.

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Trading volume for SUI peaked on the day of launch, reaching $1.2B before falling to about $239M as of this writing. The price of SUI also reached an all-time high of about $1.48 on launch before falling to about $0.99 as of this writing.

2. Zksync’s bridge is now the 3rd largest general-purpose rollup in bridge TVL behind Arbitrum & Optimism

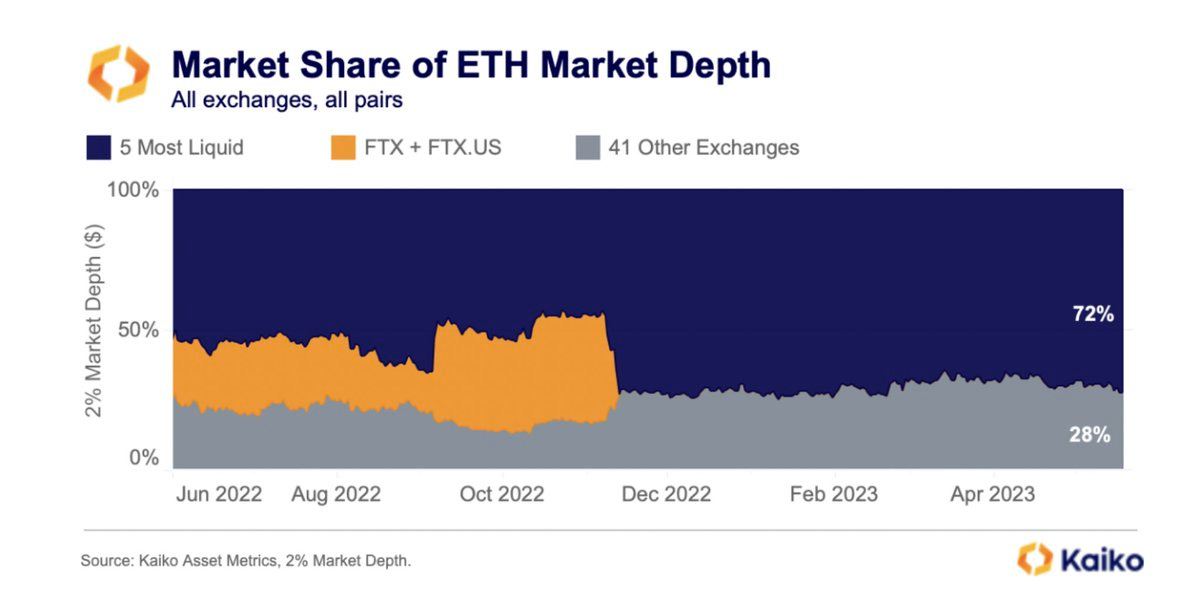

3. 72% of ETH Liquidity is Concentrated on Just 5 Exchanges.

4. With a staggering cumulative loan volume exceeding $1.2B, NFT lending platforms present an alluring avenue to unlock and maximize asset value in the burgeoning digital economy.

5. Axie Infinity leads in the Top 5 Blockchain Games by Volume 7D.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Exploring Historical and Current Yields Onchain

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

Much how molecules naturally flow from areas of high concentration to low, so does capital flowing from saturated, low-yield areas to new, high-yield opportunities. The APY rate acts as a measure of incentive where, if greater than the present rate, will attract capital to the investment pool until the yield is saturated back down to the market level (assuming risk is comparable).

This effect plays out in crypto as capital rotates to new pools, protocols, or chains which boast higher yields driven either by larger user activity (fee income) or incentive programs (token rewards).

Therefore, measuring the relative APY on a protocol or entire chain can provide a signal as to whether or not capital is going to flow into its pools. With increased investment, the respective market cap of the protocol or chain ecosystem would be expected to increase if liquidity valuation multiples are held constant. Additionally, the simple market mechanics of earning the yield can drive positive price action since a particular token may need to be purchased before earning the yield, as is the case with DEX liquidity provider pairs.

Looking back over the last year, this dynamic of yields signaling price increases can be seen in some of the top chains that experienced periods of significantly positive price action.

Historical Yield Effects

In February 2023, Canto’s native token increased roughly 5x as users rushed in to capture high yields and potential new narratives. Prior to the dramatic price appreciation was a large spike in yields within the largest pools on the chain.

The spike in the median yield on the chain was driven by DEX LP pairs against the CANTO asset, such as the ETH-CANTO pair. However, at the same time, stablecoin money market pools and DEX LP pairs like NOTE-USDC (NOTE is native CDP stable on Canto) were yielding 20-30% APY and made up the largest pools by TVL on the chain with nearly $85 million combined TVL. A 20-30% APY was roughly 5 to 10 times larger than the median stablecoin yield across leading chains and acted as a major incentive for capital to earn nearly risk-free returns in size.

While there was roughly a 1-month lead time before price followed the yield growth, that is not the same on other, more popular chains. Canto, being a new Cosmos-based chain, is further out on the risk curve than conventional chains, and therefore, users tend to pay less upfront attention and respond more slowly as they do due diligence.

On popular chains like Arbitrum, there is a similar leading relationship between yields and ecosystem market cap growth, albeit more compressed and noisy due to a greater correlation to broader market conditions.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Real Vision Crypto - BTC vs Bank Crisis: Unpacked w/ Jeff Dorman & Raoul Pal

The Breakdown With NLW - Hong Kong Opens For Crypto Business

The Defiant - 💸 Claim the (potential) zkSync airdrop - 5 step zkSync Era tutorial

Coin Bureau - A New Financial CRISIS?! Why A Credit Crunch Could Be Coming!

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.