CRML now up 154% since “The Event” …

Hello, Coinstack members.

Last week we shared an Alpha Edge Digest issue with you. AED is one of our sister publications.

Because so many of you wanted more…

We’re sharing another with you today. Enjoy!

Confirmed: The Real Reason for Greenland…

It’s NOT a Conspiracy Theory

On January 9, just a few days after “The Event” (the Venezuela raid), we shared with you why, in our humble opinion, Maduro was really captured…

And why Greenland suddenly became the biggest international news story, shortly thereafter.

In a nutshell, rare earths. Trillions of dollars’ worth.

Importantly, we shared the names of all six rare earth companies we covered in our special report.

Now, one of the companies, Critical Metals Corp. (CRML), just so happens to be a rare earth and critical-metals developer…

With its primary asset, the Tanbreez project in, you guessed it, Greenland!

Today, we’ll have a closer look at CRML and reveal something we spotted in the stock charts using our proprietary algos/indicators.

First…

As noted in our research report (available to email subscribers, HERE) Critical Metals Corp. signed a 10-year agreement to supply heavy rare earth concentrate to a U.S. government–funded processing facility in Louisiana…

Operated by Ucore Rare Metals, which is backed by the U.S. DoD.

Additionally, the U.S. Export-Import Bank (EXIM) is considering a $120M loan to support Tanbreez’s development, and the Trump administration is possibly exploring converting a $50M grant into an equity stake…

Potentially making CRML the first major U.S. overseas rare-earth mining investment.

Now…

On the 15th, as Trump was telling the world that a deal to “obtain” Greenland was all based on its geolocation relative to China and Russia, and not minerals…

The company announced it had executed a term sheet for a 50/50 joint venture with a Saudi conglomerate for a rare earth processing facility.

The facility will be a mine-to-processing supply chain for… wait for it…

The United States Defense Industry.

The deal value? Up to $1.5 billion.

This confirms, in our belief, that Greenland (and the Maduro raid that triggered the mania) was always about rare earths.

Which brings us back to our January 9th Digest issue.

In that issue (HERE), we showed you two stock charts: Chevron and Halliburton. Two companies that could benefit handsomely should Venezuela re-open its oilfields to US investment.

In those charts, we showed you how our proprietary algorithms alerted not one, but two buy signals…

Days before the Maduro raid happened.

It sure looked like someone knew about “The Event” beforehand. And it sure looked like someone could have made a whole lot of money off of it.

Back to rare earths…

Today, we’re going to look at the CRML charts (with our indicators activated) in the days leading up to the raid… and in the days leading up to the $1.5 billion 50/50 JV announcement.

Because in our opinion, Venezuela and Greenland have always been about rare earths. And the Maduro raid triggered it all.

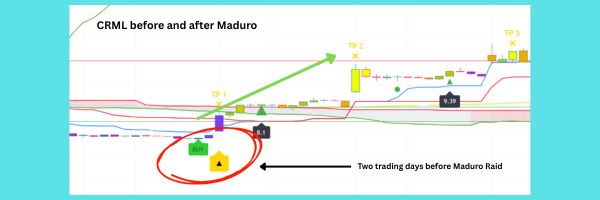

First… CRML before the Maduro raid:

As you can see, the green All in One “buy” and the yellow “Institutional Algo” flashed on the CRML chart two trading days before the raid.

Keep in mind, these indicators flash in real time.

Now, what followed was no small move. The stock went from around $6.50 when the indicators flashed, to around $9.50 the following Monday, after the news broke.

Again, it looks like somebody “knew” and could have made a killing.

However, …

Unlike the two oil companies we showed you in our Jan 9 issue, CRML kept going up, and up and up.

Because like we said… it’s all about rare earths.

Now have a look at this chart:

This is CRML from January 12th through the 16th, with our All in One indicator (green) flashing a buy signal, and our Institutional Algo (yellow) also indicating a buy…

One and two days before the company released news of its $1.5 billion JV deal on January 15th.

Again, money. Big money.

Now, since our algos gave those initial pre-Maduro buy signals, the stock’s up about 154%.

And it’s up about 36% since the algos alerted a couple of days prior to the JV deal announcement.

Now, should full development of its Greenland property occur, CRML stock could go much, much higher. CRML along with the five other rare earth companies covered in our special report are, in our opinion, a long term rare earth plays.

Get your complimentary copy of our research report on rare earths, HERE.

Oh, and sorry for the wait.

We’ll be releasing access to our proprietary trading algos to Alpha Edge Digest readers soon. Promise.

“The Edison Rules”

Last week we introduced Edison. He’s the product tester for the trading technology our parent company, a Nasdaq-listed Fintech, is about to release.

If you recall, he’s been sharing his real money trades with us, using the company’s proprietary algos/indicators. If you didn’t have a chance to review last week’s issue covering Edison’s trades, you can do so HERE. You’ll definitely want to see them.

Now…

Today, we’ll share some more of those real money trades, his latest P/L and his “rules” that have allowed him to have such great success using the tech.

Let’s got to it.

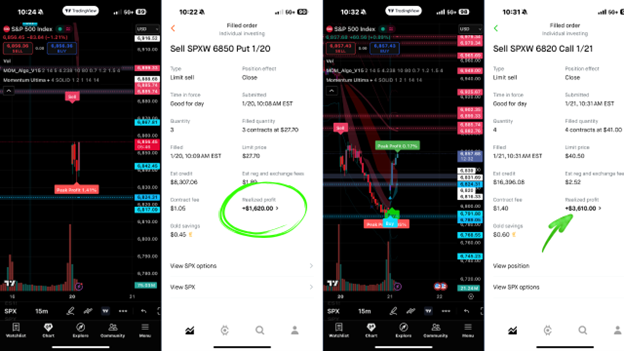

Here’s some of Edison’s trades from Monday and Tuesday…

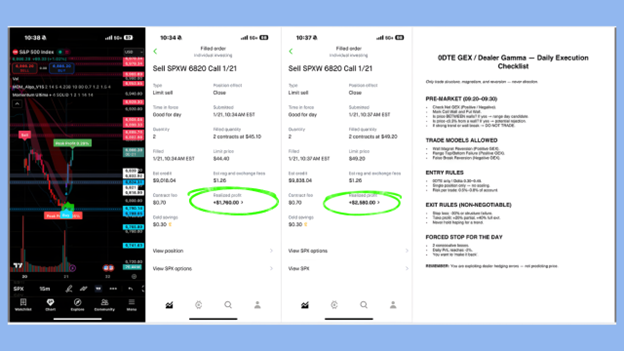

And here’s more from Tuesday…

Now, you’ll notice here that on the right side of the image above there’s a “checklist”

That’s Edison’s rules. You should zoom in and print them out.

Because when you get the trading tech, you’ll probably want to follow them as he’s been working on his “system” for a while now…

And it’s been working remarkably well for him.

But…

Not every trade of Edison’s has been a winner.

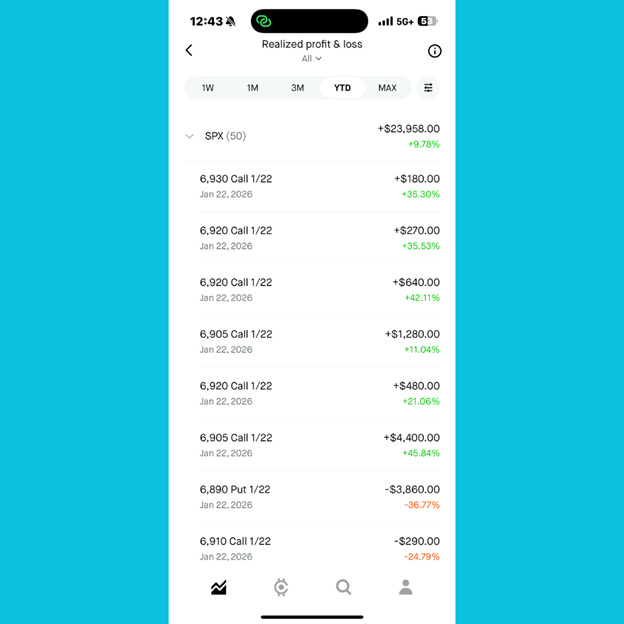

Here’s his P/L so far for today, Thursday as of 1pm Eastern.

Even with a couple of losses, one big one, he’s still having a great day in the market!

Like we said earlier, the tech will soon be available to Digest subscribers first, before it’s released nationwide.

So, stay tuned.

Subscribe to the Alpha Edge Digest, HERE.

Luke Hodgens

Director of Publications

Alpha Edge Media