Containing Contagion

3AC Liquidation Ordered, Celsius Lawyers Advising Bankruptcy, Harmony Suffers $100M Hack, CoinFlex With $47M Distressed Debt

Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem.

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News - 3AC Liquidation Ordered in BVI, Celsius Lawyers Advise Bankruptcy, Harmony’s $100M Hack

💵 Weekly Fundraises - PolySign ($53M), Kaio ($53M), Circulor ($25M)

📊 Key Stats - DYDX, Hedge Funds, Lido

🧵 Thread of The Week - The EVM Has Won…

📝 Report Highlights - Messari: Examining Portfolios of Crypto Funds

🎧 Best Crypto Podcasts - Coinstack, Bankless, Delphi Media

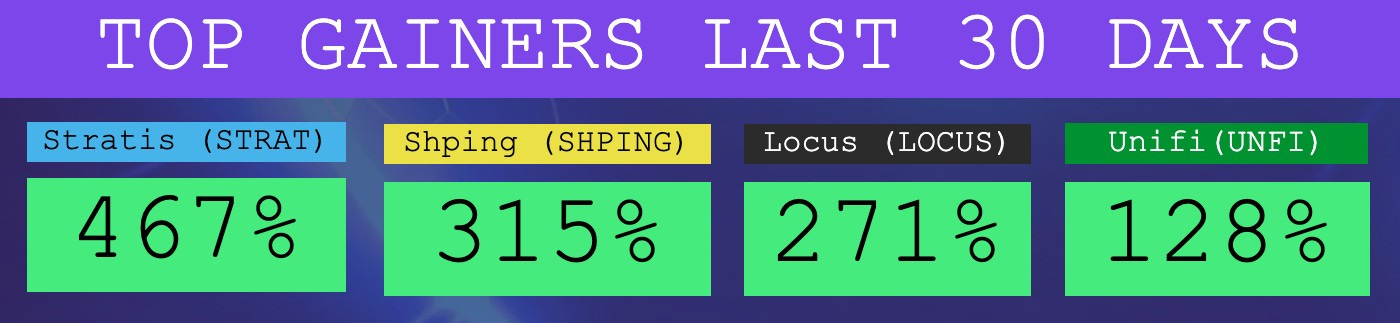

📈 Top 10 Tokens of the Week - STRAT, SHPING, LOCUS

Coinstack Podcast Episodes

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is a Web3 social network and blockchain technology company founded by Tony Tran to develop consumer-focused blockchain software, hardware, and services for Web3 — the next evolution of the internet. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc.

HeartRithm is a crypto DeFi fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

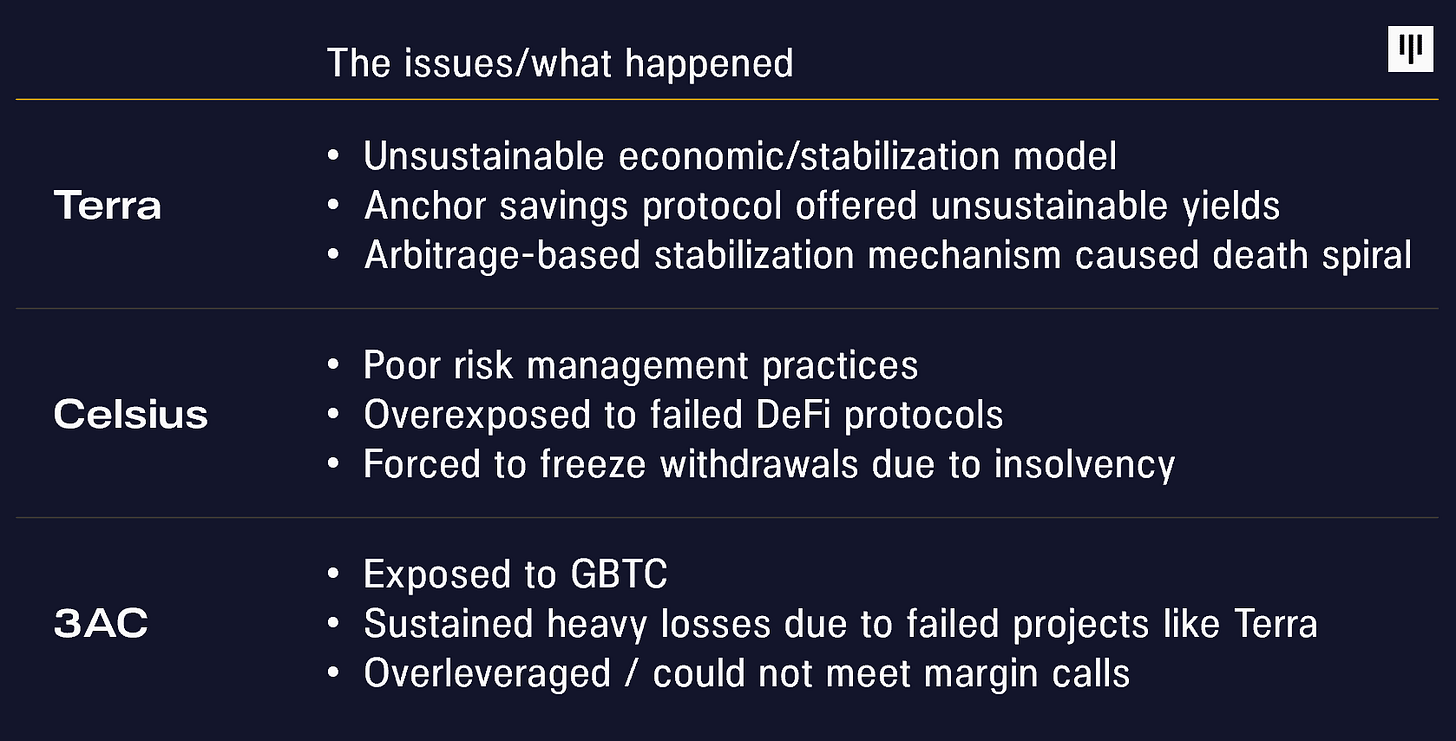

🎯 Three Arrows Capital Liquidation Ordered By Court - A court in the British Virgin Islands (BVI) has appointed financial advisory firm Teneo to handle the liquidation of troubled crypto hedge fund Three Arrows Capital (3AC). Teneo has been appointed on the orders of the Eastern Caribbean Supreme Court in the BVI's High Court of Justice.

📉 Celsius Clashes With Own Lawyers Over Chapter 11 Bankruptcy - Celsius, dogged by a liquidity crisis for weeks, has been resisting guidance from its own lawyers to file for Chapter 11 bankruptcy. Goldman Sachs is looking to raise $2 billion from investors to buy up distressed assets from troubled crypto lender Celsius, according to Coindesk.

📄 Harmony's $100M Hack From Compromised Multi-Sig Scheme - On June 23 the Harmony development team announced that $100 million was siphoned from the Horizon bridge. The organization explained it was working with national authorities and forensic specialists to learn more.

💧 Bankman-Fried Warns Some Crypto Exchanges Already Secretly Insolvent

Sam Bankman-Fried (SBF), the billionaire founder of FTX, believes that many third-tier exchanges are already secretly insolvent. SBF has been issuing cash infusions to save crypto companies from collapsing. Further, SBF is not worried about Tether, saying that there is no evidence to support the bearish views around the stablecoin.💰 Troubled Exchange CoinFlex Announces $47M Debt from Roger Ver - Crypto exchange CoinFlex is raising $47 million through a new coin after a major investor failed to pay a disputed debt.

🚫 FTX Denies Claims That It Plans To Acquire Robinhood - Crypto exchange FTX on Monday denied down a report that the company is angling to buy traditional finance brokerage Robinhood.

📱 Solana Making a Crypto Phone - Solana has announced its own mobile phone, called the Saga, made in collaboration with Osom.

🇷🇺 Russia Accelerates Digital Ruble Work, Going Around SWIFT - The Bank of Russia is currently running a pilot for its digital ruble with 12 banks and announced plans to start consumer pilots in April 2023 instead of 2024.

₿ Grayscale ‘Encouraged’ by SEC Rulings Ahead of Bitcoin ETF Decision - While crypto-focused asset manager Grayscale Investments is optimistic ahead of the SEC’s decision on giving the greenlight to the firm’s long-proposed conversion of its bitcoin trust to an ETF, the company’s CEO said it’s preparing for all possible scenarios.

₿ Bitcoin Investment Products Endured $453M of Outflows Last Week - Net outflows from bitcoin investment products totaled $453 million amid the ongoing crypto market sell-off, CoinShares revealed in the firm’s weekly report, erasing almost all year-to-date inflows in the category.

🖼️ Graphic of the Week - Contagion Summarized

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

PolySign, a Crypto Infrastructure fim, Raises $53M Series C Round

Kaio, a Crypto Data Firm, Raises $53M Series B led by Eight Roads

Circulor, a UK Based Green Supply Chain Company, Raises $25M Series B led by Westly Group

Zigazoo, a Social Network for Kids’, Raises $17M Funding Round led by Liberty City Ventures

FTT DAO, a DAO Independent of FTX, Raises $7M from Community of SBF Fans

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. DeFi TVL Has Dropped from $220B to $77B the last 90 Days

2. DYDX Announced That They Will Be Developing Their Own Chain Using Cosmos, With 50% of Supply Being Given to Insiders

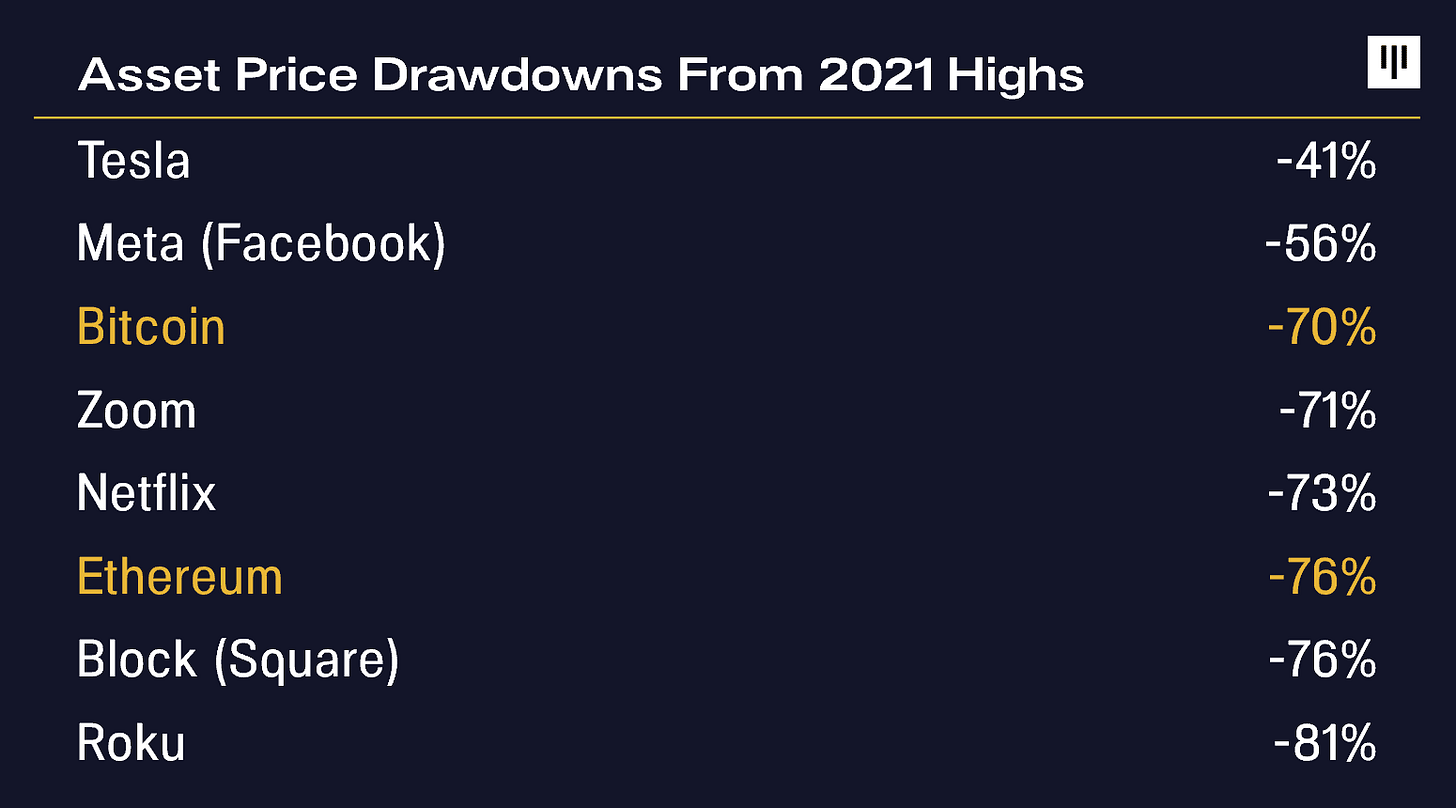

3. BTC has declined less than Zoom, Netflix, and Square off Its 2021 Highs

4. A Majority of Crypto Hedge Fund Investors Remain High-Net-Worth Individuals and Family Offices With Institutions Beginning to Allocate

5. Lido Holds 32% of All Staked ETH (~3.3% of the Total ETH Supply), It’s Also the Largest Liquid Staking Derivative With ~90% Market Share.

6. Out of All the NFT Projects at NFT NYC… GoblinTown, an Ironic Project about the Bear Market, Had the Highest Growth in Floor Price Last Week

7. In the 14 Months Since the THORSwap DEX Official Launch, the Exchange Has Processed a Total of 2.7 Million Transactions and $1.85 Billion in Volume

8. DEX Trading Volume Has Declined by 50% from Peak in November 2021, but sill up 42x in 24 Months

9. Arbitrum daily transactions just hit a new ATH of 287,019

10. Bitcoin Correlation to S&P 500 Reached an All Time High in May 2022

🧵 Thread of the Week - The EVM Has Won…

By @jonwu_

The EVM has won. It's the dominant smart contract execution architecture, and Solidity is the dominant smart contracting language. But how will Solidity devs choose between the 20+ major EVM implementations that are out there?

1/ First, let's list them all out.

Ethereum ecosystem:

- Ethereum Mainnet

- Polygon Hermez

- Polygon Zero

- Polygon PoS

- Optimism

- Arbitrum

- Loopring

- zkSync

- Metis

- Scroll

- Boba

2/ Alt-L1s":

- BSC

- Fantom

- Harmony

- Avalanche

- Neon (Solana)

- Aurora (NEAR)

- Acala (Polkadot)

- Evmos (Cosmos)

- Moonbeam (Polkadot)

3/ (There are a lot, in case I missed your favorite; I'm also only including ones that support Solidity-first) Back to the question: how does a developer choose?

Some considerations:

- fees

- devex

- security

- free $$$

- throughput

- values alignment

- existing ecosystem

4/ In the last bull run, ecosystems seemed to compete on:

- Lowest fees ("sub-penny")

- Highest throughput ("Visa-like")

- Fastest execution ("sub-second finality")

- Ecosystem incentives (funding and grants)

5/ And the pressure to conform to the above narrative led to a very specific and predictable "L1 playbook":

Step 1: Pump the token

Step 2: Create a giant ecosystem fund

Step 3: Use the treasury to buy traction

Step 4: Repeat Step 1

6/ Step 1: Pump the token. "We're faster and cheaper than Ethereum, and $ETH has a $200 billion market cap, so we can grab like, 10% of that, right?" Go on an exchange roadshow and pump it!

7/ Step 2: At the peak of the pumponomics, commit treasury tokens to a multi-billion dollar ecosystem fund and rip a thicc headline: "Introducing the $3 billion evmChain Ecosystem Fund" Start dropping helicopter money on devs 🚁💰

8/ Step 3: Use grants to incentivize core primitives and a few juicy 4-figure APR ponzis to build on your chain. Get retail to bridge across for the rewards. "Look at all our traction! We told you we're going to be bigger than Ethereum!" Then repeat Step 1: pump the token.

9/ Underlying all of this is a focus on cutting fees and improving speed ("we achieved 2x Visa throughput!"). Sometimes (but not always) at the expense of liveness, security and decentralization.

10/ There is more money, effort, and attention paid to attracting developers to Solidity and the EVM than ever before. And more solutions for developers than ever before. So where does it end?

11/ Competing on cost and giving away free money doesn't seem like a long-term sustainable business model. There's always someone willing to trade more security for cost reduction on the margin. Is it a race to the bottom? Does it even matter if insiders already have their yachts?

12/ There are many (many) teams who haven't launched tokens yet and have the opportunity to rewrite the playbook. With a focus on: - Devex - Differentiated use-cases - Non-economic innovations In other words, attracting developers and users with values, rather than dollars.

13/ If you're a startup founder you know you can't "out-perk" Google. Blockchains today can't "out-values" Bitcoin and Ethereum. So they run the playbook. Repeat Step 1.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Messari: Messari Fund Analysis H1’22: Examining Portfolios of Crypto Funds

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public make sense of this revolutionary new asset class and is building data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here

Key Insights:

Polkadot is once again the top-held asset, with 35% of the funds tracked invested in them.

Solana overtook Terra as the asset with the highest circulating market cap. Overall, most of the top assets’ market caps have decreased by at least 50% due to recent price volatility.

The top three spots are all smart contract platforms which is also the most heavily invested sector of H1.

The first half of 2022 has been chaotic for the crypto space. Negative catalysts have pushed prices to levels not seen since December 2020. Despite the volatility, new institutional investors have entered the market at a rapid rate. Hedge funds, venture capital (VC) funds, high-net-worth individuals, and DAOs continue their search for the best investments across crypto’s various sectors.

Messari usually analyzes and compiles the liquid and illiquid portfolios of top VC firms and hedge funds across crypto on a quarterly basis, but this year, we’ve combined the Q1 and Q2 analyses. Illiquid investments are selected for this analysis based on the potential of releasing a token in the near future. We use resources such as Dove Metrics, Crunchbase, and public portfolios to compile this data. Since most of the funds are assumed to hold Bitcoin and Ethereum, we omitted both in our analysis. Thanks to the public availability of these investments and the low barriers to entry in crypto compared to traditional VC, any investor can emulate the moves of institutional investors.

Messari Fund Analysis

Messari last conducted this analysis in March 2022 with 57 funds, and the top five held assets were:

Polkadot

Oasis Network

NEAR Protocol

Terra

dYdX

The H1 Messari Screener Analysis

After conducting a full analysis of all portfolios, the top-held asset across the funds was once again Polkadot (DOT). DOT is held by 29 of the 82 funds, meaning 35% of the funds we’ve tracked are betting on the success of Polkadot’s smart contract platform. After strong developer growth in 2021 (faster initial ecosystem growth than Ethereum) and the recent release of their Cross-Consensus Message Format (XCM), Polkadot has continued to set itself up to be a leader in the smart contract space. Meanwhile, DOT-holding funds will continue to show their influence as projects race to secure slots in the parachain auctions running through 2023.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Coinstack - FTX Bails Out BlockFi; Voyager Announces $661M Exposure

The Defiant - Harmony hacked, Yuga strikes, BlockFi on the rocks

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Shping is a rewards Dapp, Locus and Unifi are L1s.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 26,177 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

Episode 63 - FTX Bails Out BlockFi; Voyager Announces $661M Exposure

Episode 38 - Celo Deep Dive: The 4th Fastest Growing DeFi Blockchain

Episode 35 - Latest Market Forecast: A Cycle Top in Q1 2022? & This Week in Crypto

Episode 30 - This Week in Crypto- (BTC New ATHs, ETH Difficulty Bomb Delayed, Tether $42.5M Fines)

Episode 24 - DeFi & The Future of Finance - The Winning Blockchains & Dapps - With Ryan Allis

Episode 19 - Joining a Crypto Quant Fund 📈- Our Strategies & The Story

Episode 16 - On-Chain Analysis - How It Works & Bitcoin & Ethereum Price Forecast With Mike Gavela

Episode 15 - This Week in Crypto (BTC & ETH Forecast, Top News, Fundraises, Stats, & Reports)

Episode 14 - This Week in Crypto (Axie, Binance, CryptoPunks, Regulation, EIP-1559 Goes Live)

Episode 11 - The Future of Money: Stablecoins & Central Bank Digital Currencies

Episode 10 - This Week in Crypto (SpaceX, EIP 1559, and More)

Episode 8 - Will the Crypto Bull Market Come Back? We Think So.

Episode 7 - Double Peak Theory & Our Dec 2021 BTC & ETH Forecast

Episode 6 - Crypto: Explain It Like I’m 5 (DeFi, NFTs, DAOs, & Tokens)

Episode 5 - Crypto: Explain It Like I’m 5 (Ethereum & Smart Contracts)

Episode 4 - Crypto: Explain It Like I’m 5 (Bitcoin, Cryptography, & Blockchains)

Episode 3 - Why A16Z’s $2.2B Crypto Fund is a Bigger Deal Than Most Think

Episode 2 - Are We Near the Bottom for Bitcoin and Ethereum: We Think So.

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.