Consensus '23 Next Week in Austin

Consensus is the world's largest gathering that brings together all sides of the cryptocurrency, blockchain and Web3 community. Plus the top news, deals, stats, and reports of the week.

Issue Summary: Welcome back to Coinstack, the weekly newsletter for crypto investors and industry insiders, where we review the top deals, news, stats, and reports in the digital asset ecosystem. This week we cover the upcoming Consensus 2023 Conference April 24-28 in Austin, TX, which is one of the biggest crypto events of the year. We also cover the House Financial Services Committee grilling of Gary Gensler, the new SEC Charges against Bittrex, and big new venture funding rounds for KarateKombat and RSSR3.

Thanks to Our 2023 Coinstack Sponsors…

Amphibian Capital is hosting two events next week at Consensus. ‘Crypto & Consciousness’ 4/26 6-9pm and ‘Crypto & Cocktails’ 4/27 4-6pm. As a market/delta neutral fund for the world’s leading crypto funds, they returned approximately 5.35% net in Q1 ‘23, 186.33% net (pro-forma) since '19* and aim to deeply mitigate downside. They have USD and ETH share classes, soon BTC. Deck here: www.amphibiancapital.com. To RSVP to their Austin events or meet them there, email james@amphibiancapital.com.

Momento allows creators to create valuable digital collectables of their best social media content and build a thriving community that rewards their biggest fans. Join the only platform that allows creators to own and sell limited-edition content to their community. Momento leverages digital ownership to allow both creators and fans to make money through authentic connections. Learn more at www.momentofans.com

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has built relationships with the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck.

We have one open sponsorship spot available for your firm - please see our sponsor deck and schedule a call to discuss.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top stories of the week…

🏆 Coindesk’s Consensus Conference Happening Next Week in Austin , TX- Consensus is the world's largest and longest-running gathering that brings together all sides of the cryptocurrency, blockchain and Web3 community. Consensus 2023 is a call to action for developers, investors, founders, policymakers, brands and others to come together and find solutions to crypto's thorniest challenges and finally deliver on the technology's transformative potential. The event runs from April 26-28. Our friends at Amphibian Capital (a crypto quant fund of funds) will be there. You can reach out to them at james@amphibiancapital.com.

⚖️ Rep. Patrick McHenry Clashes With SEC’s Gensler Over Crypto Crackdown - McHenry and other committee members– attacked Gensler over his approach to regulation. They said he was focused too much on enforcement and not enough on providing clarity for the industry. They also blasted the SEC chair for stonewalling their efforts to investigate his response to the FTX failure.

🔬 SEC Charges Crypto Asset Trading Platform Bittrex and Its Former CEO for Operating an Unregistered Exchange, Broker, and Clearing Agency- The Securities and Exchange Commission today charged crypto asset trading platform Bittrex, Inc. and its co-founder and former CEO William Shihara for operating an unregistered national securities exchange, broker, and clearing agency.

💸 SEC Labels Algorand and Five Other Tokens As Securities in Bittrex Lawsuit- A legal expert said the coins’ inclusion resembles another SEC lawsuit brought against a former Coinbase employee.

💸 SEC Revisits Exchanges Definition as It Targets DeFi- On Friday, April 14, the SEC’s five-member commission voted 3-2 to again reopen the comment period on amendments that would alter the definition of an exchange under the Exchange Act Rule 3b-16.

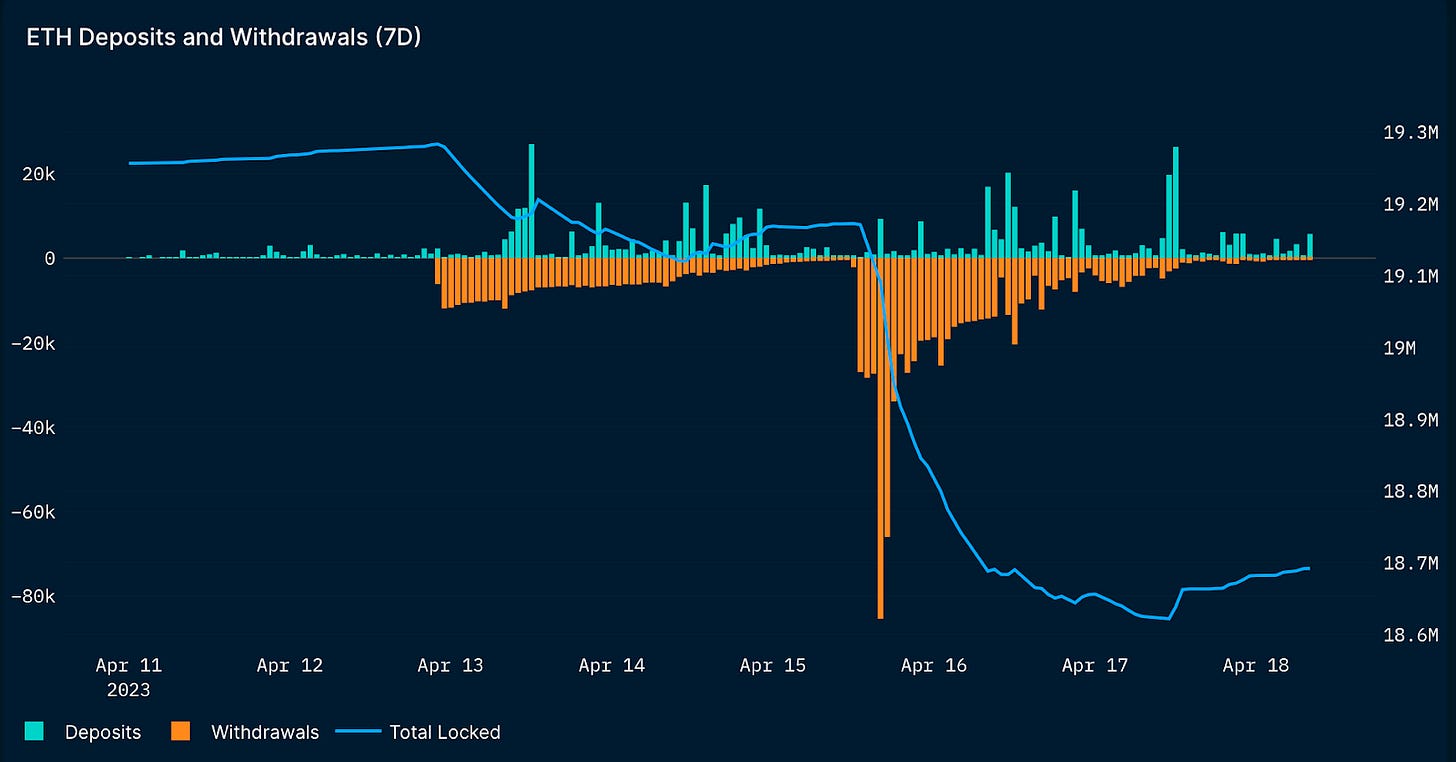

🚩 Staked ether deposits surpass withdrawals for the first time since Shapella upgrade - The surge in outflows of staked ether seen after Ethereum's Shapella upgrade enabled withdrawals for the first time has stopped after less than a week, with traders once again staking more ether than they're unlocking.

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. While there have been steady withdrawals now that they've been enabled, deposits have also risen a bit. Over 1 million ETH was withdrawn outpacing deposits the first few days.

2. MicroStrategy was briefly in the green from their $4.17 bill BTC investment. With 140k BTC bought at an avg price of $29,803, the firm was up for most of last week while BTC was over $30k.

3. DeGods had now been on Ethereum since Apr 1 after migrating from Solana. In the collection's first full week of trading it put up $7.24 mill in vol, exceeding the previous high on Solana by $220k.

4 OpenSea did just 4100 ETH of volume On April 17. This is the lowest ETH volume for a single day on OpenSea since July, 2021.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

State of Cardano Q1 2023

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Primer on Cardano

Cardano is a Proof-of-Stake (PoS) Layer-1 smart contract network launched in 2017. Cardano’s PoS mechanism allows for delegation of stake. Cardano aims to provide security, scalability, and sustainability to decentralized applications and systems building on top of the blockchain. In addition to the community of developers, node operators, and projects, Cardano is supported by three entities: Input Output Global (IOG), The Cardano Foundation, and EMURGO. They work together to support the network’s development, adoption, and finances while Cardano moves toward full decentralization of governance.

Cardano has taken a unique approach to development when compared to other smart contract networks, based on a phased roadmap:

Cardano’s development is methodical, deliberate, and sometimes slower than the market would like — prioritizing sustainability and stability over speed.

For example, smart contracts were not enabled until the Alonzo hard fork in 2021, over four years after the network launched.

The extended unspent transaction output (eUTXO) accounting model enables native token transfers, scalability, and decentralization.

Cardano has offered liquid staking and economic models to incentivize decentralization on its Ouroboros PoS consensus model since inception.

With a dedicated community of users and developers, Cardano has demonstrated staying power. In the past year, Cardano began to compete in more traditional crypto markets, such as DeFi and NFTs, while remaining focused on its core goals.

Key Metrics

Performance Analysis

New addresses and average daily transactions decreased QoQ by 71.5% and 10.6%, respectively. The average transaction fee increased by $0.01, from $0.11 to $0.12. However, it still remains lower than the average transaction fee of $0.17 in Q3 2022, which had roughly the same number of transactions. This indicates that transaction fees are decreasing, given the same amount of network traffic. The decreased transaction fees are likely a result of network traffic being more consistent in Q1 than it was in Q3, especially considering that there were no relevant network updates.

The “daily active addresses” metric represents all addresses included in ledger transactions. The metric does not directly map to users in a UTXO system, like Cardano, where multiple addresses can represent a single sender/recipient.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Bankless - Gary Gensler Testifies! - Bankless Restreaming Coverage

Real Vision - How a Long-Term Fund Positions Itself w/ Raoul Pal & Richard Galvin

The Defiant - Push Protocol's Harsh Rajat talks On-Chain ChatGPT, Driving Growth in Web3 & Web3 UX

Coin Bureau - US Treasury ATTACK On Defi!! Here's What They Plan To Do!

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.