Coinstack Newsletter Sale Process

Fill out the TypeForm to get the full deck and sale details.

Since our first issue in December 2020, we’ve had the thesis that the crypto markets would become more institutional, traditional markets would become tokenized, and big companies would add digital assets to their balance sheets.

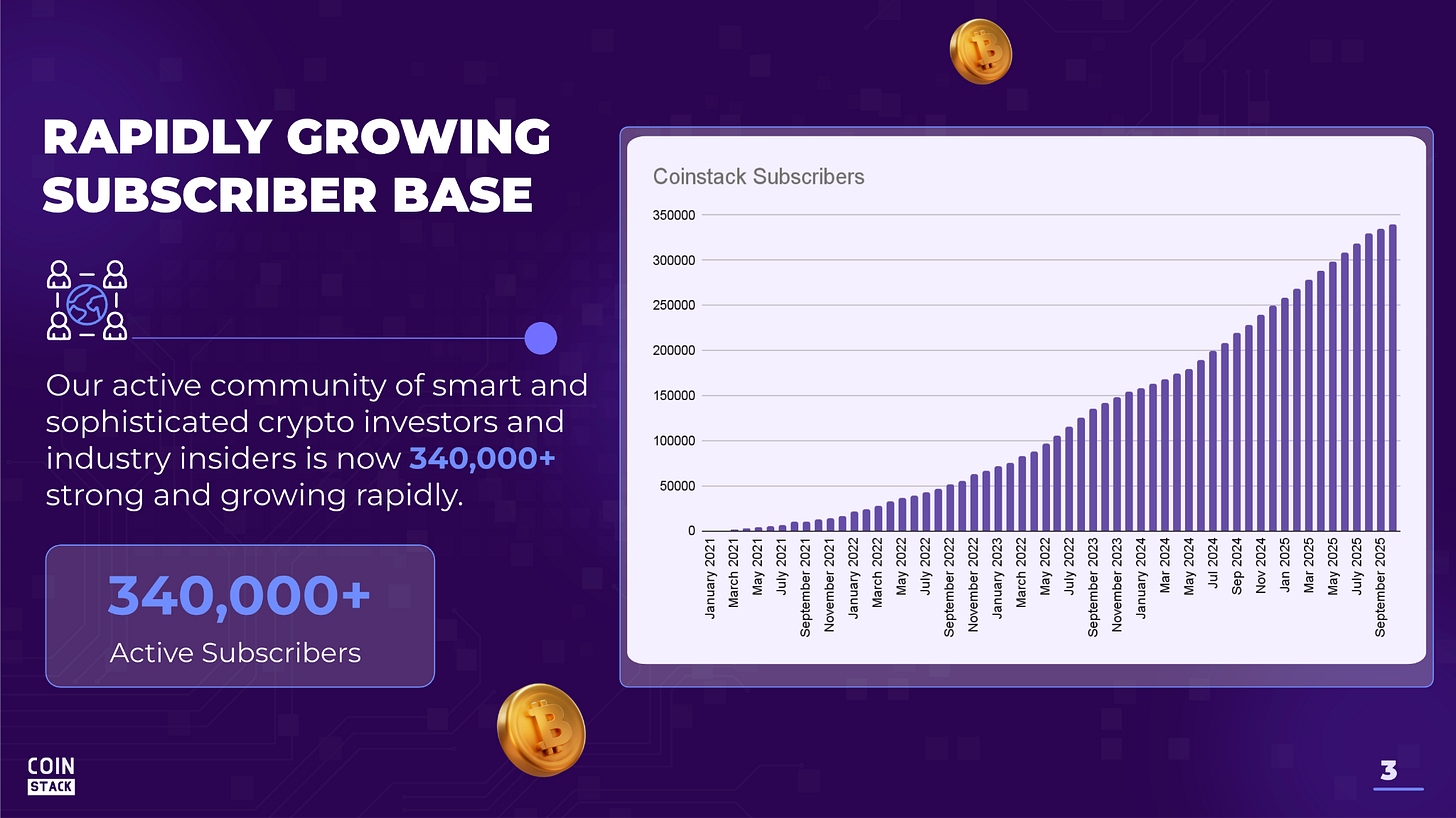

The thesis has played out with digital assets growing from a $600 billion to $3.2 trillion market cap.

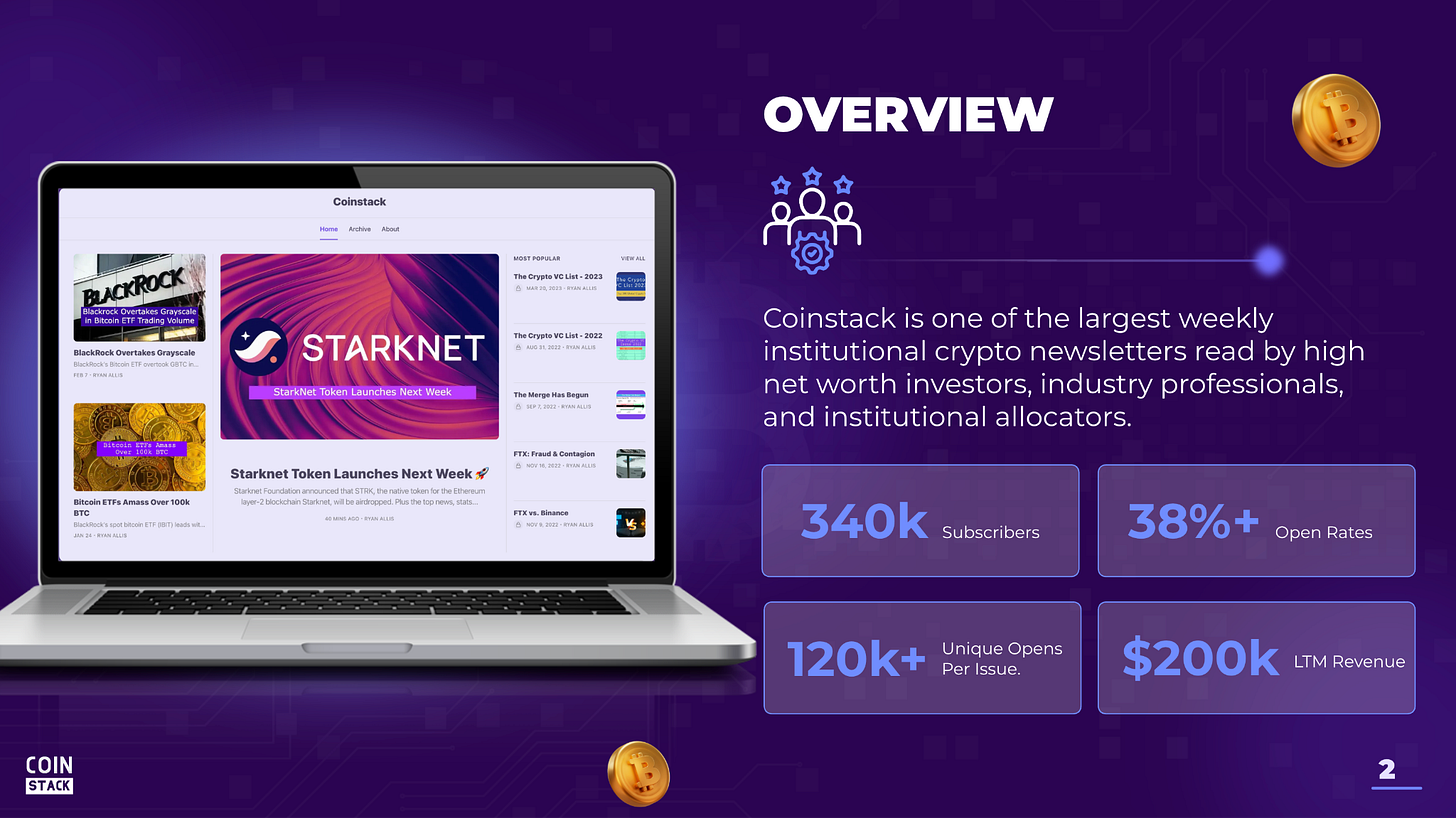

Over these five years, Coinstack has grown into one of the largest weekly institutional crypto newsletters with 340,000 subscribers and very strong open rates.

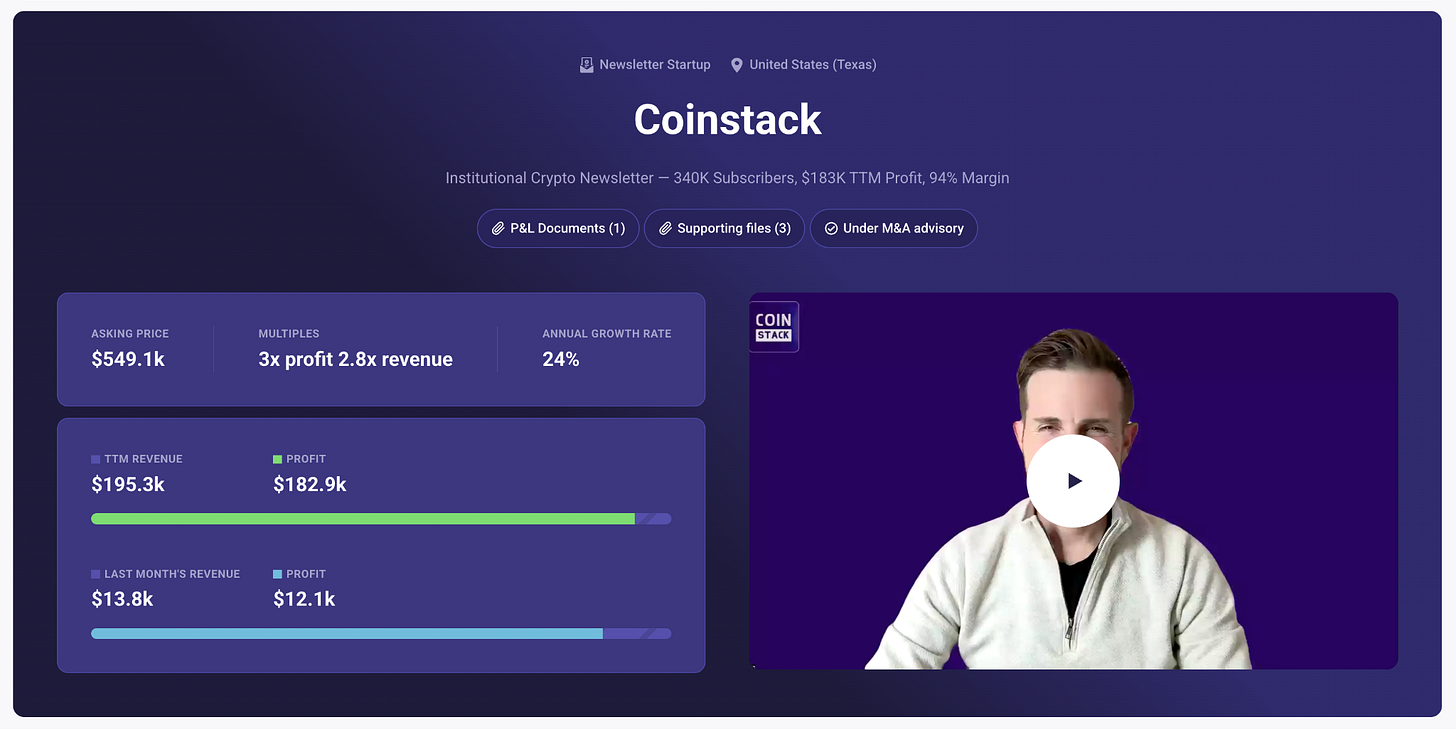

Now we are exploring a sale of the Coinstack newsletter business.

Some highlights:

Leading institutional crypto newsletter competing with Blockworks and Messari

340,000 subscribers including many industry insiders and UHNW investors

38% open rates

$183k in annual net profits (very low costs)

55 sponsors and $1.1M in revenues all time

1 part-time person, very capital efficient

Helped our crypto hedge fund sponsors raise $26M in AUM

Acquiring a weekly newsletter like this would be especially beneficial if you have an existing media arm with built in sponsor relationships — OR if you have an existing crypto VC, crypto, hedge fund or web3 fundraising effort that you want to accelerate.

If you’re interested in learning more, please fill out this TypeForm and we’ll share the full materials with qualified buyers.

You can also find the full sale info here on Acquire.com (requires account). If you already use Acquire.com you can request to see the full details there.

We are looking for a new owner who wants to own one of the largest weekly institutional crypto newsletter platforms — and is ready to scale it up and take it to the next level.

If this sounds like you, please reach out via the TypeForm.

We’ll be doing initial meetings over the next two weeks, looking for offers by December 3rd, and closing by the end of year.

In the meantime, we’ll keep publishing every Wednesday afternoon!