BitMine Immersion Raises $250M for Ether Treasury As Stock Triples

BitMine also added Fundstrat crytpo bull Thomas Lee as its Chairman. Plus the top news, funding, and stats of the week.

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 330k weekly subscribers. This week BitMine announced an ETH treasury, BlackRock’s IBIT hit $70B AUM, Powell reaffirmed Fed has no issues with banks conducting crypto activities, and big new rounds came in for Kalshi ($185M) and Bit Digital ($150M).

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Kula is a decentralised impact investment firm that transforms overlooked assets into shared prosperity and thriving communities by re-shaping how value and opportunity are recognised worldwide. By tokenising real-world assets, we provide opportunity, transparency, and financial sovereignty to historically excluded communities. Our model aligns economic growth with sustainable development, ensuring that wealth is not extracted but reinvested into the communities that generate it.

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world's leading hedge funds. *+20.4% net 2024 approx with their USD fund, *+14.1% net BTC on BTC in 2024 (*+152% in USD terms), and *+17.3% net ETH on ETH in 2024 (*+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

Become a Coinstack Sponsor

To reach our weekly audience of 330,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

World Liberty Financial, a DeFi platform has raised $100M in a private round, led by Aqua 1

Zama, has raised $57M led by Pantera Capital, enabling confidential smart contracts on any Layer 1 or Layer 2 blockchain

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🎉 BitMine Immersion Stock Triples as It Raises $250M for Ether Treasury, Adds Thomas Lee to Board: BitMine Immersion Technologies has secured a $250 million via a private placement of shares and plans to use the funds to launch an ether (ETH) treasury. The financing was led by MOZAYYX and included investors such as Founders Fund, Pantera Capital, Kraken, Galaxy Digital, and Republic, with Cantor Fitzgerald and ThinkEquity advising on the deal. BitMine also added Fundstrat crytpo bull Thomas Lee as its Chairman.

📈 BlackRock’s IBIT hits $70B AUM faster than any US ETF:BlackRock’s iShares Bitcoin Trust ETF (IBIT) is rapidly cementing its status as the most dominant BTC fund among its peers.Bitcoin analyst James Check highlighted the divergence in a June 29 X post, noting that total inflows across all other Bitcoin ETFs have stagnated around $20 billion since December 2024.

⚖️ Powell reaffirms Fed has no issues with banks conducting crypto activities:Federal Reserve Chair Jerome Powell reaffirmed that the central bank does not object to U.S. banks providing services to cryptocurrency companies or participating in crypto-related activities, so long as they follow established risk management and consumer protection standards.

🚀 Coinbase Brings Cardano and Litecoin to Base, Joining DOGE and XRP:American cryptocurrency exchange Coinbase unveiled two new wrapped assets on Wednesday, making Cardano and Litecoin tradable on Base, the firm’s Ethereum layer-2 network.

⚖️ European Commission to ease rules on foreign stablecoins despite ECB opposition:The European Union is preparing to relax its stance on foreign-issued stablecoins, potentially allowing U.S. dollar-backed tokens like USDC and USDT to circulate freely within the bloc.

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. PancakeSwap led all DEXs in total monthly volume for the second straight month, accounting for 45% ($153B) of all DEX volume in June. The protocol shattered its previous record from May ($98B), growing 56% month-over-month.

2. Over $2.2B flowed into Bitcoin ETFs this week, including three days with $500M+ inflows. That marks 14 straight days of net inflows.

Perhaps even more striking: since mid-April, we've only seen 8 total days of outflows. Demand remains resilient despite ongoing macro and geopolitical tensions.

And with in-kind redemptions on the horizon, that demand could be poised to accelerate.

3. Traditional markets are up. But blockchain is dominating. Over the past year:

S&P 500: +11%

QQQ: +11%

Coinbase: +36%

BTC: +67%

Circle: +217%

Robinhood: +242%

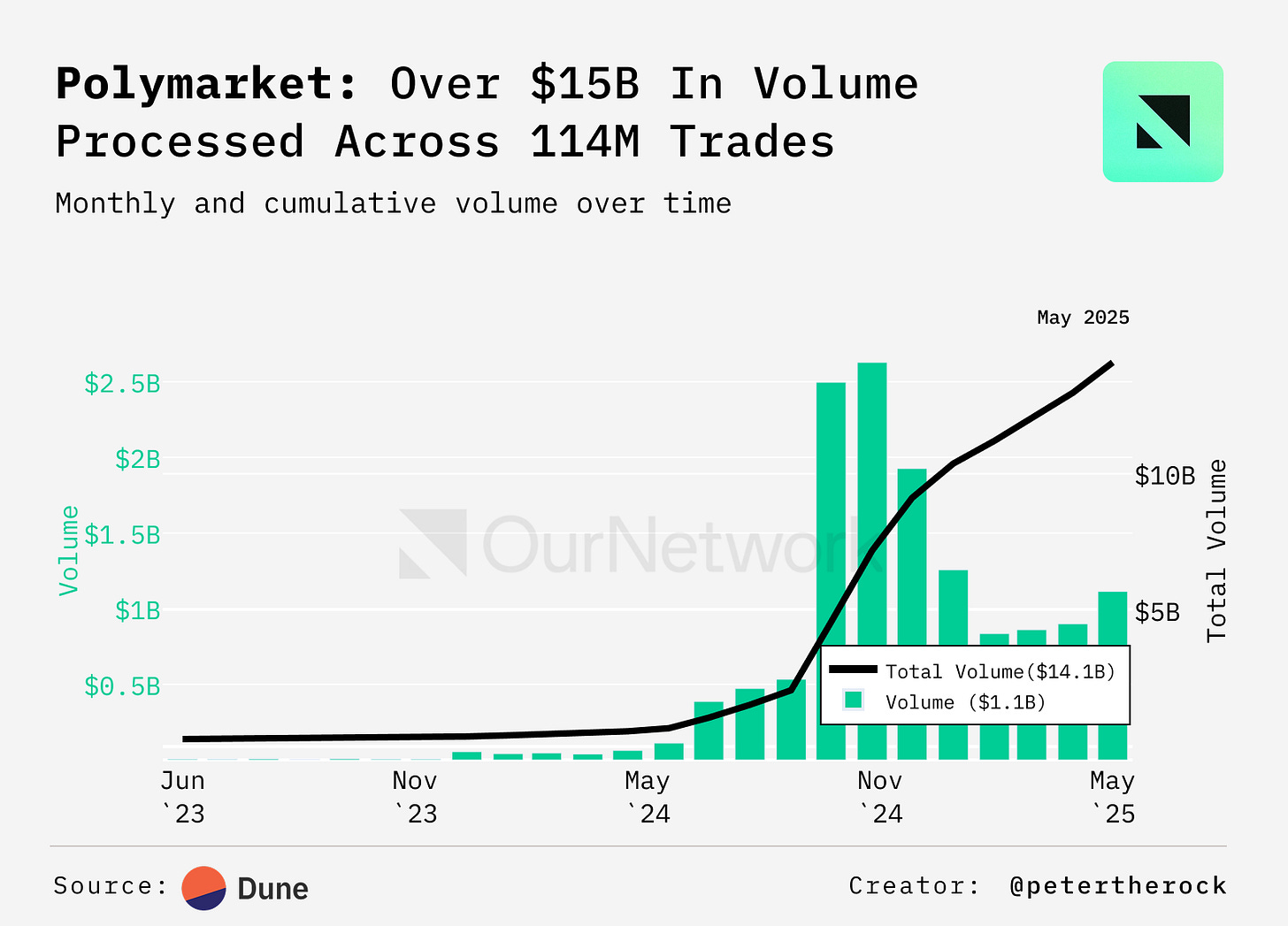

4. 📈 Polymarket is Growing Fast — and Getting it Right Thanks to Rising Volumes, Consistent Usage, and Over 90% Predictive Accuracy

5. 📈 Virtuals Pioneers AI Gaming Companions with Cross-Platform Personalization — $8.9B DEX Volume, 2.94% Agent Graduation, Massive Adoption

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

ON–350: Onchain Culture Part 1 🌐

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork’s latest! After digging into data protocols for the last two issues, we’re moving on to check out how culture looks from an onchain perspective.

In this issue we've got Alex covering Kaito, Nate covering Farcaster, David covering Zora, and Maus covering Rodeo.

Let's get into it.

– ON Editorial Team

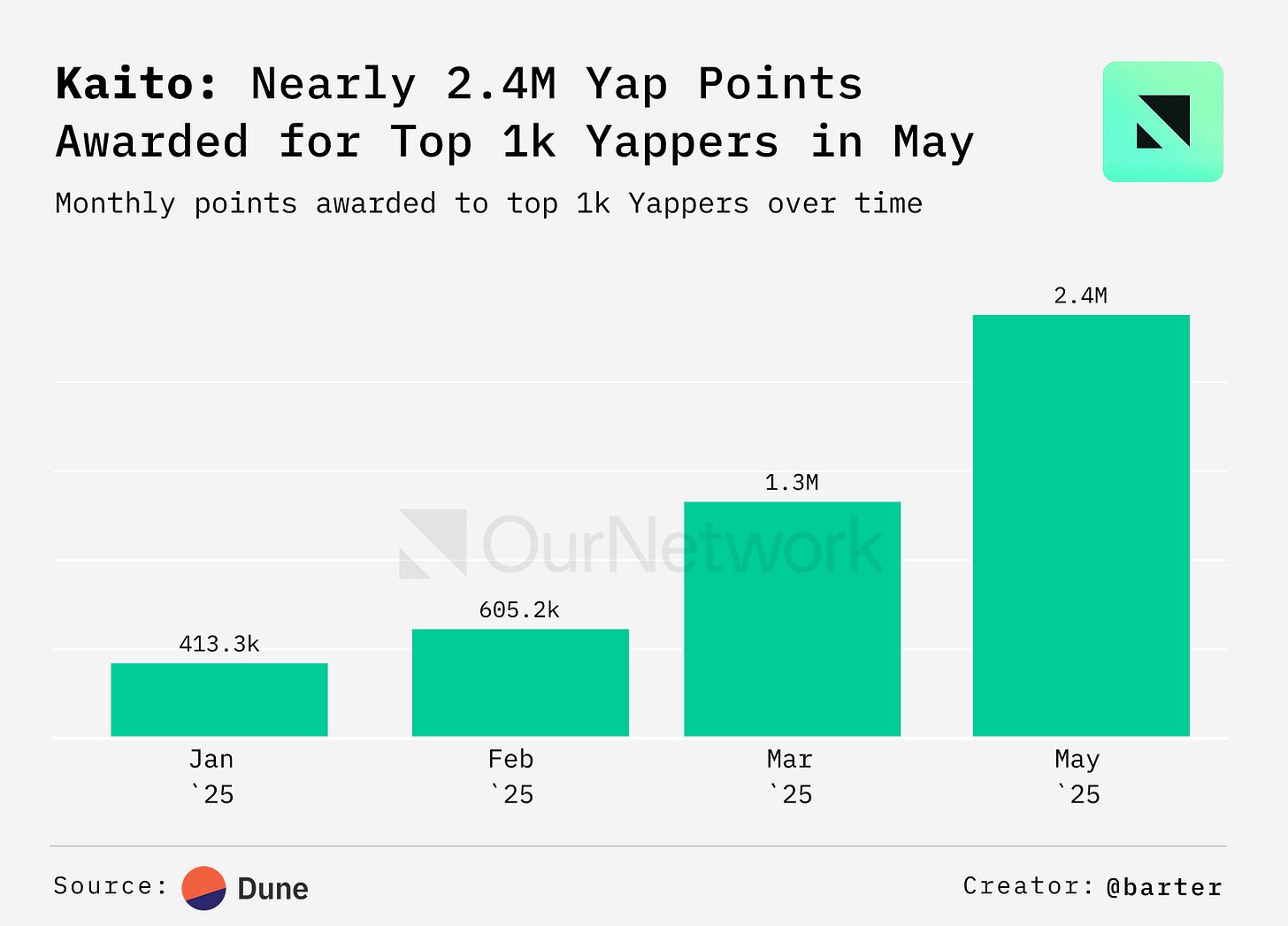

📈 Kaito Turns Noise Into Actionable Alpha, Fusing AI Search with Tokenized Onchain Reputation

Kaito is a web3-native search and intelligence platform that consolidates fragmented data from blockchains, forums, social media, and other sources into a unified layer. Its core products Kaito Pro and Kaito Connect offer vertical search and attention-based distribution through Yaps. With over 200,000 active users and over 700 teams onboard, Kaito is gaining traction as a go-to tool for research, analytics, and decision-making in the crypto space.

As of June 2025, Kaito has distributed over $90M via its InfoFi reward system. By tokenizing attention through Yaps, Kaito shifts value to creators of original crypto content, aligning incentives through a transparent, market-based model.

Kaito put the top 1,000 Yappers onchain via Ethereum Attestation System on Base, publishing usernames and Yap scores without linking wallets. Since then, their combined scores have grown by nearly a factor of five, as the 1,000 Yappers reached over 2.36M Yap points by May 2025. This highlights Kaito’s potential to become a core reputation layer in the future.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Bankless - Is Crypto’s Next Meta About to Make Markets Explode?

The Defiant - 20% Yield on Stablecoins Is Just the Beginning | Vikram Arun, Superform CEO

Coin Bureau - WARNING: The Consumer Debt Bubble Is About to Burst

Forward Guidance: The Fed’s New Mandate Is Financing The Deficit | Weekly Roundup

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.