Bitcoin Use Cases for Institutions: Maximizing Value with Layer 2 Solutions

With Bitcoin reaching an all-time high, its position as the world’s premier digital gold is undeniable, drawing institutions into a race to capitalize on its value.

Bitcoin Use Cases for Institutions: Maximizing Value with Layer 2 Solutions

Bitcoin’s price is at an all-time high today, solidifying its status as the world's new digital gold and intriguing the curiosity of Institutions who are racing to make use of it.

So far the only true use case institutions found for Bitcoin was the store of value through ETFs. However, as the Bitcoin economy grows institutions are demanding more than passive holding seeking opportunities to generate yield, optimize capital, and hedge against inflation.

As a result of this demand, a number of innovative models have emerged to serve institutions looking at adding Bitcoin to their balance sheets or maximizing existing holdings. This includes the likes of Microstrategy who have business out of securitizing Bitcoin by combining well-known financial tools and Bitcoin layer 2 solutions like Rootstock.

As the first and biggest sidechain, Rootstock makes Bitcoin highly programmable and capable of supporting a range of critical financial services including lending and borrowing while leveraging Bitcoin's billion-dollar security budget to protect the assets.

This article explores the top institutional use cases enabled by Rootstock, the first and longest-running Bitcoin sidechain.

Why Rootstock and why is it important for institutions?

Rootstock is the first, and most secure Bitcoin layer 2. Secured by over 60% of Bitcoin’s hashing power through merged mining PoW, Rootstock combines the security of Bitcoin with the programmability of Ethereum.

Moreover, Rootstock’s vast ecosystem allows institutions to build on top of Bitcoin without additional tooling, offering a straightforward way to expand Bitcoin’s utility while maintaining security.

Rootstock’s strength comes from 3 different pillars:

Unparalleled security

Rootstock was designed with a defense-in-depth principle that ties its security to Bitcoin, and now Rootstock inherits around 60% of Bitcoin’s hashing power through PoW merged mining.

And, in a sustainable cycle, a large portion of Bitcoin miners participate in Rootstock merge-mining, providing the persistence and liveness of the blockchain properties required to secure the Rootstock network.

Cheaper and faster transactions

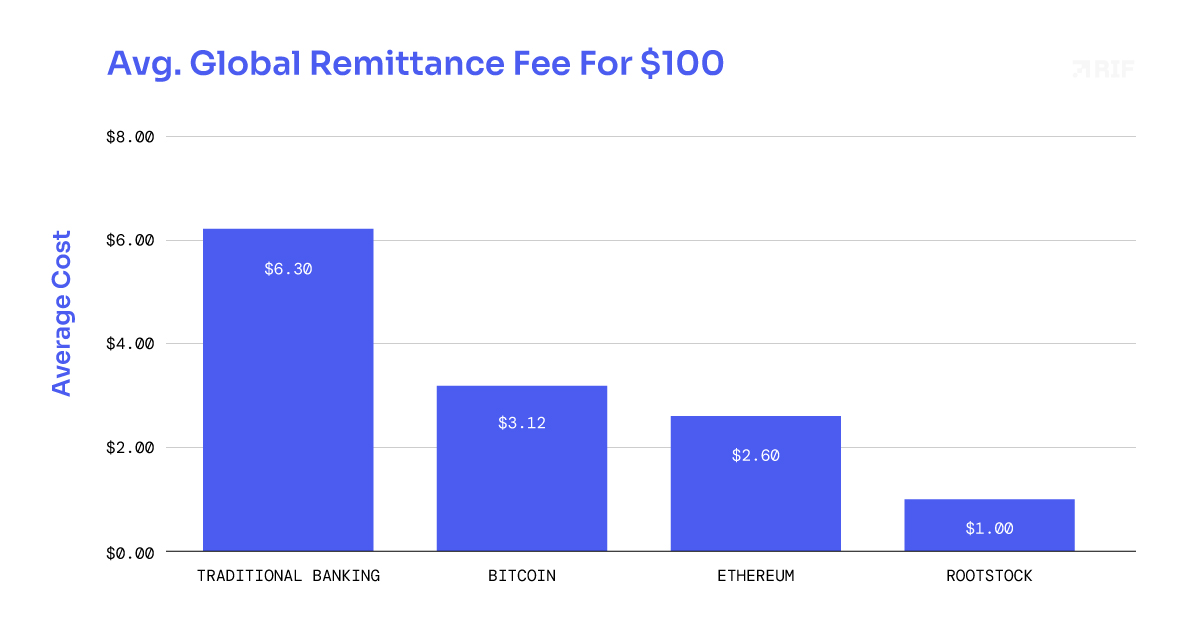

Rootstock provides lower transaction costs than Ethereum and Bitcoin due to its layer 2 nature which enables the processing of multiple transactions in parallel. This evidently batches the cost of multiple transactions.

In addition, the Rootstock network can reach up to 300 TPS (transactions per second), way faster than Ethereum’s 27 TPS and Bitcoin’s 7 TPS.

Comprehensive ecosystem

The Rootstock ecosystem has over 170 applications and services, including lending, trading, stablecoins, and more. The amount and diversity of tools in the ecosystem allows institutions to pick and choose from ready-to-use solutions (e.g. wallets, swap tools, SDKs) and reduce development time and time-to-market. An example of this would be the Boltz integration of Relay to enable faster RBTC acquisition on Rootstock.

This comprehensive ecosystem also ensures interoperability with other chains, allowing institutions to build and customize their solutions.

Bitcoin Institutional Use Cases

Institutions looking to utilize their Bitcoin without liquidating it can leverage any of the use cases on Rootstock, including:

Lending and Borrowing

Tropykus, Sovryn, and other lending and borrowing protocols within the Rootstock ecosystem allow institutions to leverage their Bitcoin holdings for capital efficiency. Institutions and miners can put their BTC to work such that borrowers can use BTC as collateral to access funds while lenders get yield on their deposits.

BTC holders can also invest their BTC in lending pools to earn interest. This use case is particularly relevant for institutional investors looking to grow their BTC assets without liquidating their possessions.

Yield Farming and Liquidity

Liquidity protocols on Rootstock such as Ichi, Gamma, and Steer allow institutions to earn revenue by providing liquidity to decentralized markets, generating predictable and stable returns while contributing to the overall Rootstock ecosystem.

Additionally, there is a growing number of protocols in the Rootstock ecosystem such as Sushiswap and Uniswap (via OKU) where institutions can earn yield by placing their Bitcoins as liquidity, allowing them to earn interest and speculate on price swings.

Another opportunity for Institutions to help shape the future of Bitcoin scaling is to become a member of RootstockCollective, a DAO focused on empowering Bitcoin builders. Staked RIF (stRIF) is used for governance within the DAO and also gives members the opportunity to earn rewards paid in Bitcoin and RIF for their participation.

Hedging Against Inflation and Remittances

The Rootstock ecosystem has a variety of stablecoins such as USDRIF, DoC, and rUSDT, that can offer a reliable hedge against Bitcoin’s volatility while inheriting its security. These stablecoins offer a medium for remittance-solution providers to conduct cross-border transactions and manage operational cash flows across the world.

According to Juniper Research, blockchain holds immense potential to generate substantial savings for financial institutions engaged in cross-border transactions, with an estimated $10 billion in savings projected by 2030, driven by the speed, reliability, and transparency of payment settlements.

Gaining first-mover advantage

Institutions investing in Bitcoin unlock a unique opportunity to fuel innovation via grants and DAOs, while generating tangible value.

For example, institutions, miners, and Bitcoin holders staking RIF in RootstockCollective, a DAO supporting Bitcoin developers through grants and rewards, can fund innovation on Bitcoin, earn a governance role to define the future of innovations, and evidently receive acknowledgment for empowering developers and promoting decentralization.

Moreover, the rapid growth of Rootstock including new accounts increasing by 112% QoQ, TVL increasing by 27%, and other growth factors, underline the potential of this network, positioning Rootstock as a key driver of Bitcoin-based innovation.

There are more use cases to be unlocked on Rootstock such as bridging, staking, leverage, and trading.

Keep ahead of this fast-moving environment and start building on Rootstock.

Legal Disclaimer

This article is for informative purposes and shall not be considered, in any way, a financial advice. Investing in cryptoassets carries significant risk. Prices are highly volatile, and you may lose all the money you invest. Cryptoassets are not regulated in many jurisdictions and may not be protected by financial compensation schemes. Past performance is not indicative of future results. Ensure you fully understand the risks and consider seeking advice from a qualified financial advisor before investing.