Bitcoin Rockets to $108K as Likelihood of U.S. Strategic Reserve Increases 🚀

Bitcoin set a new ATH of $108k on Tuesday. Plus the top crypto news and funding rounds of the week.

Issue Summary: Welcome back to Coinstack, the weekly crypto newsletter for institutional investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 280k weekly subscribers. This week, BTC hit a new ATH, Solana developer growth exploded, Grayscale launched Lido and Optimism Trusts and big new venture rounds for Avalanche ($250M) and MegaLabs ($10M). Here’s to the new global monetary system.

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Amphibian Capital, managing $110M+ AUM, is a fund of the world's leading hedge funds. *+14.92% net YTD approx with their USD fund, *+11.00% net BTC on BTC YTD (90.93% in USD terms), and *+14.39% net ETH on ETH YTD (33.01% in USD terms) through 10/31. They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com. *Approximate estimates through 10/31/24

CryptoCasino.com is a leading GameFi project featuring an online and Telegram casino. Launched by a team of iGaming industry experts that turned RakeTheRake.com into the world's largest poker affiliate, the platform is designed to capture the next generation of online bettors. Learn more at token.cryptocasino.com

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Bitcoin price registered a fresh all-time high above $108,000: Bitcoin recorded its new all-time high of $108,357 on Tuesday before retracing to $103k. The BTC price has increased by over $45k since October, with growing speculation that the new U.S Administration will form a U.S. Strategic Bitcoin Reserve.

📈 Solana emerges as fastest-growing ecosystem for developers globally: Solana has claimed the top spot as the preferred blockchain ecosystem for new developers, eclipsing Ethereum’s dominance for the first time in nearly a decade.

🚀 Grayscale launches Lido DAO and Optimism Trusts to expand Ethereum investment offerings: Grayscale Investments has announced the launch of two new crypto investment vehicles, the Grayscale Lido DAO Trust and the Grayscale Optimism Trust, providing institutional and accredited investors with exposure to tokens central to the Ethereum ecosystem.

📈 Ethena Labs launches stablecoin backed by BlackRock’s tokenized fund shares: Ethena Labs announced the launch of its USDtb stablecoin, which will leverage BlackRock’s tokenized fund, USD Institutional Digital Liquidity Fund (BUIDL), for 90% of its backing.

⚖️ FTX to begin initial distributions by March with Kraken and BitGo as partners: FTX and its affiliated debtors announced on Dec. 16 that their reorganization plan will take effect on Jan. 3, 2025, and distributions will commence within 60 days.

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. The yearly growth of Hyperliquid and how they've come to dominate the perpetuals market is truly incredible. In 12 months, Hyperliquid increased volume by 620% and now represents over 61% of the entire market. Overall, the protocol has handled more than $71B of volume in December with two weeks left in the month.

2. The next FOMC meeting is upon us and CME Group now has a 96% likelihood that a rate cut of 0.25% will be announced on December 18th.

During the last rate cut in November (0.25%), BTC increased by 25.5% from the week before the FOMC meeting to the week after ( 🟠 ).

Obviously, the election played a pivotal role here, but a similar pattern occurred in September when the Fed first began to cut rates (0.50%): BTC increased by 12% from the week before the FOMC meeting to the week after ( 🔴 ).

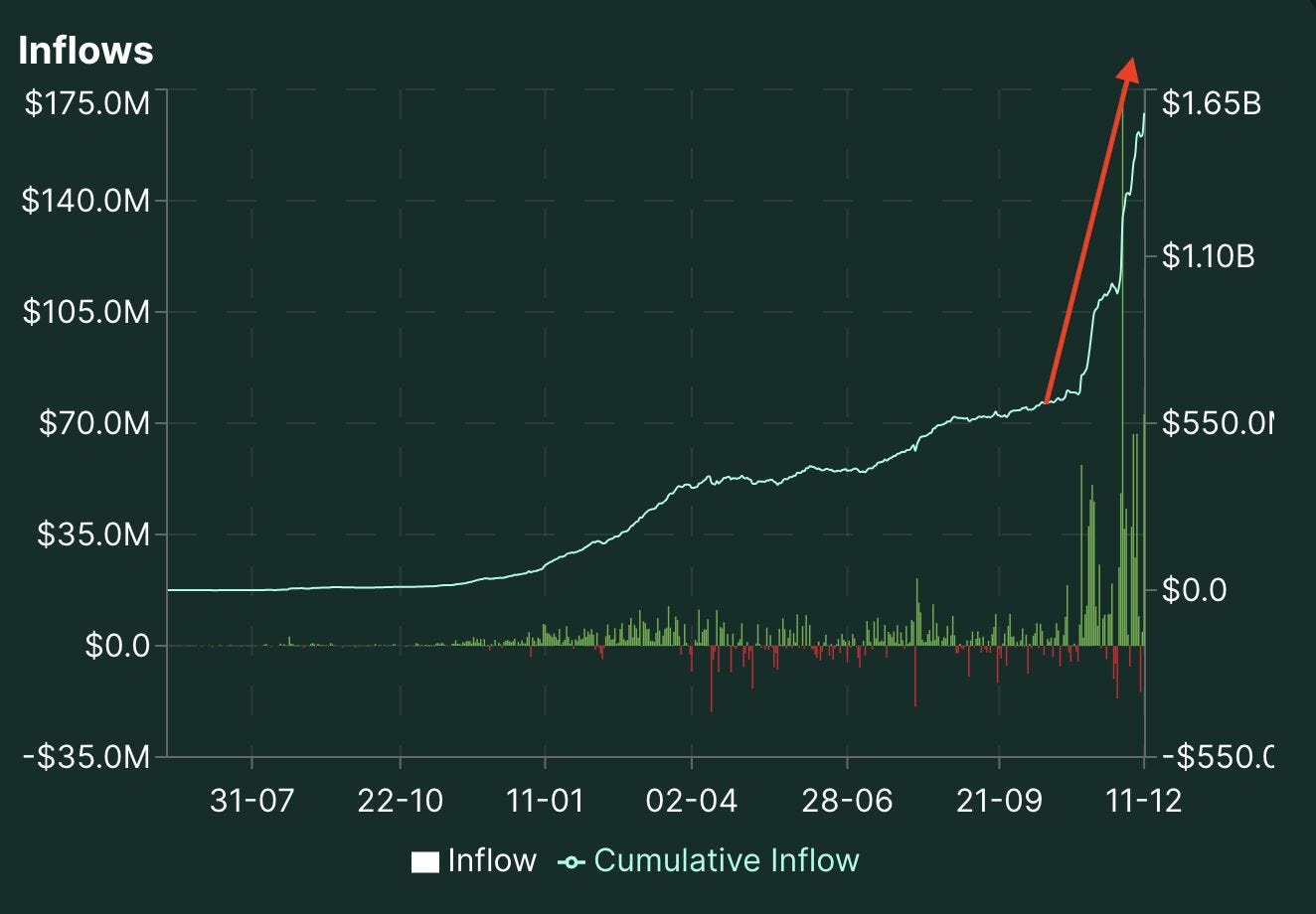

3. The Hyperliquid effect on the Arbitrum ecosystem has been quite pronounced.

Since November, total circulating supply of stablecoins on Arbitrum has grown by 38% ($1.73B), the most by any competing L2 including Base and Optimism - both of which have remained relatively flat.

Meanwhile, stablecoin inflows on Hyperliquid during this same time frame increased by more than $920M. Overall, this represents 53% of all Arbitrum stablecoin inflows since November.

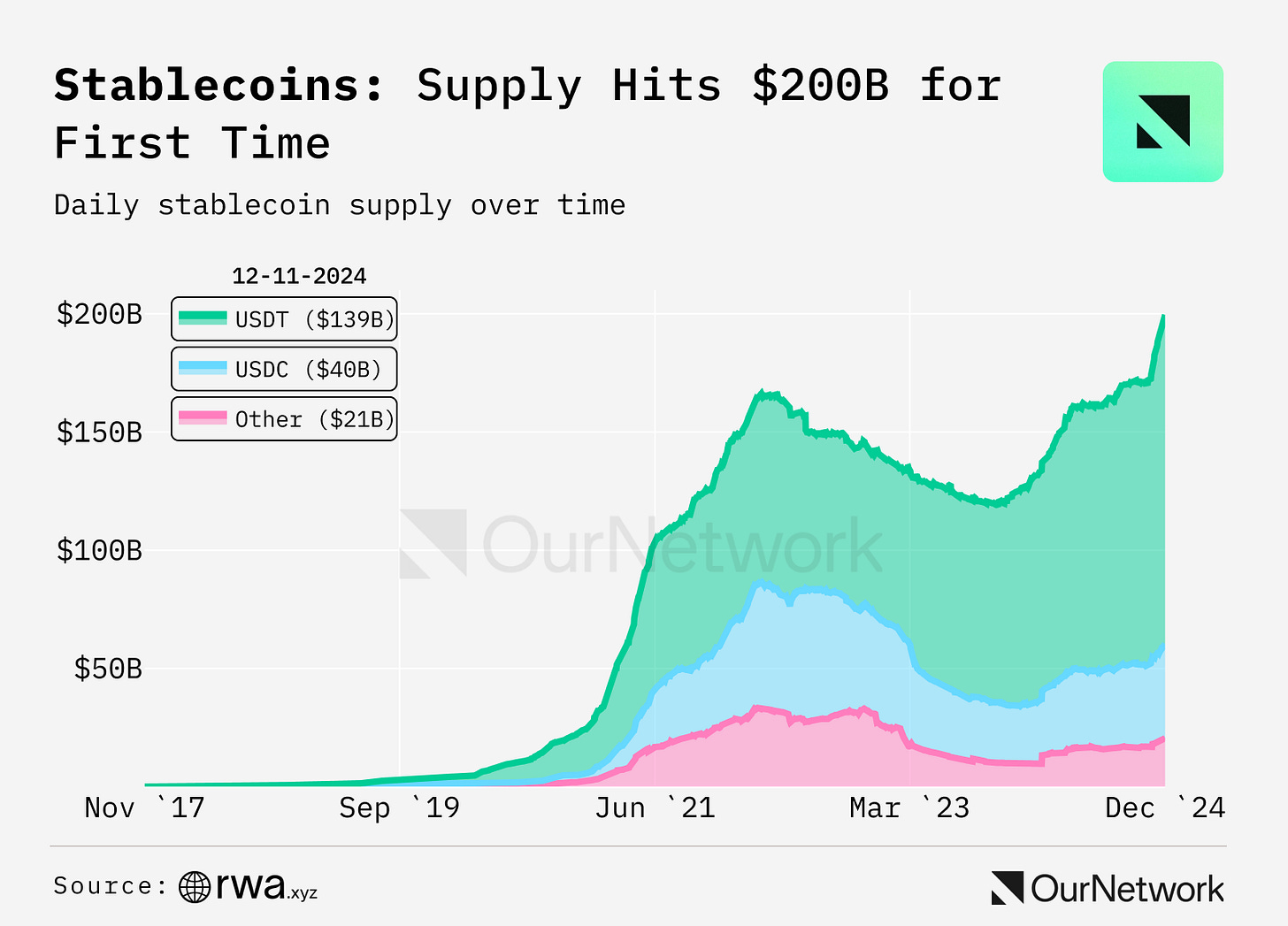

4. Stablecoin supply has passed $200B. That means we have more dollar-pegged assets than ever being used for payments in personal and institutional contexts, as well as stablecoins' increasing usage in DeFi.

5. sUSDe Total Value Locked Surpasses $4B

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Major BTC Moves Are Here: Key Dates, Prices Targets, and Alt Season Setup

About the Author: 1995 Digital Asset Research, serves actionable insights, market research, and Web 3 Tech Tutorials for informed investing. This is an excerpt from the full article, which you can find here.

Introduction

This week we are changing our stance a bit as to how this year will end and when we can expect our first big correction in BTC.

We will show you substantial evidence as to how these cycles continue to rhyme and what upcoming catalysts and anniversaries could mean for a typical -30% correction of this final phase.

We will then cover what this means for the alt coin market and how to prepare over the next 2-4 weeks.

Gann Rules

Above is a short excerpt from Gann on some of his seasonal rules around the dates I have been talking about. December 22nd is a natural date and likely an important inflection point going into what will be an emotional early January window. What I’m seeing in time and price lines up perfectly with these Gann rules.

You can also see these rules in action from the previous two cycles nearly to the day. In both 2017 and 2021 a big rally started on December 21st and culminated on January 4th exactly. The 2013 cycle is the outlier. Price in 2013 basically just went straight vertical to start the year with no pullbacks at all until April. I doubt we see that. I expect more volatility in both directions with the Gann dates being key to watch.

BTC Weekly Time Counts

2017

2021

Today

The above charts are just to illustrate that after the major August low of previous cycles the first multi week correction in BTC has historically taken place in the early January window.

With both the 2017 and 2021 cycles having a -30% or more correction around 160 weeks from the previous top and 20 weeks give or take from the August low we can draw some similarities.

I understand this is not a lot of historical data by any means but if we look at the current cycle and what time is telling us, this time may not look so different.

Familiar Patterns and Possible Scenarios

The above chart is a little bit busy but if you look closely you can see that we have a near identical setup to a year ago with equal moves in time in play.

In 2023 we had the major April high that set the summer range which culminated in a low on September 11th.

You can see that the first big inflection point in the run up came on an emotional ETF announcement which was 270 and 120 degrees from those major dates.

Also notice the RSI in the box on the bottom and how it was setting up a bearish divergence while the market ripped higher on the announcement. Lower highs on the RSI while the price was making higher highs is bearish. When see this divergence setting up into an important time window it tells us time and price are coming together for an inflection point.

If you then look at the setup going into this January it’s nearly identical. The final factor here is that January 6th with also coincide with a 360 degree cycle from the ETF launch.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Bankless - One Billion AI Agents Are Coming (ai16z Creator Interview)

The Defiant - Is Robinhood Transitioning to a Full Crypto Exchange?

Coin Bureau - Why Europe Is Falling Apart—and What It Means for YOU

Blockworks Macro: Convertible Bond Expert Breaks Down Why MicroStrategy Is Soaring | Richard Byworth

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.