Avalanche Gets First US ETF

The first U.S. spot Avalanche (AVAX) exchange traded fund (ETF)—VAVX—from global asset manager and fund issuer VanEck. Plus the top news, stats, and reports.

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 340k weekly subscribers. This week, VanEck launched the first U.S. ETF tied to Avalanche with the debut of its AVAX fund, while BlackRock filed with the SEC to introduce the iShares Bitcoin Premium Income ETF as institutional product expansion continues. Spot Bitcoin ETFs also recorded $1.62B in outflows across a four-day negative streak, and Kraken rolled out its new “DeFi Earn” product across the U.S., EU, and Canada by integrating yield-bearing Veda vaults. Meanwhile, influential NFT marketplace Nifty Gateway announced plans to shut down in February, signaling ongoing consolidation in the digital collectibles space. On the fundraising front, BitGo raised $212.8M in an IPO round to expand its institutional custody infrastructure, while Superstate secured $82.5M in Series B funding led by Bain Capital Crypto to scale its tokenized investment products.

Become a Coinstack Sponsor

To reach our weekly audience of 340,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

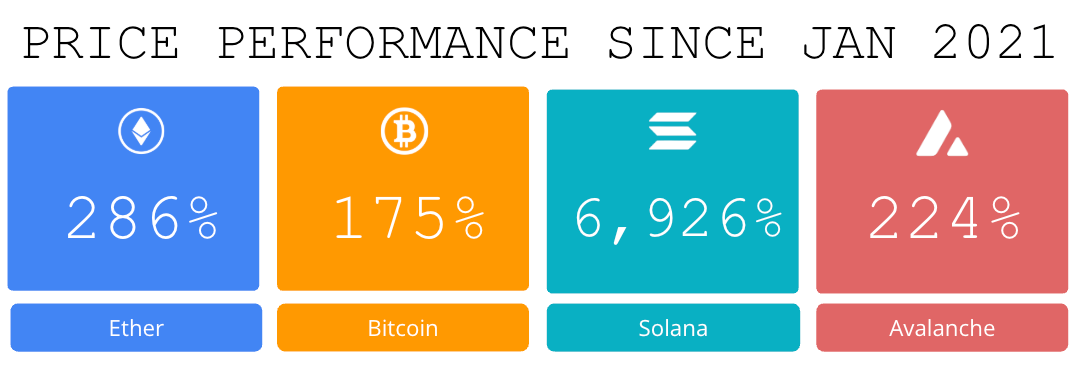

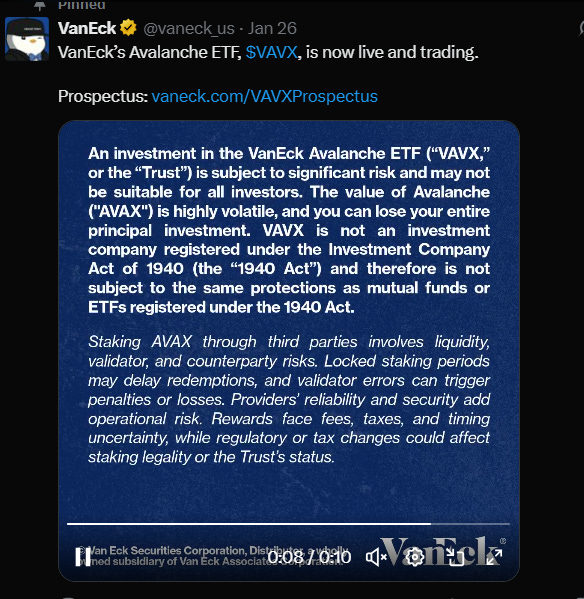

🚀 Avalanche Gets First US ETF As VanEck Debuts AVAX Fund: The first U.S. spot Avalanche (AVAX) exchange traded fund (ETF)—VAVX—from global asset manager and fund issuer VanEck began trading on the Nasdaq on Monday.

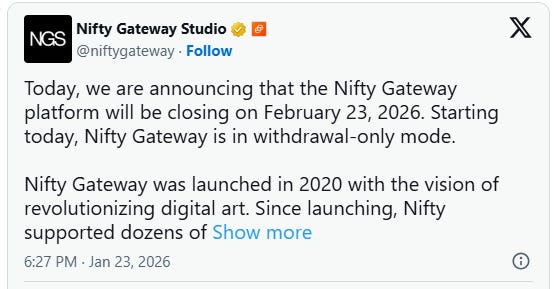

👋 Influential NFT Platform Nifty Gateway Set to Shut Down in February: Nifty Gateway, one of the most influential platforms of the early NFT boom, announced on Friday that it will shut down on February 23. The move blindsided many artists and collectors and reignited long-standing concerns around custodial platforms, centralization, and the long-term preservation of digital art.

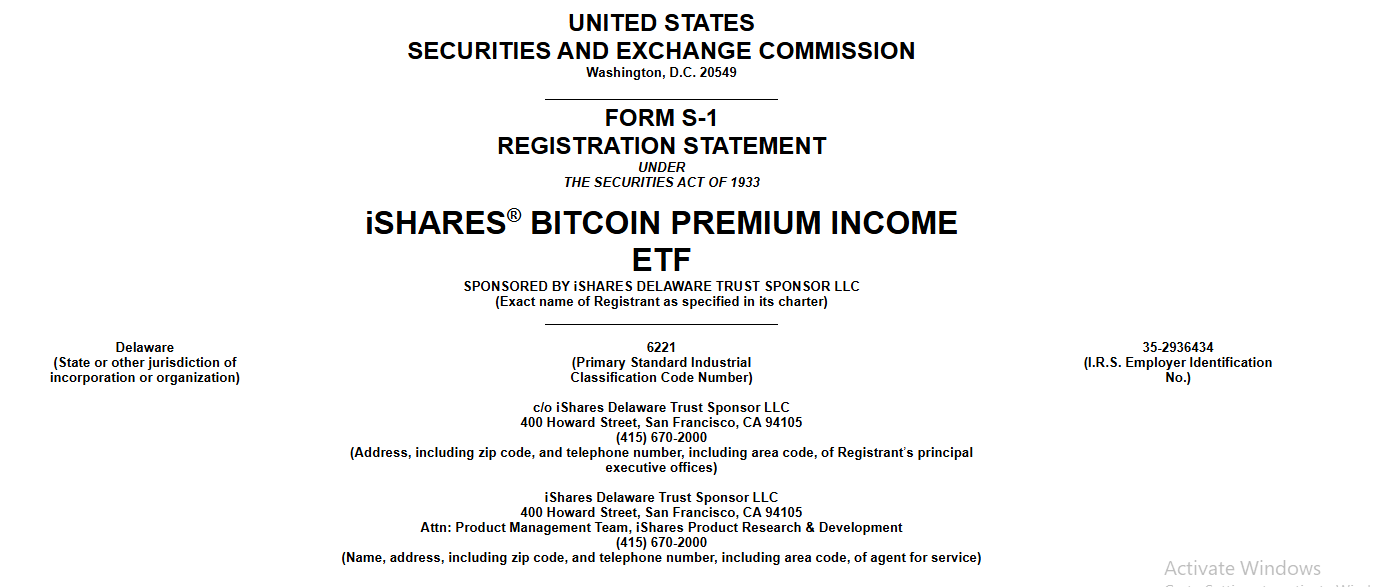

👨⚖️ BlackRock Files With SEC to Launch iShares Bitcoin Premium Income ETF: BlackRock could soon debut its iShares Bitcoin Premium Income ETF, according to a registration statement filed with the SEC on Friday.

📉 Spot Bitcoin ETFs Shed $1.62B in Four-Day Negative Streak: Investors pulled capital from U.S. spot Bitcoin exchange-traded funds on Thursday, marking the fourth successive trading day of outflows amid heightened macroeconomic and geopolitical volatility.

🎉 Kraken rolls out ‘DeFi Earn’ in US, EU and Canada tapping yield-bearing Veda vaults: Crypto exchange Kraken is rolling out a new DeFi Earn product in Canada, the European Economic Area, and most U.S. states. The product will provide onchain earning opportunities, including APYs of up to 8%, with the “simplicity and security” expected from a centralized exchange, according to an announcement shared exclusively with The Block.

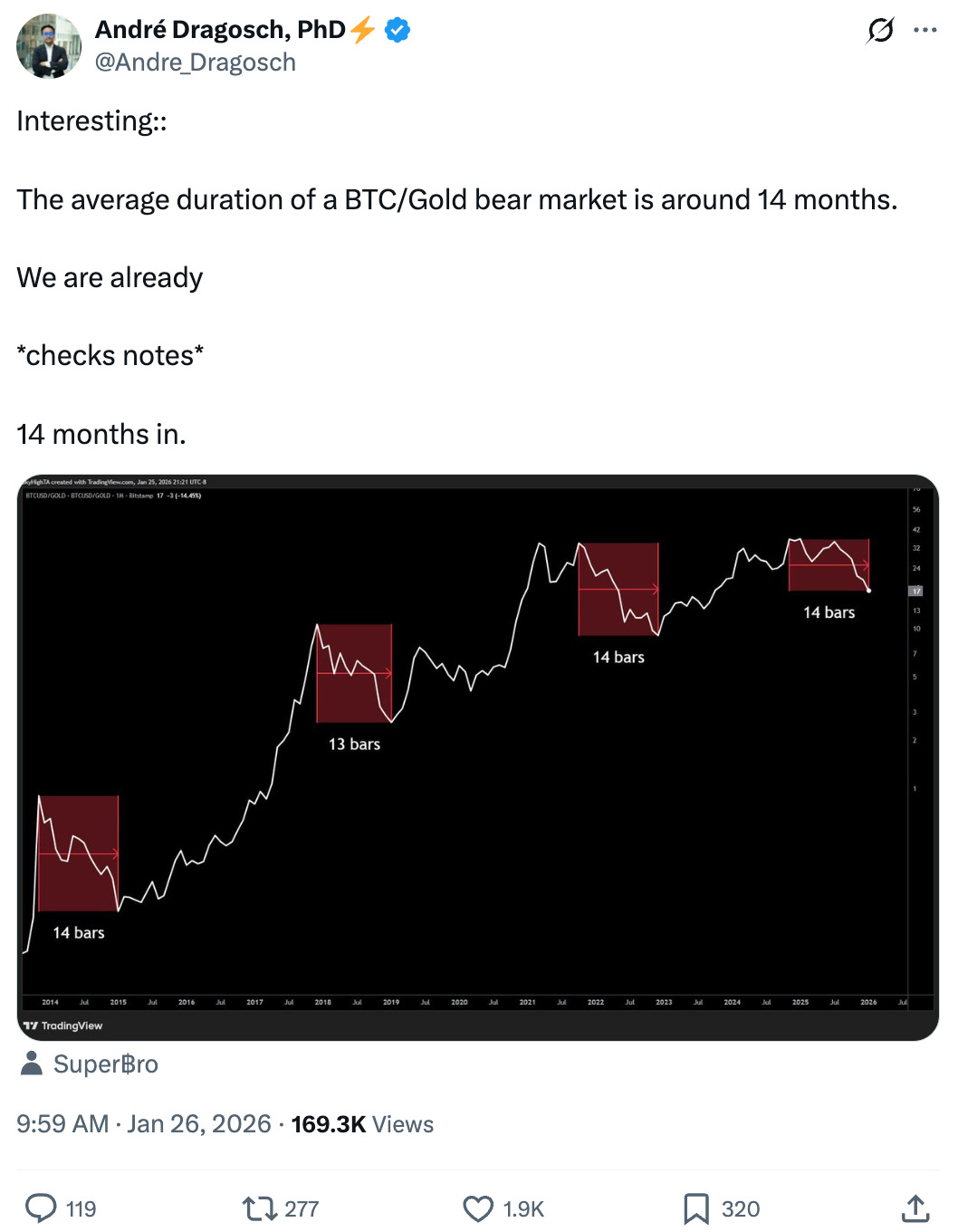

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

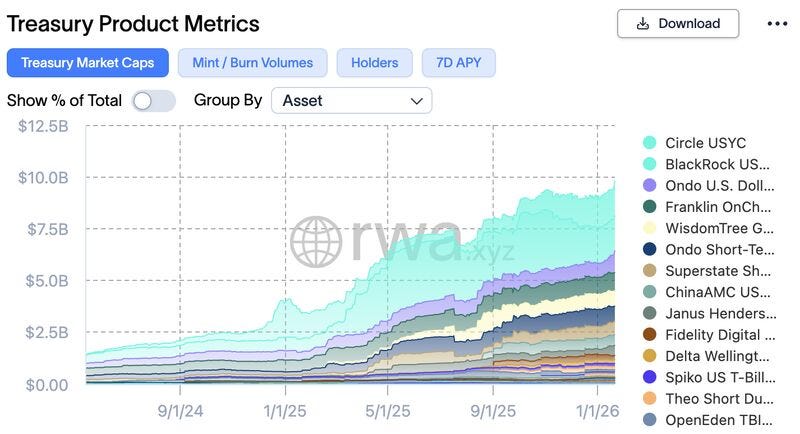

1. In less than 2 weeks, Ondo Finance’s USDY has grown 91% to a record $1.25B in onchain assets, catapulting it into the top 3 largest tokenized Treasury products.

This comes as the tokenized U.S. Treasuries sector surpassed $10B for the first time — a major milestone for onchain capital markets.

Capital continues to flow into tokenized Treasuries despite broader macro risk, signaling structural demand for programmable money and onchain yield.

2. Quietly, Circle’s USYC has surpassed BlackRock’s BUIDL to become the largest onchain treasury product.

Over the last 6 months, USYC has grown 520% and now holds $1.7B+ in onchain assets, a signal that tokenized treasuries are accelerating faster than most realize.

The sector is now closing in on a record $10B in onchain treasury assets. Programmable money is becoming a balance-sheet primitive.

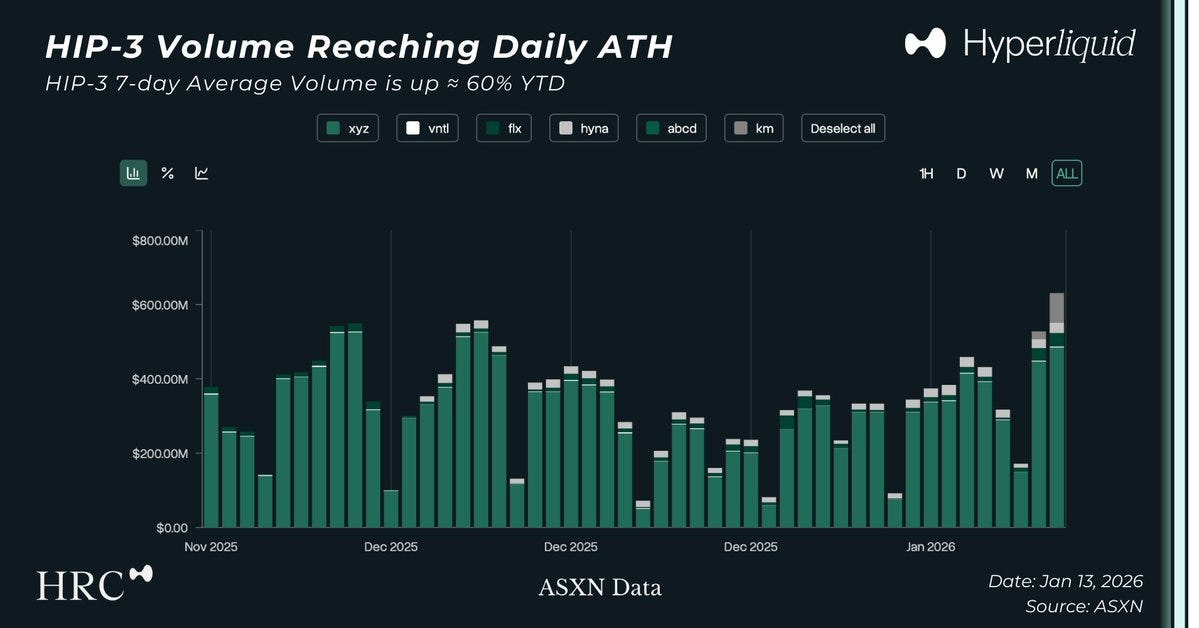

3. HIP-3 volume reached a daily ATH of $630M today || @HyperliquidR

HIP-3 7-day average volume is up around 60% YTD.

Over the last 24 hours, HIP-3 contributed 7.4% of Hyperliquid’s total volume.

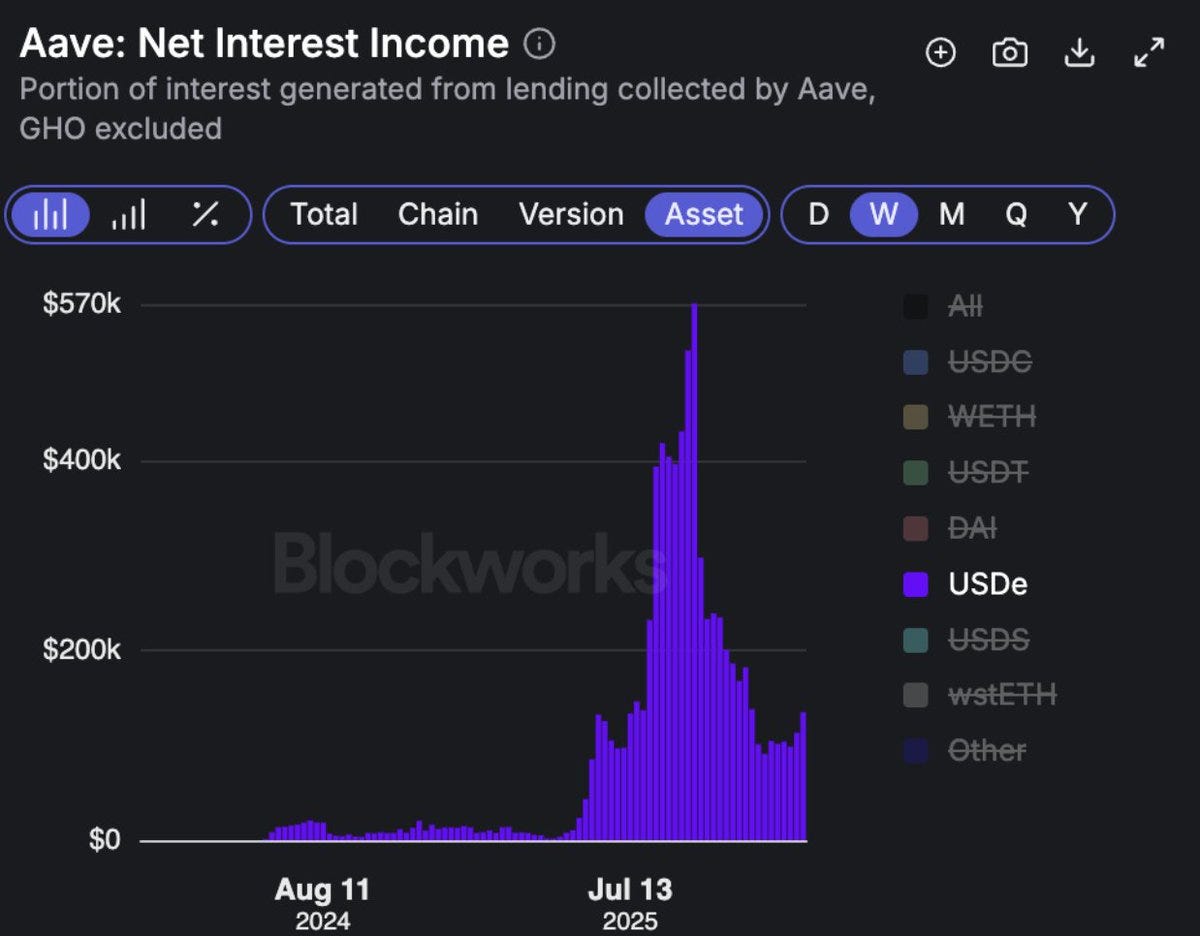

4. How much money Aave made with Pendle / Ethena integration last year?

- 7m$ on USDe interest fees

- around 5-10m$ interest fees from PT backed USDC and USDT loans

- increased rates on stables (hard to quantify)

So roughly 10-15% of Aave interest revenues are Ethena related

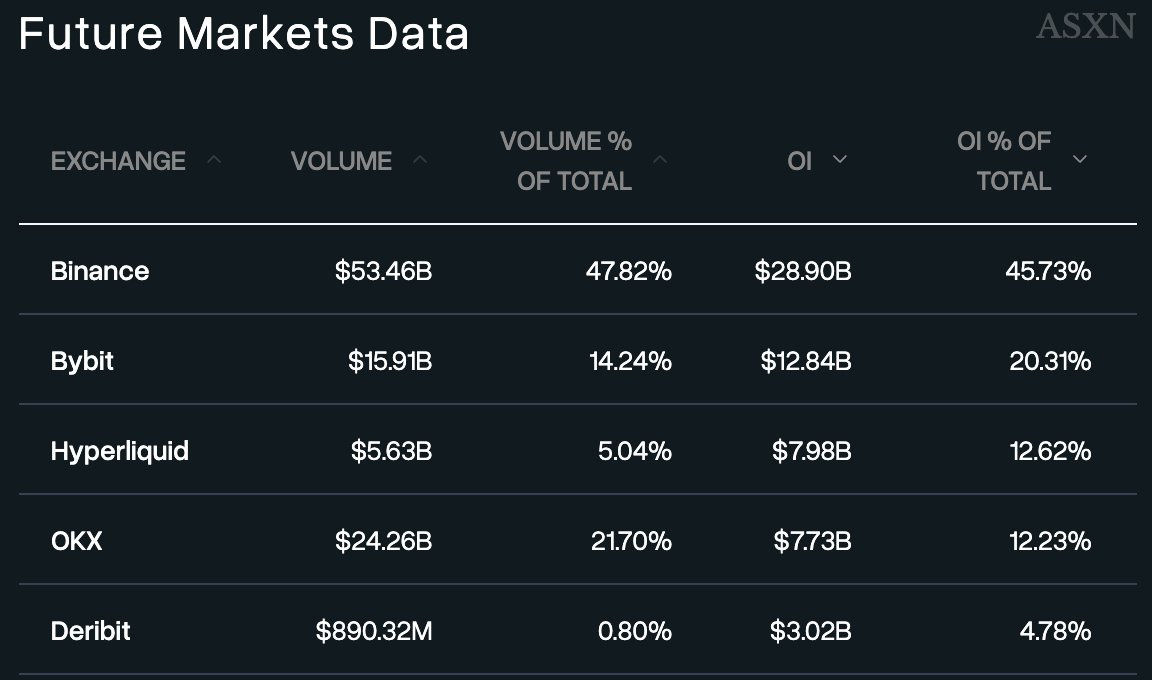

5. Hyperliquid has just overtaken OKX in terms of futures OI and is now the third largest perps exchange in crypto

house of all finance

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

ON-386: SKALE 🌊

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Note from the Editor-in-Chief

Today I’m sharing a bittersweet update: OurNetwork is going on an indefinite hiatus. Today’s issue will be our last for the foreseeable future.

I started OurNetwork in the depths of the 2018 bear market to publish truly crypto-native research that was useful, legible, and grounded in onchain data — at a time when narratives on Crypto Twitter routinely overwhelmed fundamentals and what was actually happening onchain.

What I’m most proud of is the community. Over the seven years since our genesis issue, OurNetwork became home to a deep bench of onchain analysts whose work materially raised the level of discourse — not just within the publication, but across the broader crypto ecosystem. We are all better analysts, builders, users and investors because of their contributions.

I’ll break one of my long-standing editorial rules — that cumulative statistics are often incomplete at best and misleading at worst — to note that we have published nearly 387 consecutive weekly issues, reaching more than 33,000 readers each week. The consistency mattered, and the work compounded.

It has been a privilege to steward this project, but it’s time for OurNetwork to either evolve under new stewardship or pause indefinitely. I believe there’s still meaningful work to be done in advancing our mission of crypto education and financial empowerment, and I’m actively exploring what that could look like. If there’s an update, I’ll share it. If not, I’m grateful for what we built together.

Spencer Noon 🕛

Founder & Project Lead

Unless someone’s been living under the proverbial rock, it would be hard not to know that AI has become a key driver of the economy. Specifically agents, a term for AI-enabled entities operating with minimal supervision, are becoming a focal point for organizations. A report from McKinsey found that 62% of 1,933 polled organizations were either experimenting with, or scaling, agentic systems.

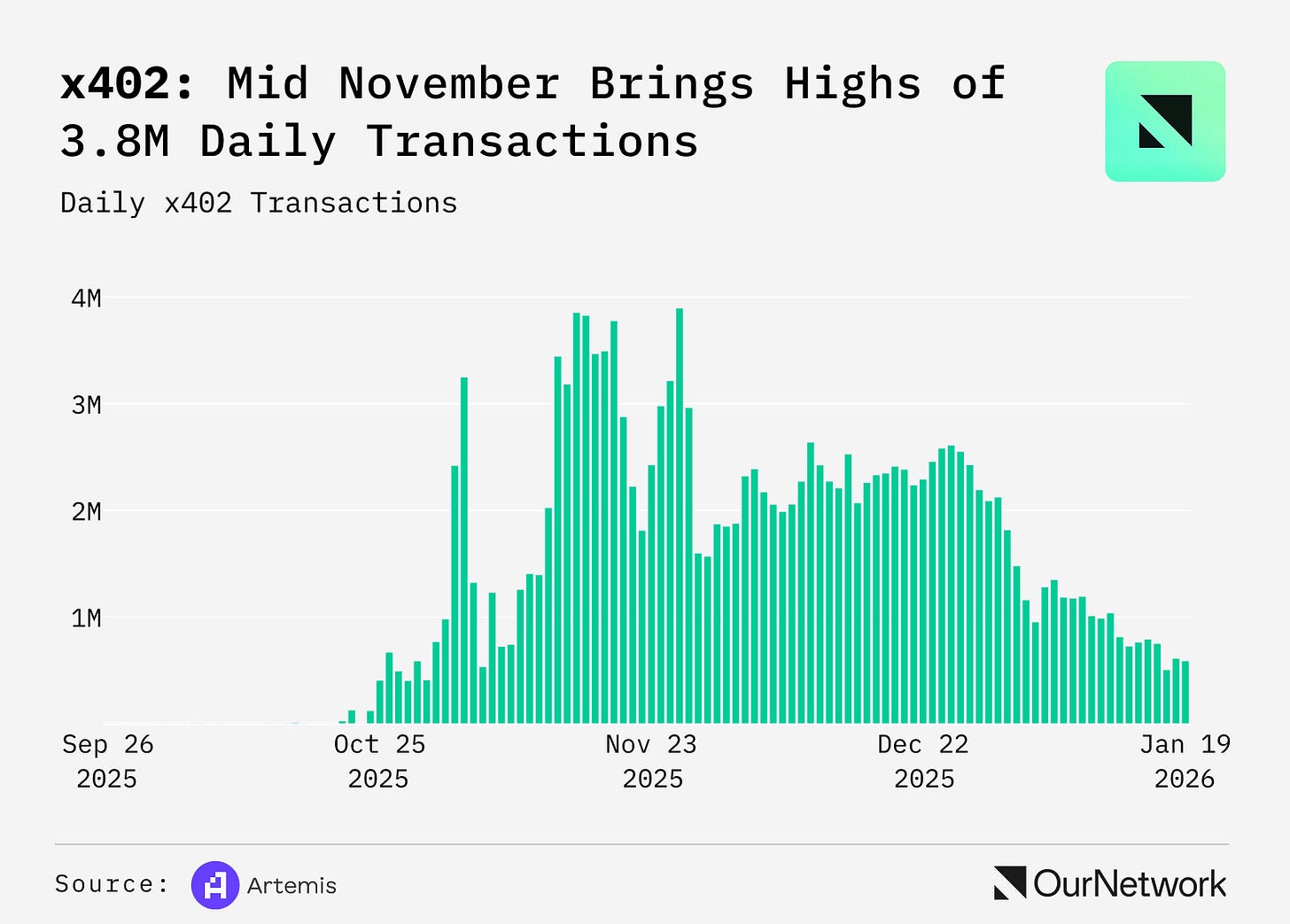

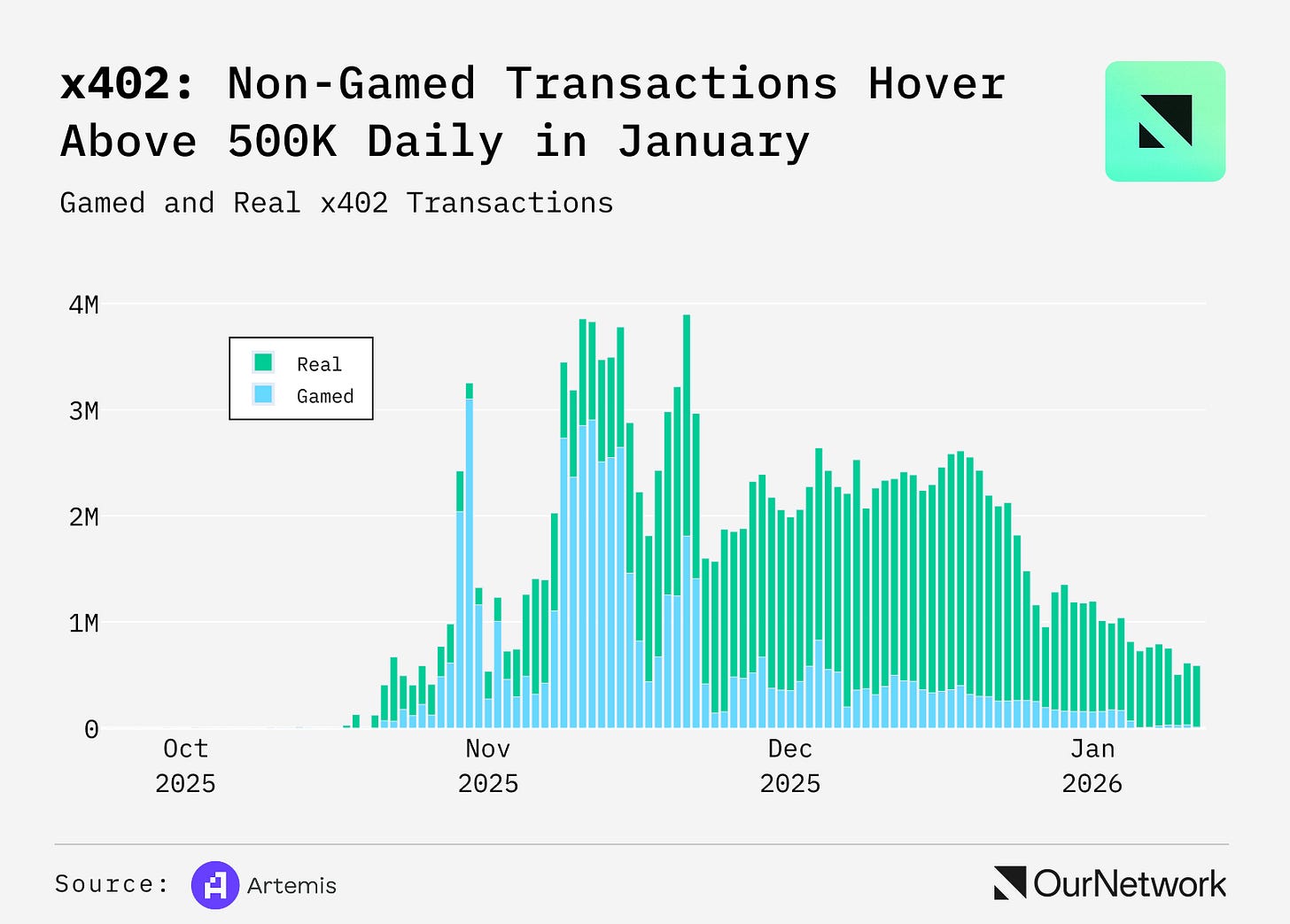

Crypto hasn’t been untouched by AI. Projects like Render and Akash are focused on providing a decentralized compute marketplace. The Graph and others are working on verifiable AI, ways of cryptographically proving systems’ inputs, outputs, and models. There’s also x402, a payments protocol launched by Coinbase which is a significant contender to become a key financial rail for AI agents. x402 came alive in October after its May 2025 launch.

While the number of x402 transactions has trended downward somewhat, the number of non-gamed transactions has reduced to essentially zero.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Bankless - The “Quantum Threat” Behind Bitcoin’s Sudden Sell-Off

The Defiant - How Stablecoins Are Rewiring Global Payments | Borderless CPO Alex Garn

Coin Bureau - Trump Just KILLED Credit Cards!! Here’s What Replaces Them...

Forward Guidance: Markets Are Entering A Wartime Economy | Cem Karsan

Unchained: Banks vs. Crypto: The $1T Yield Fight - The Chopping Block

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.