Are Stablecoins Securities?

Paxos has stopped minting BUSD after a request from the SEC, Kraken settles for $30M fine for staking product, plus Big Venture Rounds for Taurus ($65M), Coincover ($30M), and Superplastic ($20M)

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders, where we review the top news, stats, and reports in the digital asset ecosystem. This week we cover stories about the SEC’s claim that the $16B market cap Paxos BUSD stablecoin is a security, Three Arrow Founders’ Open Exchange, and Kraken’s $30M settlement with the SEC, as well as new big venture rounds from Taurus ($65M) and Coincover ($30M) and Superplastic ($20M). The money is flowing into the sector as we all continue to build during the bear.

Thanks to Our 2023 Coinstack Sponsors…

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your web3/crypto/fintech company, please review our deck and schedule a free consultation. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Connect Financial empowers people and businesses to do more with their digital assets. Their flagship credit cards allow users to enjoy their crypto's spending power, without selling their digital assets and earn rewards on everyday purchases. Learn more at www.connect.financial.

Revix is a multi-asset WealthTech business targeting the African and Middle Eastern market. It allows for effortless purchase of crypto, stocks, thematic ETFs, real estate, currencies, commodities, and more. With Revix, everyday people can easily grow and manage their own wealth, using a personal wealth management platform that is effortless, automated, and engaging. Learn more at www.revix.com.

Viridius is a Decentralized Autonomous Organization (DAO) building a modern, community-driven carbon credit registry that solves the massive problem of transparent carbon credit verification. Learn more at www.viridius.io.

We have one open sponsorship spot available - please see our sponsor deck and schedule a call to discuss.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

Taurus raises $65M Series B for digital asset infrastructure from Credit Suisse and Deutsche Bank

Coincover, a digital assets protection firm, has raised $30M in a round led by Foundation Capital

Alongside, a crypto index platform, raises $15M in a round led by A16Z

Mino Games raises $15M from Standard Crypto, Boost VC, and Collab+Currency

Vault, a music platform built with web3 technology, raised a $4M Series A led by Placeholder VC

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Paxos to Stop Minting BUSD Stablecoins for Binance- Blockchain infrastructure platform Paxos Trust Company will halt the issuance of new Binance USD (BUSD) stablecoins amid the ongoing probe by New York regulators. All existing BUSD tokens will remain fully backed and redeemable through Paxos Trust Company until at least February 2024.

⚔️ Paxos Says It’s ‘Prepared to Vigorously’ Fight SEC Lawsuit- Paxos confirmed Monday it received a Wells Notice from the Securities and Exchange Commission, stating it’s prepared to take on the agency and any enforcement actions related to the stablecoin Binance USD (BUSD). Considering stablecoins fail the Howey Test for investment contracts as they are not an “investment of money in a common enterprise with the expectation of profit to be derived from the efforts of others” we really aren’t sure how in the world the SEC can claim a stablecoin is a security. This will be a very interesting litigation process to follow.

⚖️ CZ Issues Response to SEC vs. Paxos Lawsuit- Changpeng Zhao (CZ) confirmed the recent report that Paxos — a regulated blockchain infrastructure platform based in the US — has been directed to cease minting BUSD per instructions from the New York Department of Financial Services (NYDFS).

😲 Three Arrows Founders Roll Out Bankruptcy Claims Exchange— But US Residents Are Barred- While Su Zhu, a co-founder of bankrupt crypto hedge fund Three Arrows Capital (3AC), announced Thursday that a waitlist is live for Open Exchange (OPNX), the new exchange may not be as open as its name implies.

⚖️ SEC Hits Kraken With $30 Million Fine, Orders Crypto Exchange to Halt Staking in US- The SEC today hit San Francisco-based cryptocurrency exchange Kraken with a $30 million fine for violating securities laws with its staking offering.

💬 Thread of the Week #1 - Are Stablecoins Securities?

1/5 - This is what people don't realize… Howey test = precedent for investment contracts. "Securities" is a much broader category defined by the 1933 Securities Act. Honestly, if the SEC wants to, with how vague the act is, its fairly easy to put anything under it.

“no there doesn't need to be an expectation of profit, that's only for investment contracts” -_gabrielShapir0

2/5 - [The term security means any] “Note, debenture, evidence of indebtedness, certificate of interest, collateral trust certificate, certificate of deposit, rights, or in general any interest or instrument know as a security, or certificate of interest or participation in, or right to.”

3/5 - If all that mattered was the Howey Test, you wouldn't have an entire field of law dedicated to this one act. Unless otherwise exempt (as a bank or regulated trust), redeemable deposits in trust, can easily fall under this.

4/5 - The fact that these assets hold underlying treasuries, makes them a lot like a money market fund, exposing holders to a security, even if they don't earn from it. Making an argument (not one I agree with, but a reasonable enough one) that they can be a security.

5/5 - Worth fighting tooth and nail, but everyone who is shrugging this off as "lol the SEC got it wrong, this doesn't pass the Howey test" needs to re-eval. The SEC, believe it or not, has knowledgeable securities counsel. "But I don't earn from it - how can it be a security" Doesn't have to be a good or lucrative security to be a security. If someone is holding or otherwise securing value for you, and you are trusting them to do it, and not otherwise exempted, its a security.

📝 Thread of the Week #2 – BUSD Funds Are SAFU

By: @cz_binance

1/ #BUSD. A thread. In summary, BUSD is issued and redeemed by Paxos. And funds are #SAFU!

2/ We were informed by Paxos they have been directed to cease minting new BUSD by the New York Department of Financial Services (NYDFS).

Paxos is regulated by NYDFS.

BUSD is a stablecoin wholly owned and managed by Paxos.

3/ As a result, BUSD market cap will only decrease over time.

4/ Paxos will continue to service the product, and manage redemptions.

Paxos also assured us the funds are #SAFU, and fully covered by reserves in their banks, with their reserves audited many times by various audit firms already.

5/ On the alleged SEC vs Paxos lawsuit, I have no information about it, other than public news articles. The lawsuit is between the US SEC & Paxos.

I am not an expert on US laws. But personally, I agree with Mile’s logic here (not that it means much):

6/ "IF" BUSD is ruled as a security by the courts, it will have profound impacts on how the crypto industry will develop (or not develop) in the jurisdictions where it is ruled as such.

7/ Binance will continue to support BUSD for the foreseeable future. We do foresee users migrating to other stablecoins over time. And we will make product adjustments accordingly. eg, move away from using BUSD as the main pair for trading, etc.

8/8 Given the ongoing regulatory uncertainty in certain markets, we will be reviewing other projects in those jurisdictions to ensure our users are insulated from any undue harm.

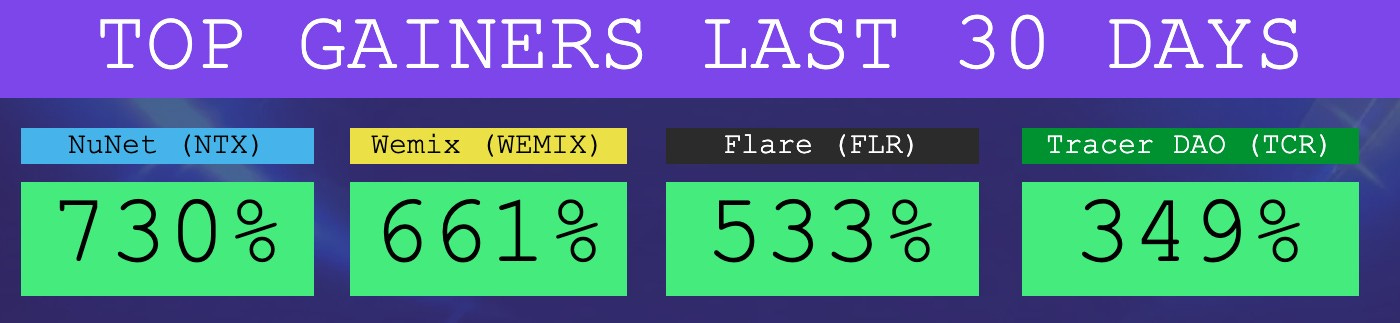

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. OpenSea Recorded a Surge in Its User Base for the Second Month in a Row, Which Grew to 329.4K Users in January, Up 10.6% MoM

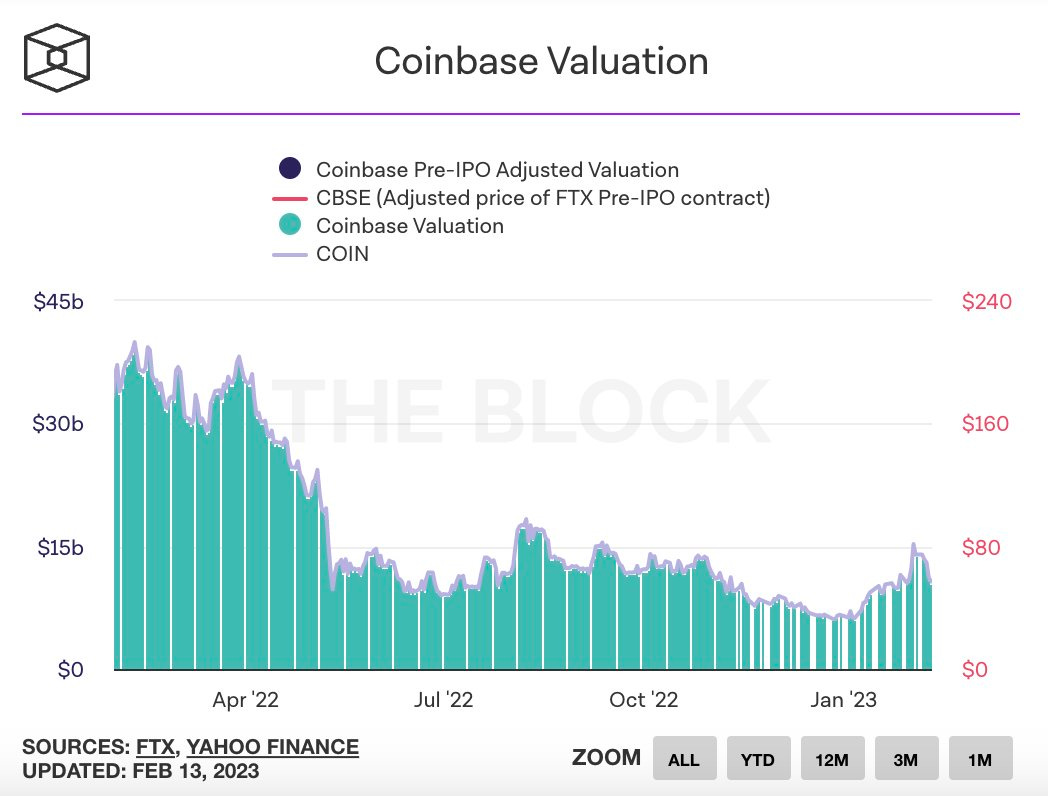

2. COIN Fell ~30% From Its Peak on Feb 2nd Due to Crypto Regulatory Woes and the Uncertainties Around Centralized Staking in the US

3. The Number of DEX Traders on Ethereum on Feb 7th Reached 57.67k, the Highest Since Dec 2021

4. Aave v3 on Ethereum Has Been Off to a Slow Start, With Only ~$177 Million in TVL Compared to v2’s ~$5.2 Billion

5. The Discount of GBTC Compared to the NAV Has Been Widening Again (Reaching 47% on Feb 9), After Narrowing in Jan

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

An Update on zkEVM Progress and Development

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Intro

zkEVMs have the ability to help scale Ethereum while maintaining its security and decentralization guarantees. They are architectured to deliver a significant reduction in transaction cost and an increase in throughput, surpassing the capabilities of the fully EVM-compatible Optimistic Rollups. Developing zkEVMs has been a challenging task because the EVM does not natively support Zero-Knowledge proofs, which makes the upcoming mainnets highly anticipatory events. Several zkEVMs are actively developing toward mainnet, with many already on testnet. Most of these projects are on track to launch on mainnet sometime in 2023.

zkEVM Progress Report

Before delving into the depths of video game mechanism design, some context. The markets for gaming and gambling are both quite large:

We use Vitalik's zkEVM classifications to map the projects according to EVM equivalency. Type-1 is exactly Ethereum-equivalent, which means that the rollup can re-use 100% of EVM infrastructure. Type-2 and Type-3 fall in the middle of the spectrum, trading some minor changes for compatibility. Type-4 is the least EVM compatible, striving to compile some EVM code but sacrificing compatibility with most Ethereum apps.

Type-1

The Ethereum Foundation’s Privacy and Scaling Explorations (PSE) team and Taiko chose to take on the hefty task of building a Type-1 zkEVM. Type-1 zkEVMs make no compromises in achieving equivalency. Even after completing the implementation and auditing process will probably take a minimum of several months to complete.

Taiko spun out of Loopring to build an EVM-compatible ZK-Rollup. On February 15, the project moved from its Alpha-1 testnet to the Alpha-2 testnet; users can utilize this network to bridge tokens from Taiko to Ethereum, send transactions, or run a node.

Compared to Taiko, the PSE team has announced less information on the status of their zkEVM.The Scroll and PSE team have closely collaborated to build their zkEVMs (literally sharing a repository), with the former team focusing on speed to market while sacrificing some elements of full compatibility. Because of the complex nature of a Type-1 zkEVM, there likely won’t be a mainnet anytime this year.

Type-2

ConsenSys, Polygon zkEVM, and Scroll fall into the Type-2 bucket. As of now, Polygon and Scroll are in Type-3, slowly working towards further equivalency. Polygon is expected to launch mainnet in March, while Scroll is slotted for the end of Q2.

ConsenSys is the newest zkEVM to enter the field. It launched a permissioned testnet in December 2022 and is expected to launch on mainnet in Q2 2023. The team hopes to address therollup training wheel problem, where a multisig that can force a particular outcome in case there are bugs in the code, through a multi-prover system. With this system, a rollup would utilize several proving mechanisms with different levels of security to remove the risk of a single point of failure, which is the case with single-prover rollups.

Type-3

Under the StarkNet umbrella, there is Kakarot. It is a zkEVM written in Cairo and has launched as a smart contract on StarkNet. Because it functions as an interpreter for EVM bytecode, it is best categorized as a Type-3 zkEVM. It is expected that Kakarot might eventually become a Layer-3 on StarkNet.

Type-4

Type-4 zkEVMs are only language-level compatible, meaning high-level code, such as Solidity or Vyper, is compiled to be ZK-friendly.

zkSync is on mainnet and in progress to launch to projects and users before the conclusion of Q1. In its existing instantiation, StarkNet qualifies as a Type-4 zkEVM using Warp, a compiler for Solidity to Cairo. So far, StarkNet is the only zkEVM that has decentralized its sequencer and prover. There is also room for further equivalency for StarkNet with Kakarot.

💬 Tweet of the Week

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Bankless - 158 - You're Not Bullish Enough on NFTs with Punk6529

Real Vision - Is Crypto Staking at Risk in U.S. as Kraken Settles With SEC? | Crypto VC

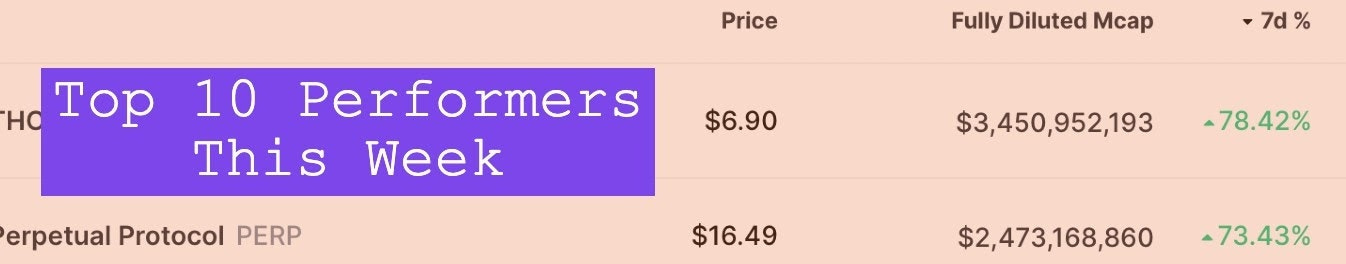

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 35,353 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

Episode 85 - El Salvador Repays $800M Debt Despite Bitcoin Bet

Episode 84 - Annual Web3 Developer Report by Electric Capital

Episode 80 - This Week in Crypto - Binance, FTX, Terra, Deribit

Episode 78 - This Week in Crypto: The New Frontier in Finance

Episode 71 - Peer - The Metaverse for Augmented Reality: A Digital Layer on Top of the World

Episode 69 - The King of Bitcoin Steps Down While Ethereum Moons 🌕

Episode 65 - This Week in Crypto: Updates on 3AC, Voyager, BlockFi, and Vauld

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Understanding Polkadot - The Next Generation Blockchain Tech (Website)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.