An Improved Approach to Crypto Price Protection 🛡️

Bumper, a DeFi protocol, can remove the downside volatility of crypto assets, by combining an innovative peer-to-pool risk model with a novel rebalancing mechanism.

In the sophisticated world of decentralized finance (DeFi), risk management and yield optimization are paramount.

Where traditional financial models like the Black-Scholes equation have been used to price options and manage risk, the crypto space requires innovation, and Bumper is one of the players at the forefront of this evolution.

Bumper, a DeFi protocol, can remove the downside volatility of crypto assets, by combining an innovative peer-to-pool risk model with a novel rebalancing mechanism. This approach underpins a significant improvement over traditional Black-Scholes Option desks, undercutting Deribit, the market leader, by an average of 30%, which may lead to disruption of its $1bn in daily volume.

The protocol is the culmination of a three-year research and development programme. It is backed by $20m in early funding and is in collaboration with the Swiss Center for Cryptoeconomics, known for their work on Synthetix, and coded by renowned developers Digital Mob, who previously worked on protocols such as Barnbridge, Gnosis and Filecoin.

Beyond Black-Scholes

The Black-Scholes model, a cornerstone in financial derivatives pricing, relies on continuous-time mathematics and assumes constant volatility. While it has been a valuable tool in traditional finance, its application in the highly volatile and fragmented crypto market is fraught with challenges.

Bumper adopts an innovative approach by combining a decentralized risk market with a novel rebalancing mechanism to create an efficient protection protocol. This new model is around 30% cheaper than put options on platforms like Deribit, and also offers yields ranging between 3-18% per annum for USDC liquidity providers.

The Bumper Protocol: Protection and Earning

The Bumper protocol is designed with two core functions: Protection and Earning. Here's how it works:

The Bumper protocol is designed with two core functions: Protection and Earning. Here's how it works:

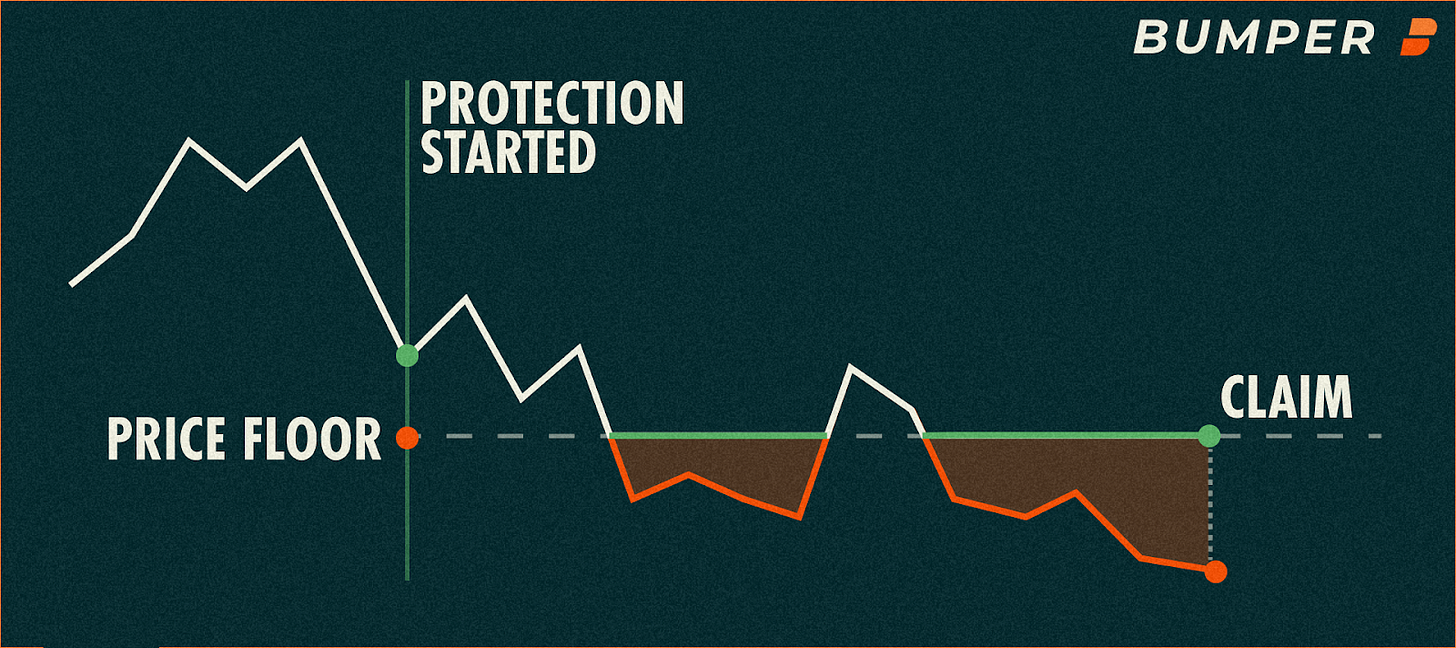

Protection (Protection Takers): Users lock crypto (initially ETH) into the protocol, selecting the amount, a floor price (akin to a strike price in options), and a term length (30, 60, 90, 120, or 150 days). If the price of ETH falls below the floor at contract expiry, users claim stablecoins at the floor value. If not, they reclaim their locked crypto. Either way, a dynamically calculated premium is paid, forming the yield basis for liquidity providers.

Earning (Yield Seekers): Liquidity providers commit USDC, choose a term length and risk tier to begin earning yields paid by protection takers. These yields are paid in USDC, making for a sustainable income stream and are dynamically calculated based on protocol health, market volatility, and price proximity from the floors.

Simulation Data: A Proven Model

Bumper commissioned the Swiss Centre for Cryptoeconomics and the financial modeling scientists at CADLabs to build an Agent Based Model. This provides for a high fidelity simulation of backtested price feeds, and was vital in testing parameter configurations, solidity implementations and trialing new protocol features. You can read the full Simulation Report to better understand the methodology and detailed results.

Protect & Earn Use Cases

For Venture Capitalists and Funds: Bumper's protection mechanism allows VCs to hedge their crypto investments without the complexities of traditional options desks. The protocol's decentralized nature ensures transparency and accessibility.

For High Net Worth Individuals: Sophisticated investors can leverage Bumper to protect their crypto assets while participating in the earning side to optimize yields.

For Hedge Fund Managers: Bumper offers a unique opportunity to diversify risk management strategies and enhance returns through a decentralized platform.

Incentives: Driving Adoption

To reward early adopters of the protocol, Bumper has kickstarted a bootstrap program offering $250,000 worth of incentives. These will be distributed to both protection takers and yield seekers based on position size, term length, and how early they participate. There is an added incentive of 200,000 BUMP tokens to encourage users of Deribit, Hegic, Opyn, Premia, Lyra, or Ribbon by registering here.

Summary: A New Era in DeFi Risk Management

Bumper represents a compelling value proposition and a paradigm shift in DeFi risk management. By expanding beyond the limitations of traditional models like Black-Scholes, it offers a more tailored solution for the crypto space.

With its live protocol, token rewards, and compelling use cases for VCs, funds, and high-net-worth individuals, Bumper may very well redefine how investors protect and earn in the decentralized world.